A big investor shifted funds into tokenized gold this week, and Bitcoin felt the influence. Costs dipped whereas a whale quietly purchased tens of millions in XAUT, a gold-backed token, signaling a short-term transfer towards conventional hedges.

Associated Studying

Whales Transfer Into Tokenized Gold

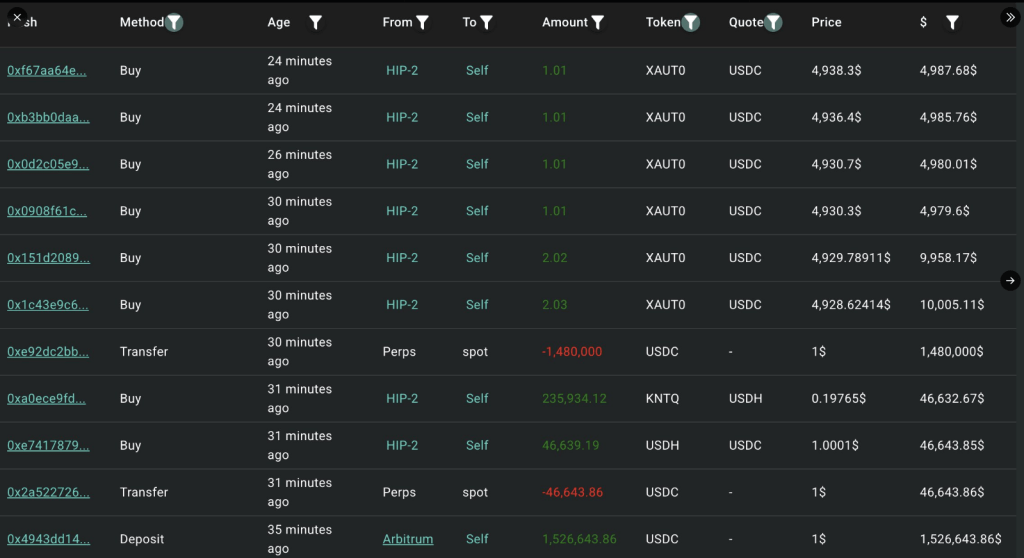

Based on on-chain trackers, one tackle moved $1.53 million in USDC into Hyperliquid to purchase XAUT. Studies notice that the identical pockets had earlier purchased about 481 XAUT, a purchase order price roughly $2.38 million.

The tackle nonetheless holds near $1.44 million in USDC, which suggests extra purchases might observe. These strikes have been picked up on public blockchains after which flagged by analysts watching massive transfers.

This type of motion can matter. When massive gamers shuffle money, smaller merchants typically take discover and hedge their bets. The shift is just not proof of a long-term development, nevertheless it reveals that, a minimum of for now, some massive holders favor gold publicity over further crypto threat.

Whales are shopping for gold, not crypto.

~30 minutes in the past, whale 0x6B99 deposited 1.53M $USDC into Hyperliquid to purchase $XAUT once more.

He has already purchased 481.6 $XAUT($2.38M) and nonetheless holds 1.44M $USDC, which can be used to purchase extra $XAUT.https://t.co/0uV2kNEiD0 pic.twitter.com/rYA09b1OEn

— Lookonchain (@lookonchain) January 23, 2026

Gold And Silver Hit Contemporary Highs

Studies say gold has been shifting sharply increased, with spot costs climbing near $5,000 per ounce in international buying and selling this week. Silver additionally rose above $100 per ounce, with intraday gold prints close to $4,988 earlier than settling.

Merchants tie the surge to geopolitical tensions and the concept rates of interest could ease, which inspires cash into metal-based shops of worth.

A weaker greenback has additionally helped. Market chatter factors to elevated demand as buyers search steadier locations to park capital whereas international politics and coverage decisions create extra fear.

Bitcoin’s Value Motion And Market Temper

Bitcoin traded round $88,653 at one stage, slipping about 1% on the day and practically 30% beneath its prior cycle prime. That hole is massive. It has market individuals questioning whether or not BTC will keep the go-to hedge throughout occasions of excessive stress. Some long-term holders stay assured. Others are watching liquidity and macro alerts extra carefully.

Studies have disclosed renewed criticism from economist Peter Schiff, who argued that Bitcoin has underperformed versus gold since 2021.

He highlighted the chance value for buyers holding BTC whereas metals climb to file costs. Schiff wrote on social platforms that treasured metals are outperforming and that this weak run for Bitcoin weakens its function as a retailer of worth within the eyes of some.

Associated Studying

What This Means For Crypto Traders

Brief-term rotations like this typically replicate threat preferences moderately than everlasting shifts. Some funds and rich people search lower-volatility belongings when headlines develop louder and coverage paths look unsure.

Others nonetheless view Bitcoin as a long-term play tied to shortage and community results. The present image is a mixture: metals are sturdy, tokenized gold is drawing consideration, and crypto markets are reacting.

Featured picture from Pexels, chart from TradingView