This week, traders in Bitcoin, gold, and silver are carefully monitoring key US financial alerts that might sway market sentiment and asset costs.

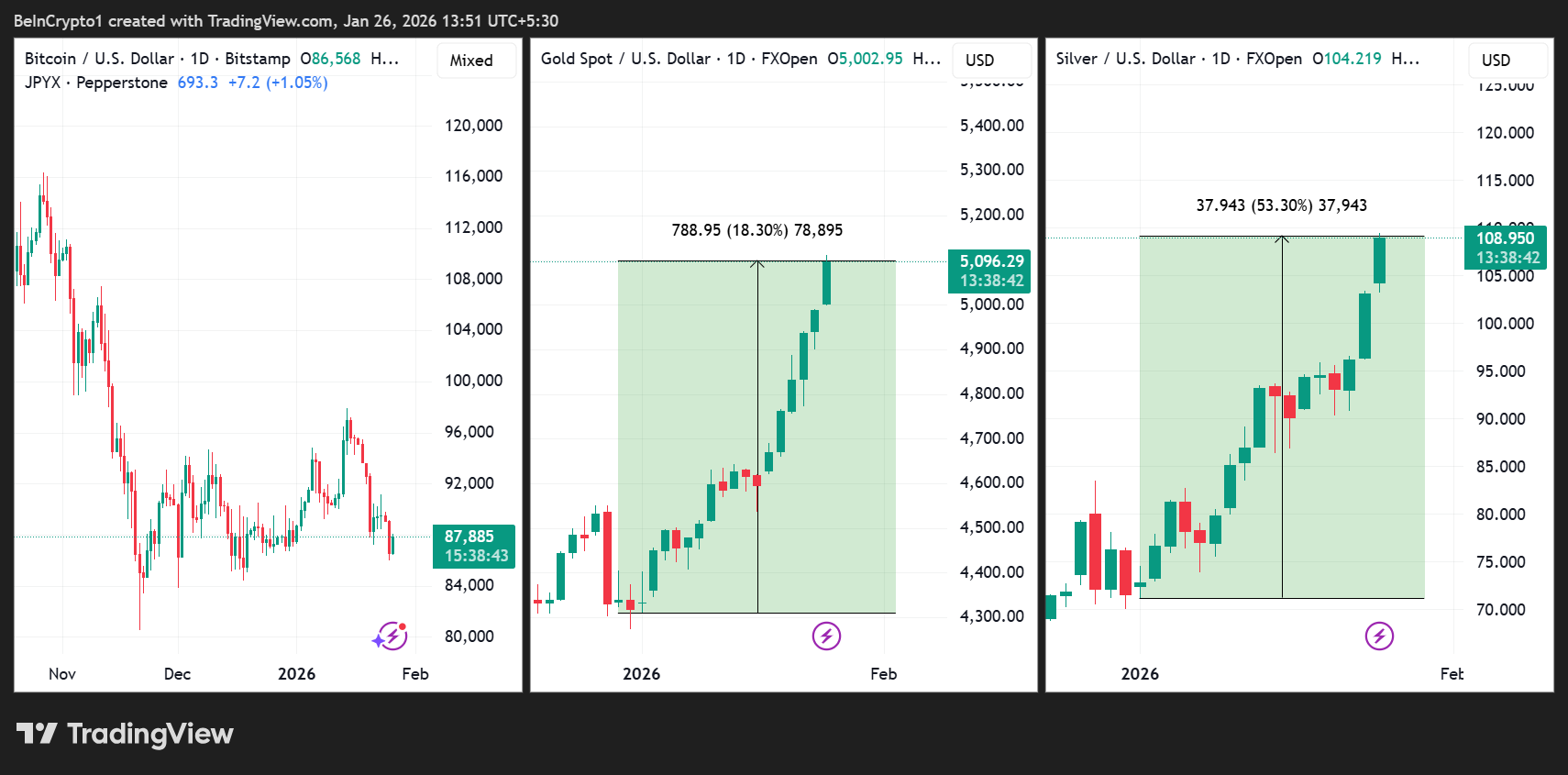

With Bitcoin hovering round $88,000, gold nearing $5,000 per ounce, and silver surpassing $100 per ounce amid ongoing safe-haven demand, these occasions carry vital implications.

