Stablecoins develop throughout Africa, chopping remittance prices and providing a substitute for conventional banking

Africa’s rising reliance on stablecoins is gaining floor throughout cross-border funds and on a regular basis finance. With remittance charges consuming into incomes and inflation weakening native currencies, fiat-pegged cash are gaining traction amongst households and companies alike. Blockchain information now signifies that stablecoins play a central function in how cash is saved and settled throughout the continent.

Africa’s Cash Flows Shift as Stablecoins Reduce Remittance Prices, Songwe Says

Vera Songwe mentioned remittances account for additional cash circulate into Africa than overseas help. In her speech on the World Financial Discussion board in Davos, Songwe confused the pressure brought on by charges and sluggish settlement on cross-border funds.

In accordance with the previous UN worker, stablecoins permit funds to maneuver inside minutes at a decrease value. Quicker settlement provides households faster entry to help and helps small companies handle funds with out counting on sluggish and costly banks.

Inflation has additionally pushed stablecoin adoption throughout Africa. Songwe famous that inflation has risen above 20% in roughly 12 to fifteen international locations because the COVID-19 pandemic. Greenback-pegged property supply a option to defend financial savings from fast foreign money depreciation.

Even with the rise in smartphone use, about 650 million folks in Africa shouldn’t have a checking account. Cell wallets permit customers to retailer and switch stablecoins with out counting on banks. For a lot of, these wallets present a primary entry level into formal monetary companies.

Nations comparable to Egypt, Nigeria, Ethiopia, and South Africa account for probably the most stablecoin customers on the continent. Excessive inflation and stress of conducting cross-border transactions push companies towards the fiat-pegged cash. Within the aforementioned jurisdictions, many small firms depend on them for cost and settlements.

Songwe highlighted the transparency that comes with blockchain-based funds. Illicit monetary flows and weak tax assortment have turn out to be a key speaking level amongst governments within the area. With the rise in stablecoin use, funds and enterprise actions might be tracked simply.

“So I feel for us, it really is a governance enhancer. It’s a fiscal coverage enhancer, and it’s a financial coverage disciplinary device.”

Vera Songwe mentioned.

Fiat-Pegged Property Take Maintain in Africa as Fee Volumes Climb

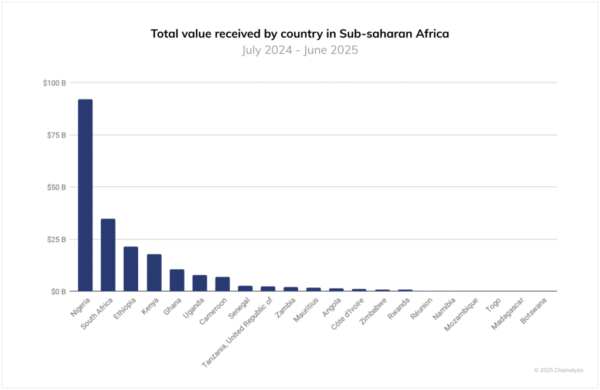

Latest reviews present Sub-Saharan Africa is among the many fastest-growing areas for crypto adoption. Chainalysis information reveals over $205 billion in crypto exercise between July 2024 and June 2025. This displays a 52% year-over-year improve, inserting Africa third globally.

Transfers below $10,000 make up a bigger share of transactions than in different areas. Nigeria and South Africa lead in quantity and present robust institutional participation. Analysts hyperlink a lot of that exercise to business-to-business funds and regional commerce.

Picture Supply: Chainalysis

Then again, stablecoins are settling high-value transactions tied to commerce with the Center East and Asia. Multi-million greenback transfers help sectors comparable to power imports and service provider funds.

Stablecoins are filling gaps left by banks, providing sooner funds, decrease prices, and entry to world currencies. For thousands and thousands throughout the continent, fiat-pegged cash now perform as a working various to conventional banking techniques.