GameStop strikes complete Bitcoin stash, signaling potential sale: CryptoQuant

GameStop has transferred its complete Bitcoin holdings to Coinbase’s institutional buying and selling platform, sparking hypothesis that the online game retailer could also be reconsidering its Bitcoin treasury technique.

“GameStop throws within the towel?” blockchain intelligence platform CryptoQuant requested in a put up to X on Friday after noticing that GameStop moved its complete 4,710 Bitcoin stash value greater than $422 million to Coinbase Prime.

CryptoQuant stated the switch was “more likely to promote” the holdings, noting {that a} sale with Bitcoin at $90,800 would imply GameStop realizing round $76 million in losses from its Bitcoin wager.

GameStop amassed 4,710 Bitcoin throughout a number of investments in Might at a mean buying worth of $107,900.

Ethereum prepares for quantum period with new safety workforce and funding

The Ethereum Basis has made post-quantum safety a central focus of the community’s long-term roadmap, asserting the formation of a devoted Submit Quantum (PQ) workforce.

The brand new workforce will probably be led by Thomas Coratger, a cryptographic engineer on the Ethereum Basis, with help from Emile, a cryptographer intently related to leanVM, in accordance with crypto researcher Justin Drake.

“After years of quiet R&D, EF administration has formally declared PQ safety a high strategic precedence,” Drake stated in a Saturday put up on X. “It’s now 2026, timelines are accelerating. Time to go full PQ.”

The researcher described leanVM, a specialised, minimalist zero-knowledge proof digital machine, as a core constructing block of Ethereum post-quantum technique.

UBS weighing crypto buying and selling for personal banking purchasers: Report

The world’s largest world wealth supervisor, UBS, is reportedly exploring a transfer to open crypto buying and selling to its wealthiest purchasers.

Bloomberg reported Friday, citing an individual conversant in the matter, that the Swiss banking big goals to let choose non-public banking purchasers in Switzerland commerce Bitcoin and Ether first, with a potential rollout to the Asia‑Pacific area and america later.

The individual additionally reportedly stated that UBS was presently deciding on companions for its crypto providing, though the financial institution has not publicly confirmed the small print.

UBS already runs tokenization pilots such because the uMINT tokenized US greenback cash market fund on Ethereum and a Swift-UBS-Chainlink tokenized fund settlement trial, experimenting with placing conventional fund merchandise on blockchain rails even earlier than contemplating providing spot crypto buying and selling.

CertiK retains IPO on the desk as valuation hits $2B, CEO says

Blockchain safety firm CertiK is maintaining the door open to a future preliminary public providing, in accordance with co-founder and CEO Ronghui Gu.

Talking in an interview with Acumen Media on Thursday on the World Financial Discussion board in Davos, Switzerland, Gu stated CertiK’s valuation stands at about $2 billion and that pursuing a public itemizing could be a pure step for the corporate. Nevertheless, the CEO stated the corporate would wish “funding, plenty of strategic partnerships” to attain this objective.

“We nonetheless don’t have a really concrete IPO plan, however that is positively the objective we’re pursuing,” stated Gu, including that CertiK going public would signify a major step for Web3 infrastructure corporations:

“Many individuals wish to see the success of CertiK, wish to see the profitable IPO of CertiK, as a result of they view [it as] essential not just for CertiK but in addition for the trade.”

SEC dismisses civil motion towards Gemini with prejudice

The US Securities and Alternate Fee’s civil lawsuit towards Gemini Belief Firm and Genesis International Capital within the Earn-related unregistered securities case has been dismissed with prejudice.

Court docket filings present the events submitted a joint stipulation to dismiss the motion on Friday within the US District Court docket within the Southern District of New York, successfully ending the SEC’s declare over Gemini’s crypto lending program with Genesis.

A federal choose nonetheless must log out on the joint stipulation to dismiss.

The dismissal comes about 9 months after the SEC paused the civil motion in April 2024 when then-acting chairman Mark Uyeda was main the company.

