[PRESS RELEASE – Toronto, Canada, January 23rd, 2026]

LISTA DAO CLOSES 2025 WITH STRONG GROWTH AND MAJOR PRODUCT MILESTONES

Closing out 2025, Lista DAO finalized a sequence of main product developments, together with Good Lending, a local Swap interface, and Fastened-Charge Borrowing. Rolled out towards the top of the yr, these additions cap a interval of sustained progress and sign a transparent shift towards constructing a extra complete and capital-efficient DeFi stack.

A Yr of Important Progress

2025 marked Lista DAO’s evolution from a liquid staking supplier into the Capital Routing Layer of the BNB ecosystem. By empowering customers to handle their portfolios as energetic stability sheets, the protocol achieved exponential progress and absolute market dominance.

Key Efficiency Highlights:

- Report-Breaking TVL: The protocol’s TVL peaked at an all-time excessive of over $4.5 Billion earlier this yr, marking a 179.40% progress year-over-year.

- Main BNB Staking Market Share: Lista DAO now instructions almost 50% of all the BNB Chain staking market. Over 12 million BNB are staked instantly via Lista DAO, cementing its standing because the undisputed infrastructure chief.

- Lending Market Explosion: Since its launch, the Lending sector has gone from zero to an enormous $1.35 Billion in TVL, proving the protocol’s capability to efficiently diversify its product traces past staking.

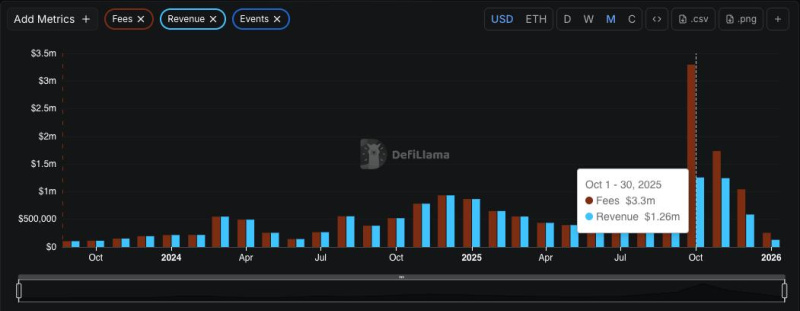

Past TVL progress, Lista DAO demonstrated income scalability, surpassing $1 million in month-to-month protocol income twice in H2 2025, reinforcing its place as a sustainable, yield-generating DeFi infrastructure.

With the launch of Good Lending and its native Swap interface, Lista DAO launched a brand new capital effectivity layer that essentially modifications how collateral is utilized.

As a substitute of remaining idle whereas securing a mortgage, deposited belongings are actually actively deployed as liquidity inside Lista’s inside markets. This enables customers to preserve full borrowing performance whereas concurrently incomes buying and selling charges, reworking collateral from a passive assure right into a yield-generating element of the protocol.

For slisBNB holders, Good Lending permits a triple-yield construction constructed round a single asset:

- Liquid Staking Yield: slisBNB continues to accrue base BNB staking rewards.

- Buying and selling Charge Earnings: By taking part in slisBNB/BNB liquidity via Good Lending, customers earn DEX buying and selling charges through slisBNBx.

- Binance Ecosystem Rewards: slisBNB stays eligible for Binance ecosystem incentives, together with Launchpool, Megadrop, and HODLer Airdrops.

By consolidating staking yield, buying and selling charges, and ecosystem rewards right into a unified movement, Good Lending & Swap characterize a significant step towards larger capital effectivity and extra versatile asset utilization throughout the BNB Chain.

Fastened-Charge & Fastened-Time period Loans: Predictable Borrowing by Design

To satisfy the wants of customers searching for certainty over capital prices, Lista DAO launched Fastened-Charge & Fastened-Time period Loans inside its Lending CDP Zone.

In variable-rate lending methods, borrowing prices fluctuate with utilization and market situations, creating uncertainty for customers who depend on exact price management. Fastened-Charge & Fastened-Time period Loans take away this publicity by permitting debtors to lock in each rates of interest and mortgage length on the time of minting lisUSD.

- Fastened Maturities: 7-day, 14-day, and 30-day phrases

- Supported Collateral: BNB, slisBNB, and BTCB

- Key Profit: Totally predictable borrowing prices over all the mortgage interval

By eliminating charge volatility, this module helps use circumstances akin to structured hedging, interest-rate arbitrage, and portfolios that require strict balance-sheet planning.

For long-term holders of BTC, ETH, and BNB, this function is a game-changer. It permits strategic buyers to have interaction in cross-cycle investing with zero danger of charge shocks. By exactly calculating curiosity prices upfront, customers can safely leverage their mainstream belongings with out the concern of liquidation attributable to sudden rate of interest spikes in a unstable market.

2026 H1 Roadmap

In 2026, Lista DAO will proceed to develop its function as core monetary infrastructure on BNB Chain and past. Key priorities embody scaling Good Lending into a number one stableswap hub by buying and selling quantity, increasing to the Ethereum mainnet, and broadening supported buying and selling pairs. Lista can even deepen its RWA providing by introducing bond-backed collateral, company bonds, and yield-generating RWA merchandise, whereas increasing on-chain utility for RWA belongings.

On the protocol stage, Lista plans to pioneer on-chain credit score lending via its proprietary credit score framework and ship a unified lending expertise by integrating Lending and CDP on the sensible contract layer. In parallel, Lista will discover prediction market–derived merchandise, enabling new vault methods and low-risk, revenue-linked merchandise in collaboration with ecosystem companions.

About Lista DAO

Lista DAO is the main BNBFi protocol on BNB Chain, providing overcollateralized decentralized stablecoin (CDP), BNB LST, Lista Lending, and revolutionary options that enable customers to earn rewards from Binance Launchpool, Megadrop, and HODLer Airdrops.

As the primary to have its DeFi BNB acknowledged for Binance Launchpool, Lista DAO has achieved a TVL progress of 1,000% year-to-date, reaching an all-time excessive of $4.5B, making it the biggest protocol on BNB Chain by TVL. LISTA is the native token of Lista DAO, tradable on main exchanges akin to Binance, Bitget, Coinone, and extra.

The publish Lista DAO Closes 2025 With Sturdy Progress and Main Product Milestones appeared first on CryptoPotato.