Bitcoin and Ether ETFs recorded sharp midweek outflows, although long-term inflows and whole belongings stay sturdy.

U.S.-listed crypto exchange-traded funds (ETFs) confronted a sudden pullback final week as traders reduce publicity throughout main merchandise. Amongst these funding merchandise, Bitcoin and Ethereum recorded heavy redemptions throughout a shortened buying and selling interval. Onchain knowledge factors to a change in market temper after the sector posted sturdy inflows earlier within the month.

BlackRock’s IBIT Leads Bitcoin ETF Outflows Throughout Weak Buying and selling Week

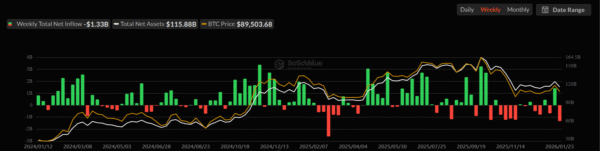

In response to knowledge captured by SoSoValue, Bitcoin-focused funds posted their weakest week in nearly a 12 months, with about $1.33 billion leaving the sector. This determine lined a four-day buying and selling week as markets closed on Monday for the Martin Luther King Jr. Day vacation.

Apparently, this pattern marks a pointy flip from the week prior, when the automobiles pulled in $1.42 billion in web inflows.

Picture Supply: SoSoValue

Promoting stress peaked midweek, as BTC funds posted $709 million in exits on Wednesday. Tuesday adopted with $483 million in outflows.

Nevertheless, redemptions eased towards the tip of the week, with $32 million leaving on Thursday. And on Friday, the funds closed the week with $104 million in funding losses.

BlackRock’s IBIT led the weekly outflows, with the heaviest funding losses approaching Tuesday and Wednesday. IBIT holds about $69.75 billion in web belongings and accounts for roughly 3.9% of whole BTC provide.

Weekly Bitcoin ETF Losses Attain Highest Level Since February 2025

Market observers date again to February final 12 months because the final time Bitcoin ETFs recorded such a heavy weekly drawdown. Throughout that stretch, funds misplaced $2.61 billion because the OG coin fell from $109K to under $80K.

Analysts later labeled that episode the “February Freeze,” pushed by sharp value swings and threat discount.

A number of components have formed buying and selling patterns throughout the week:

- Market schedule was shortened, which in flip decreased liquidity and amplified every day strikes.

- Losses peaked in the course of the week, significantly on Tuesday and Wednesday.

- Massive funds absorbed nearly all of redemptions.

- Regardless that stress decreased late within the week, withdrawals remained regular.

Regardless of current losses, the funding automobiles nonetheless have a optimistic long-term move file. Previously two years, spot Bitcoin ETFs have attracted $56.5 billion in web inflows. And with that, whole web belongings throughout merchandise stand at $115.9 billion.

Ether ETF Flows Flip Unfavourable as Midweek Promoting Intensifies

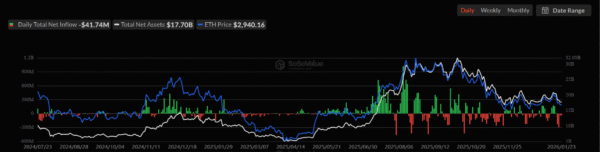

Ether ETFs moved in the identical course as their BTC friends, posting $611 million in web outflows. Wednesday marked the worst session, with $298 million redeemed. Tuesday adopted intently with $230 million in outflows, primarily based on SoSoValue figures.

Picture Supply: SoSoValue

Grayscale’s ETHE misplaced one other $10.8 million throughout the interval. Nevertheless, smaller inflows helped soften the impression of the losses. Grayscale’s ETH belief added $9.16 million, whereas Constancy’s FETH gained $4.4 million. Different ether ETFs from Bitwise, VanEck, Franklin, 21Shares, and Invesco recorded flat flows.

Just like Bitcoin, Ether ETF efficiency reversed sharply from the prior week. Earlier classes had introduced $479 million in web inflows, pushed by sturdy demand for BlackRock and Grayscale merchandise.

When considered over the previous two years, whole Ethereum ETF belongings now stand close to $17.7 billion. Cumulative web inflows since launch in July 2024 reached $12.3 billion.

Not all crypto ETFs adopted the downward pattern previously week. As an example, spot Solana ETFs posted $9.6 million in web inflows over 4 days. Merchandise have now logged positive factors for a number of consecutive weeks, led by Bitwise’s BSOL.

In per week the place the large market gamers noticed massive losses, spot XRP ETFs confirmed blended outcomes. Funds recorded $40.6 million in web outflows for the week. Heavy promoting on Tuesday drove most losses, although modest inflows returned later. Outflows adopted the primary every day web redemption for the reason that merchandise launched in mid-November.