Be a part of Our Telegram channel to remain updated on breaking information protection

GameStop has transferred its whole Bitcoin holdings to Coinbase Prime, suggesting a possible plan to promote all of them, in keeping with CryptoQuant knowledge, because the change typically serves as a staging floor for giant gross sales.

Despite the fact that the corporate is but to substantiate a sale, analysts have been fast to explain the timing as per a possible exit from its BTC place.

On January 17, GameStop moved 100 BTC, price round $9.5 million, and a further 2,296 BTC on January 20, accounting for 51% of its complete BTC treasury, with 4,710 BTC acquired between Might 14 and Might 23, 2025, spending about $504 million at a mean worth of $107,900 per coin.

GameStop throws within the towel?

Their on-chain wallets simply moved all BTC holdings to Coinbase Prime, prone to promote.

Between Might 14–23, 2025, they purchased 4,710 BTC at an avg. worth of $107.9K, investing ~$504M.

Now promoting for round $90.8K, probably realising roughly… pic.twitter.com/Bp7MwRVQ43

— CryptoQuant.com (@cryptoquant_com) January 23, 2026

The BTC hoard remained untouched for months earlier than the abrupt outflow in January 2026, suggesting the transfer was deliberate reasonably than routine.

With the corporate promoting BTC close to $90,800, it could lock in roughly $76 million in losses primarily based on the distinction between the typical buy worth and present market pricing.

GameStop Sale Hypothesis Amid Warning In The Market

Hypothesis of an incoming sale by GameStop comes as Bitcoin struggles to regain bullish momentum, buying and selling at $89,534 as of 1:39 a.m. EST, amid indicators pointing to rising sell-side exercise.