4 US Financial Knowledge Posts to Affect Investor Sentiment This Week

The Federal Reserve’s stance on rates of interest stays pivotal. Decrease charges usually enhance threat belongings like Bitcoin whereas decreasing the chance value of holding non-yielding belongings like gold and silver.

Conversely, indicators of financial power or persistent inflation may stress these belongings by supporting larger charges.

Sponsored

Sponsored

Earnings from tech giants might also affect broader threat urge for food, probably spilling over into crypto and valuable metals markets.

As international uncertainties persist and amid doable US authorities shutdown, the next indicators will form short-term trajectories for these various investments.

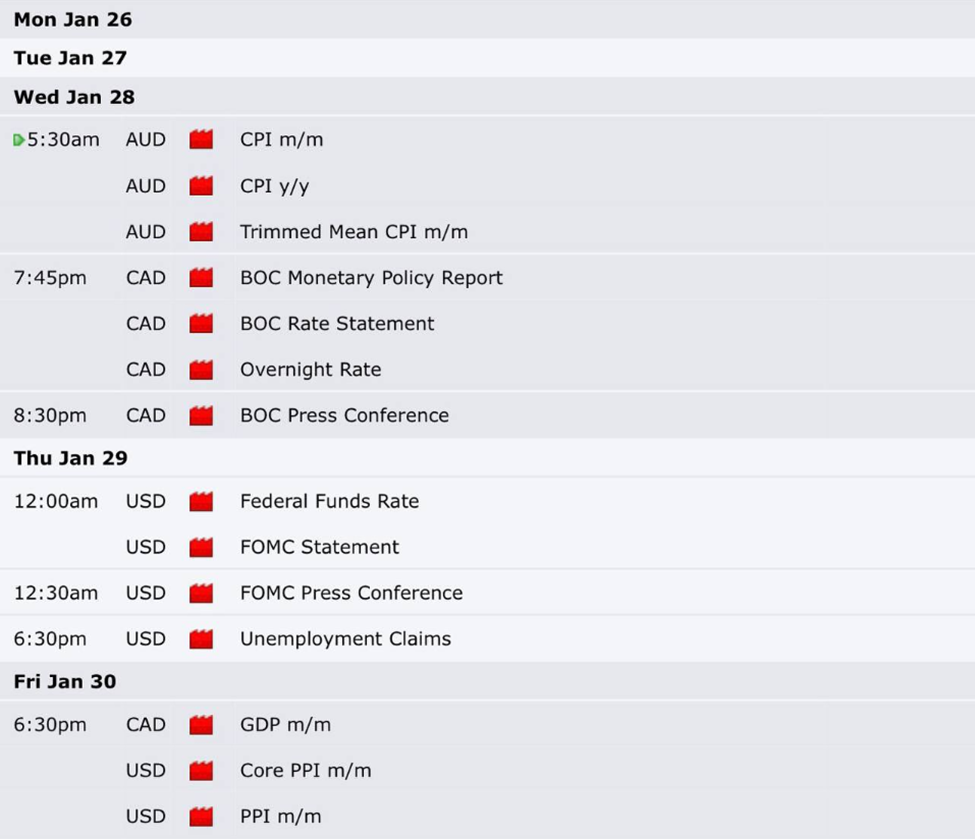

Fed Curiosity Fee Determination (FOMC) and Powell Press Convention

The Federal Open Market Committee’s (FOMC) rate of interest determination on January 28, 2026, adopted by Chair Jerome Powell’s press convention, is poised to be a significant catalyst for Bitcoin, gold, and silver costs.

