- Company Bitcoin treasuries added roughly 494,000 BTC in 2025, bringing whole holdings to 1.13 million BTC

- Treasury companies now management about 5.1% of Bitcoin’s whole provide, led by Technique

- Bitcoin worth stays muted as ETF demand stays weak regardless of decreased promoting from long-term holders

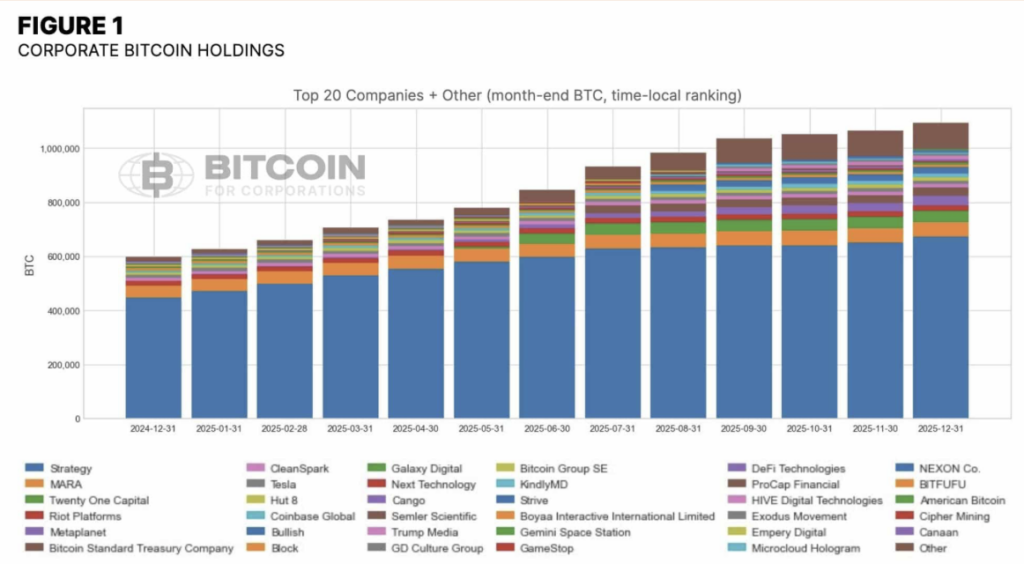

Bitcoin treasuries had a busy 12 months, even when the value motion didn’t precisely cooperate. In 2025, company holders led by Michael Saylor’s Technique gathered roughly 494,000 BTC, pushing whole treasury holdings to about 1.13 million cash. That’s a large chunk, particularly contemplating how the 12 months performed out.

In keeping with knowledge from Bitcoin For Firms (BFC), these companies saved shopping for at the same time as Bitcoin closed 2025 down 6.4%, underperforming each main asset class, together with gold and silver. It wasn’t an incredible 12 months on paper, but treasury gamers clearly weren’t shaken out.

What’s notable is that purchasing exercise did sluggish later within the 12 months because the market correction deepened. Nonetheless, the important thing level is what didn’t occur. These companies didn’t dump their BTC. Holdings saved climbing steadily, suggesting conviction stayed intact even whereas costs sagged and sentiment cooled.

New Capital Methods Substitute Previous Playbooks

BFC additionally highlighted a shift in how these treasuries raised capital. As a substitute of leaning closely on convertible debt, companies more and more turned to most well-liked inventory buildings, generally described as “digital credit score,” providing variable rates of interest.

Technique rolled out 5 most well-liked inventory merchandise, which have now overtaken its convertible debt choices in measurement. That transfer successfully decreased chapter danger whereas protecting its Bitcoin accumulation engine operating. Elsewhere, Metaplanet launched its Mars and Mercury automobiles, whereas Try issued SATA most well-liked inventory to increase its personal capital struggle chest. Completely different names, identical thought, hold stacking BTC with out stressing steadiness sheets.

Treasury Holdings Attain 5% of Whole Provide

Thanks to those mechanics, company treasury companies now management about 5.1% of Bitcoin’s whole provide, based on Bitbo. Technique alone accounts for roughly two-thirds of that, holding round 709,715 BTC, or about 3.3% of all cash that may ever exist.

ETFs, nevertheless, nonetheless sit forward. As of early 2026, spot Bitcoin ETFs management round 7.1% of whole provide, almost 1.5 million BTC. That hole issues as a result of it’s made Bitcoin’s worth more and more delicate to ETF flows, generally extra so than what treasuries are doing.

Why Worth Nonetheless Feels Caught

Whenever you take a look at demand extra broadly, the image will get a bit murkier. The 30-day common Obvious Demand Progress (ADG), which tracks mixed exercise from ETFs and treasury companies, has remained adverse since December. In easy phrases, even when treasuries are accumulating, ETF outflows can nonetheless outweigh that demand and drag on worth.

Curiously, promoting stress from long-term holders, traders who’ve held BTC for greater than 5 months, has eased considerably over the previous few months. That’s often a constructive signal. But ADG staying adverse reveals that ETF demand hasn’t returned in drive.

In the course of the Q2 2025 rally, when Bitcoin ripped from round $74,000 to over $120,000, the turning level got here when ADG flipped constructive. Till one thing related occurs once more, the information suggests BTC might stay capped, struggling to push decisively above $100,000.

Briefly, treasuries are nonetheless shopping for, holders are calmer, however the market is ready on one factor. Sustained demand, particularly from ETFs. Till that reveals up, Bitcoin’s subsequent huge transfer could keep on pause.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.