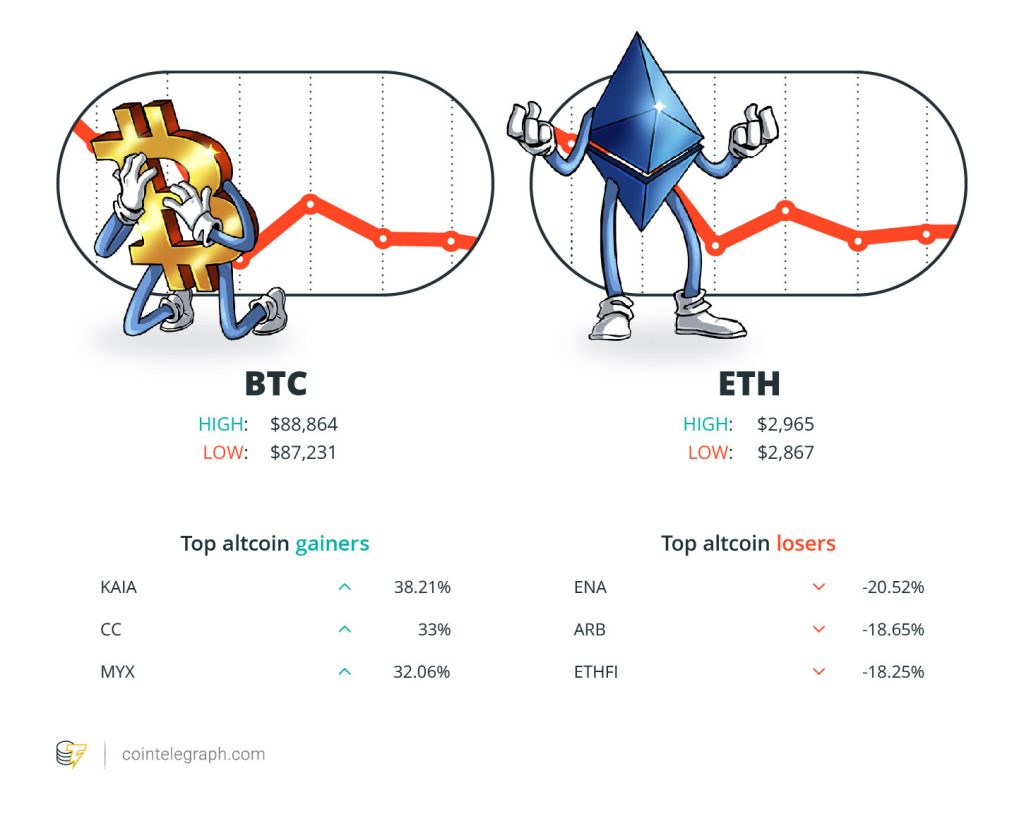

Winners and Losers

On the finish of the week, Bitcoin (BTC) is at $88,864 Ether (ETH) at $2,964 and XRP at $1.89. The whole market cap is at $3.23 trillion, in accordance with CoinMarketCap.

Among the many largest 100 cryptocurrencies, the highest three altcoin gainers of the week are Kaia (KAIA) at 38.21%, Canton (CC) at 33.% and MYX Finance (MYX) at 32.06%.

The highest three altcoin losers of the week are Ethena (ENA) at 20.52%, Arbitrum (ARB) at 18.65%, and ether.fi (ETHFI) at 18.25%. For more information on crypto costs, make certain to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“They want an financial system. They want a monetary system. They want a cost system. There is no such thing as a different different, for my part, apart from stablecoins to do this proper now.”

Jeremy Allaire, CEO of stablecoin issuer Circle

“Now, Congress is working very laborious on crypto market construction laws — Bitcoin, all of them — which I hope to signal very quickly, unlocking new pathways for People to achieve monetary freedom.”

Donald Trump, US President

“What stands out is that 2024 and 2025 report the best annual revived provide from long-term holders in Bitcoin’s historical past.”