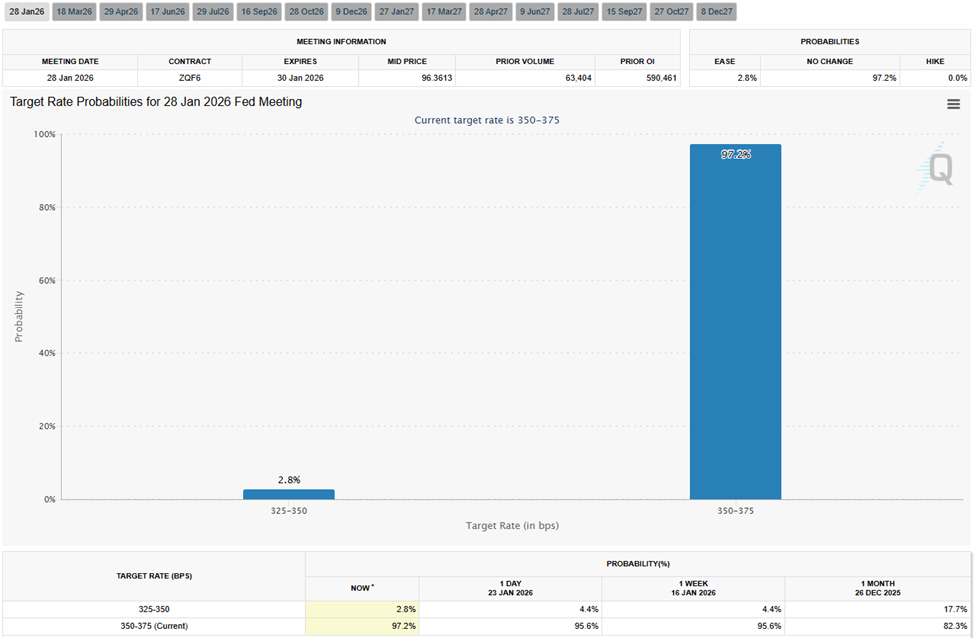

Present expectations overwhelmingly level to the Fed holding the federal funds charge regular at 3.50%-3.75%. All 100 economists in a latest Reuters ballot anticipate no change, citing robust financial progress.

In opposition to this backdrop, markets assign a 97.2% chance to this pause, as latest charge cuts in late 2025 have stabilized circumstances.

JPMorgan forecasts the Fed will stay on maintain via 2026, probably climbing in 2027 if inflation reaccelerates.

For Bitcoin, a dovish pause, signaling future cuts, may gasoline upside, as decrease charges improve threat urge for food and liquidity. Traditionally, this has boosted crypto throughout easing cycles.

Nonetheless, hawkish rhetoric from Powell on persistent inflation may set off sell-offs, given Bitcoin’s sensitivity to financial tightening.

Sponsored

Sponsored

“The market has totally priced in no charge minimize… Why is that this? – Low inflation – Higher than anticipated GDP – Job numbers simply mediocre. Take note of Powell’s speech and the steering shifting into 2026 as an alternative,” commented analyst Mister Crypto.

Gold and silver, typically considered as inflation hedges, usually rise when charges fall, as diminished alternative prices cut back their alternative prices. A maintain may stabilize them close to data, however affirmation of no cuts may cap features.

With gold up over 18% year-to-date to round $5,096 and silver surging 53% to $108, any trace of extended larger charges may stress these metals by strengthening the greenback.

Powell’s feedback on housing or progress might be scrutinized, as they might amplify volatility throughout these belongings amid market-wide geopolitical tensions.