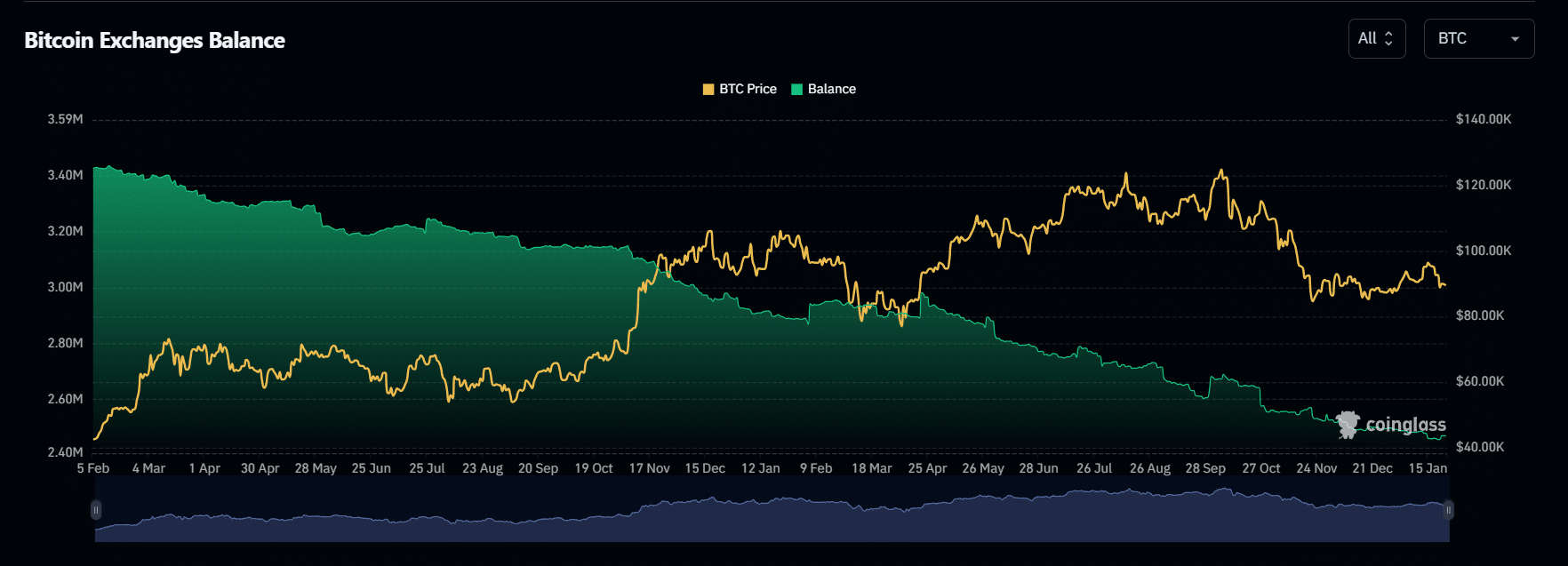

Knowledge from Coinglass exhibits that centralized exchanges proceed to face a sustained BTC outflow, with 208.95 BTC leaving exchanges within the final 24 hours.

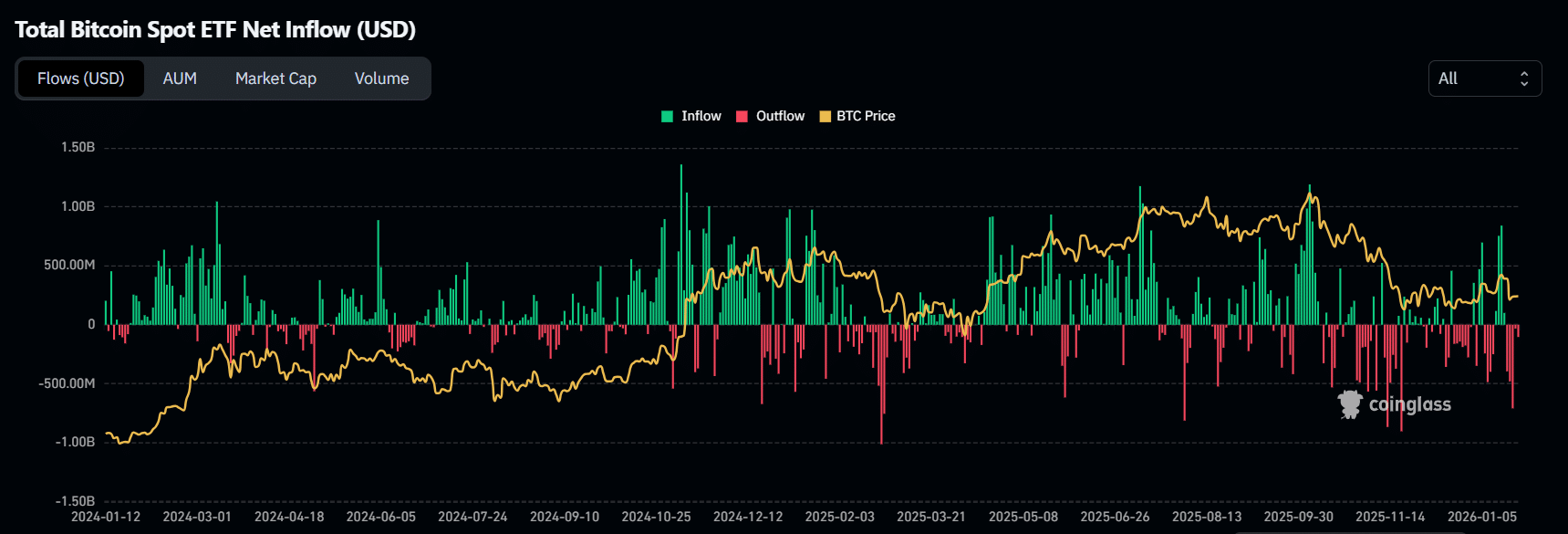

In the meantime, US Spot BTC exchange-traded funds (ETFs) recorded web outflows of $103.5 million during the last 24 hours, marking the fifth consecutive day of outflows this week.

The weaker demand comes amid per week of macro uncertainty tied to President Donald Trump’s renewed tariff threats, as buyers turned to safe-haven property like gold and silver, each of which have hit new all-time highs.

In the meantime, GameStop’s inventory moved in a special route with the sale, with the corporate’s shares buying and selling at round $23.28 after a 1.26% leap within the final 24 hours.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection