- February 2026 forecasts cluster round $0.0000095, with volatility anticipated inside a good vary

- Weak Shibarium utilization and slowing burn charges proceed to cap long-term upside

- A breakout is dependent upon holding key help and overcoming resistance close to $0.0000090

The Shiba Inu value outlook for February 2026 is shaping up as a good however tense vary, with most forecasts pointing to buying and selling between roughly $0.00000787 and $0.0000125. A rising variety of analysts are clustering round a midpoint close to $0.0000095, which has quietly turn into the consensus goal for now. As this outlook takes form, volatility has picked up throughout main exchanges, with merchants watching intently for both a clear breakout above resistance or a sharper pullback into close by help.

That rising consideration isn’t occurring in a vacuum. SHIB has as soon as once more moved right into a zone the place value reactions are likely to speed up, for higher or worse. Some see this as early positioning forward of a breakout try, whereas others are extra cautious, stating that momentum nonetheless feels fragile, nearly hesitant.

Value Targets Form February Buying and selling

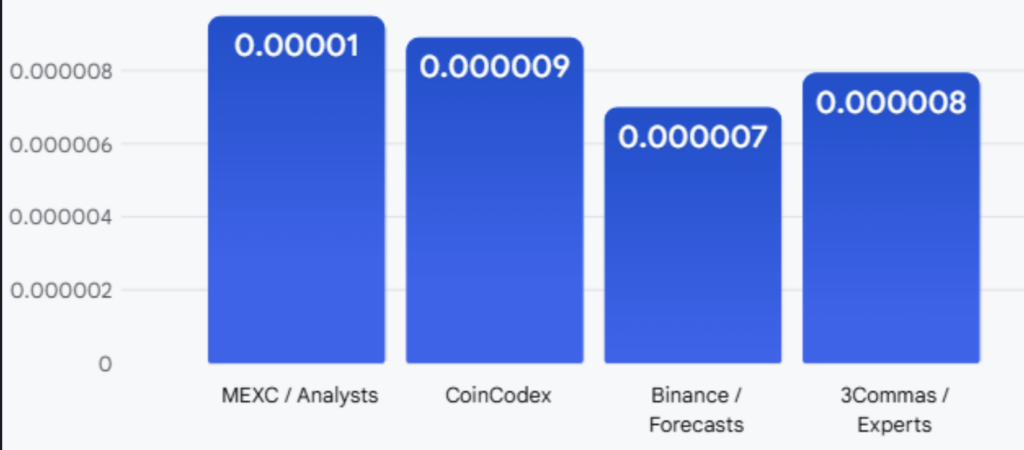

Forecasts for February stay pretty clustered, although not an identical. Information from Changelly suggests a minimal goal close to $0.00000841 and a possible excessive round $0.00000940, implying a potential 19% transfer throughout the month. CoinCodex projections lean nearer to $0.000009, whereas estimates from 3Commas sit barely decrease close to $0.000008. Taken collectively, these fashions counsel SHIB could keep range-bound, whilst volatility spikes inside that vary.

Some analysts consider the present setup is extra significant than it appears. TradingView analyst Crypto Patel has identified that SHIB is revisiting a traditionally essential help zone. Prior to now, value has tended to react strongly when coming into this space, typically adopted by quick however aggressive rallies. That historical past doesn’t assure a repeat, nevertheless it’s one purpose merchants are paying nearer consideration than traditional.

Ecosystem Components Weigh on the 2026 Outlook

Past value charts, the broader SHIB ecosystem continues to ship combined indicators. Shibarium’s Layer-2 community at the moment holds round $870,000 in whole worth locked, which stays modest. Much more regarding for longer-term bulls, day by day transactions have dropped sharply from roughly 4 million in mid-2025 to simply about 2,600 by January 2026. That slowdown suggests adoption has cooled, limiting upside strain for now.

Token burn exercise has additionally misplaced momentum. Day by day burns have fallen by practically 88%, sliding from round 28 million SHIB to roughly 3 million per day. Whereas a complete of about 410 trillion tokens have been burned thus far, the remaining provide of practically 589 trillion nonetheless hangs over value motion. Many merchants at the moment are watching to see whether or not burn charges can recuperate, as a result of with out that, the deflation narrative weakens fairly rapidly.

Technical Setup Defines Breakout Danger

From a technical standpoint, SHIB stays a high-beta asset with robust correlation to Bitcoin. Momentum indicators are providing cautious optimism, with the MACD histogram flashing short-term bullish indicators, whilst total sentiment stays impartial. The 23-day transferring common has crossed above the 50-day common, forming a golden cross that some analysts interpret as a possible mid-term development shift, although affirmation continues to be wanted.

For a significant breakout, a number of circumstances would doubtless have to align. Continued Shibarium utilization, renewed burn exercise, and supportive macro circumstances all play a job. Whale conduct provides one other layer of uncertainty, particularly after 82 trillion SHIB moved onto exchanges throughout a 23% value drop earlier in 2026. If SHIB can maintain above $0.0000080 and push larger, a transfer towards the 200-day transferring common close to $0.00001050 turns into potential. If not, a drift again towards decrease help round $0.0000065 can’t be dominated out both.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.