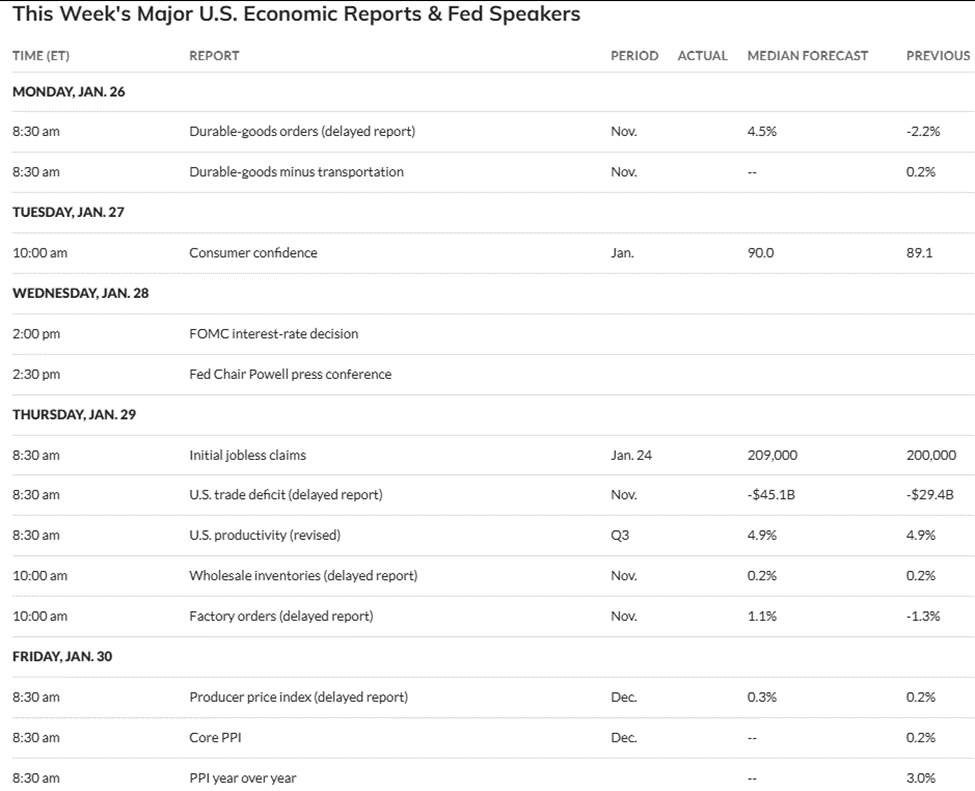

Preliminary Jobless Claims

Thursday’s launch of preliminary jobless claims for the week ending January 24, 2026, will present recent insights into the well being of the US labor market. This might immediately affect sentiment round Bitcoin, gold, and silver.

Forecasts range: RBC Economics predicts 195,000 claims, under the prior week’s 200,000, whereas market bets on platforms like Kalshi middle on 210,000 or larger.

Latest information reveals claims regular at 200,000 for the week ending January 17, signaling low layoffs and a resilient economic system. The four-week common has dipped, reinforcing stability.

Sponsored

Sponsored

Decrease-than-expected claims may bolster perceptions of financial power, probably delaying Fed charge cuts. This might stress Bitcoin downward as larger charges curb risk-taking in crypto.

Conversely, a spike may sign softening, prompting dovish bets and lifting BTC costs, as seen in previous situations the place weak labor information fueled rallies.

For gold and silver, robust information may weigh on costs by supporting a hawkish Fed stance, rising alternative prices. Nonetheless, if claims rise, these metals may achieve as protected havens amid uncertainty.

With Bitcoin stalling whereas gold and silver soar, this report may exacerbate volatility, particularly if it diverges from the median forecast of 209,000.

Such an final result may amplify broader market reactions to Fed alerts earlier within the week.

December PPI and Core PPI

Friday’s December 2025 Producer Value Index (PPI) and Core PPI information, launched on January 30, 2026, will make clear wholesale inflation tendencies. Ripple results may spill over to Bitcoin, gold, and silver.

Sponsored

Sponsored

Forecasts point out a 0.3% month-to-month rise in headline PPI, up from November’s 0.2%, whereas year-over-year may hit 3.0%. Core PPI is seen flat month-to-month however up 3.5% yearly.

Latest November information confirmed a 3.0% yearly improve, with core at 2.9% in October. Analysts count on moderation, however surprises may alter Fed expectations.

Hotter-than-expected PPI may sign persistent inflation, strengthening the case for regular or larger charges. This might depress Bitcoin by decreasing liquidity enchantment for speculative belongings.

Softer readings, nevertheless, may enhance BTC by reinforcing easing bets, as seen in previous tender information rallies. Gold and silver typically profit from inflation alerts, appearing as hedges. Due to this fact, elevated PPI may propel them larger, constructing on their features to date.

But, if information suggests disinflation, costs may dip amid a stronger greenback. This launch, following the FOMC and jobless claims, may drive weekly volatility, with PPI’s sensitivity to the enterprise cycle making it a key barometer of those belongings’ trajectories.

Varied Earnings Studies (Microsoft, Meta, Tesla, Apple)

Tech giants Microsoft, Meta Platforms, and Tesla report earnings on Wednesday, January 28, 2026. Apple will observe on Thursday, January 29, amid heightened market concentrate on AI and progress prospects.

These “Magnificent 7” corporations are anticipated to drive 2026 S&P earnings progress of 14.7%, with AI themes central to commentary.

Robust outcomes may improve threat sentiment, lifting Bitcoin as tech optimism spills into crypto, particularly given BTC’s correlation with progress shares throughout bull phases.

Weak beats or steering may set off sell-offs, pressuring BTC downward amid broader fairness declines.

For gold and silver, robust earnings could foster risk-on environments, probably diverting flows from protected havens and capping costs. Conversely, disappointments may enhance them as hedges towards uncertainty.