- Solana ETFs recorded their first outflow on January 16 earlier than rebounding with $9.5M in inflows

- SOL value fell over 7.7% this week, returning to a long-standing consolidation zone

- On-chain exercise stays resilient, pushed partially by sturdy development in RWAs

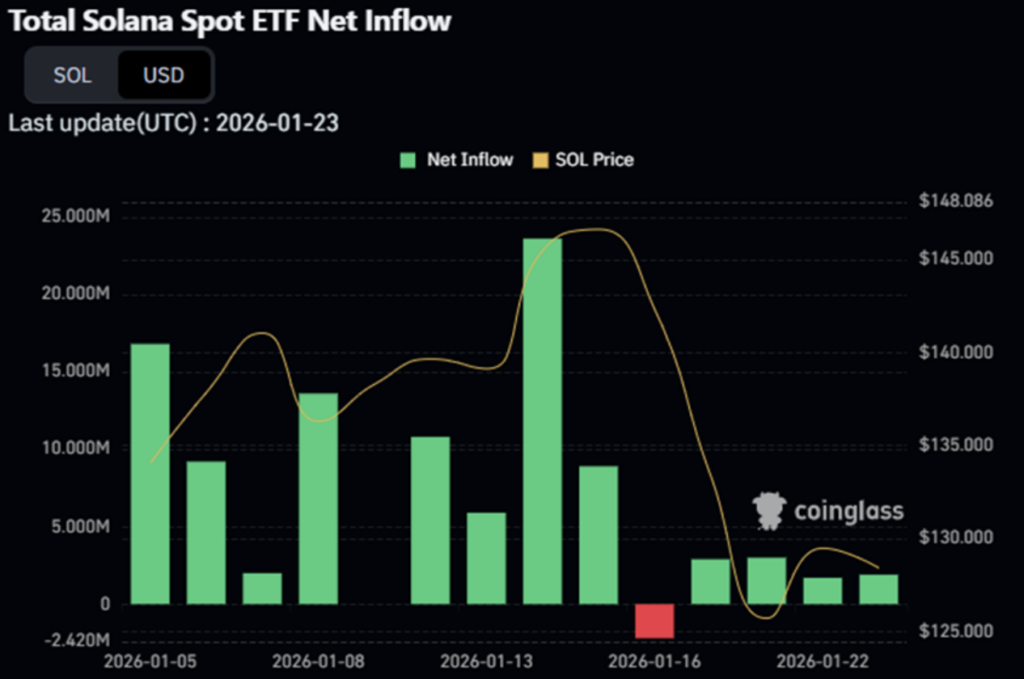

Solana ETFs had a short wobble final week after recording their first-ever outflow on January 16. For a product that had maintained an uninterrupted run of optimistic flows, that single dip was sufficient to lift eyebrows. Some analysts started questioning whether or not institutional demand was beginning to cool.

The hesitation didn’t final lengthy. By the top of the week, spot Solana ETFs have been again in optimistic territory, including roughly $9.5 million price of SOL between Tuesday and Friday, based on CoinGlass. Monday registered no exercise as a result of U.S. vacation. Even so, the rebound was modest, and notably smaller than inflows seen earlier in January, hinting that uncertainty continues to be influencing conduct.

SOL Worth Slips Again Into Its Consolidation Zone

Regardless of ETFs turning inexperienced once more, SOL’s value moved in the other way. The token confronted regular promoting stress, dropping greater than 7.7% over the previous seven days. That decline prolonged bearish momentum from the prior week and pushed value again towards acquainted territory.

On the time of writing, SOL was buying and selling close to $127, proper inside its earlier consolidation vary and near a six-month low. Whereas the short-term development seems weak, momentum indicators equivalent to RSI and MFI nonetheless recommend underlying energy, a mix that always factors to quiet accumulation slightly than outright capitulation.

This identical zone has acted as sturdy help since April 2024. SOL did briefly break under it in March 2025, however that transfer was pushed by broader macro stress. The same breakdown now would possible require demand to dry up additional, and up to now, traders seem cautious slightly than fearful.

Community Exercise Holds Up Underneath Market Strain

On-chain knowledge tells a extra resilient story. Solana’s complete worth locked slipped from a mid-month excessive of $9.1 billion to round $8.28 billion, a typical response in periods of market stress. However not all exercise cooled.

Solana’s DEX income jumped by greater than $28 billion this week, marking an 11-week excessive, at the same time as SOL’s value moved decrease. That divergence suggests customers are nonetheless energetic, buying and selling and interacting with the community regardless of weaker sentiment.

Deal with exercise and weekly transactions additionally remained elevated, although barely under final week’s peak. This confirms that Solana’s ecosystem hasn’t gone quiet, at the same time as value motion struggles.

RWAs Proceed to Drive Utilization on Solana

A key contributor to this energy seems to be real-world property. Based on knowledge from RWA.xyz, Solana’s RWA phase continues to broaden. Thirty-day stablecoin switch volumes on the community surged greater than 43%, whereas RWA holder counts rose by 12%.

By late 2025, the overall worth of RWAs on Solana had crossed the $1 billion mark. That development has helped help community utilization throughout a interval when broader market situations stay unsure.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.