Kripto Mevsimi, CryptoQuant contributor

“I’m speaking with most likely a dozen governments about tokenizing a few of their property, as a result of this fashion the federal government can truly understand the monetary features first and use that to develop these industries.”

Changpeng “CZ” Zhao, former CEO of Binance

“650 million folks don’t have entry to a checking account in Africa. With a smartphone you’ve got entry to stablecoins, so it can save you in a foreign money that’s not uncovered to fluctuations of inflation and making you poor.”

Vera Songwe, a former UN under-secretary-general

“Whereas crypto networks are borderless, adoption isn’t.”

PricewaterhouseCoopers

High FUD of The Week

‘Bitcoin commerce is over,’ Bloomberg strategist says in 2026 macro outlook

Bloomberg Intelligence strategist Mike McGlone stated he has reversed his long-term outlook on Bitcoin and the broader crypto market, arguing that buyers ought to “promote the rallies” throughout danger property in 2026.

Learn additionally

Options

Longevity knowledgeable: AI will assist us change into ‘biologically immortal’ from 2030

Options

That is your mind on crypto: Substance abuse grows amongst crypto merchants

In McGlone’s view, the situations that after made Bitcoin compelling have modified basically. What started as a scarce, disruptive asset has change into a part of a crowded and extremely speculative ecosystem, more and more correlated with equities and susceptible to the identical macro forces that drive conventional markets.

He attracts parallels with previous market peaks, pointing to extreme hypothesis, the approval of exchange-traded funds and traditionally low volatility as warning indicators. Bitcoin, he argues, has gone from being a hedge towards the system to being firmly inside it, and that modifications every little thing.

BitGo’s IPO pop turns unstable as shares slip beneath provide worth

Shares of digital asset custodian BitGo Holdings have swung sharply because the firm’s public debut on the New York Inventory Alternate on Thursday, with early features shortly reversing as preliminary IPO enthusiasm cooled and buyers moved to lock in income.

BitGo priced its preliminary public providing at $18 a share and it jumped about 25% in its first day of buying and selling, reflecting sturdy early demand. Whereas the inventory closed solely modestly greater in its first full session, the rally proved short-lived.

Shares have since fallen beneath their IPO worth, declining as a lot as 13.4% on Friday, in accordance with Yahoo Finance information.

French authorities examine information breach of crypto tax platform

Authorities in France have began a preliminary investigation right into a breach of cryptocurrency tax platform Waltio that might have compromised customers’ private information.

Learn additionally

Options

Regardless of the unhealthy rap, NFTs is usually a pressure for good

Options

Assault of the zkEVMs! Crypto’s 10x second

In keeping with a Thursday discover by French cybersecurity authorities, the Paris Public Prosecutor’s Workplace and the nation’s Nationwide Cyber Unit had been investigating the character of the stolen information and identities of Waltio customers.

The discover warned that customers affected by the breach might be focused in an try to maneuver their digital property below the guise of reliable safety issues.

In keeping with a Friday report from Le Parisien, a bunch of hackers known as ShinyHunters despatched a ransom demand to Waltio following the assault. The hackers obtained private information from about 50,000 Waltio customers, the vast majority of whom had been based mostly in France.

High Journal Tales of The Week

A ‘tsunami’ of wealth is headed for crypto: Nansen’s Alex Svanevik

Nansen co-founder Alex Svanevik reveals why he thinks “crypto is basically inevitable” and predicts trillions are set to enter.

The crucial motive it is best to by no means ask ChatGPT for authorized recommendation

ChatGPT is usually a supply of cheap authorized recommendation, however the chat logs will also be used towards you in court docket.

‘If you wish to be nice, make enemies’: Solana economist Max Resnick

Max Resnick might be controversial, however Ethereum did refocus on L1 scaling after his marketing campaign, and he’s making Solana higher by lowering MEV.

Subscribe

Essentially the most participating reads in blockchain. Delivered as soon as a

week.

Editorial Workers

Cointelegraph Journal writers and reporters contributed to this text.