Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth has dropped 2% within the final 24 hours after Cathie Wooden’s ARK Make investments elevated its publicity to crypto-linked equities, including shares of Coinbase, Circle, and Bullish amid sector-wide worth declines.

In response to ARK’s Friday commerce disclosures, the ARK Innovation ETF (ARKK) bought 38,854 Coinbase shares, whereas the ARK Fintech Innovation ETF (ARKF) added 3,325 extra, totaling $9.4 million. Circle Web Group noticed a mixed 129,446 shares purchased throughout ARKK and ARKF, value round $9.2 million, and ARK additionally invested $3.2 million in 88,533 Bullish shares.

Coinbase shares closed down 2.77% at $216.95, Circle fell barely by 0.03%, and Bullish declined 2% to $35.75. Alongside these crypto buys, ARK trimmed positions elsewhere, together with promoting 12,400 Meta Platforms shares valued at $8.03 million. ARK’s elevated publicity comes regardless of crypto-linked equities underperforming in current quarters.

Breaking 🚨: ARK Make investments is planning two crypto index ETFs, one with Bitcoin and main altcoins, and one with out Bitcoin.

The ETFs might be listed on NYSE Arca, as Cathie Wooden’s agency additionally invests in corporations like Netflix, Tempus AI, and WeRide.

The corporate stays bullish on… pic.twitter.com/Cf4UeeJqYP— CFN (@cryptoflairnews) January 24, 2026

The downturn in digital property throughout late 2025 weighed closely on ARK ETFs, with Coinbase rising as the biggest drag on the ARK Subsequent Era Web ETF (ARKW), ARKF, and ARKK. Coinbase shares fell extra sharply than Bitcoin and Ether as spot buying and selling volumes on centralized exchanges dropped 9% quarter-on-quarter following October’s liquidation occasion.

ARK Make investments Stays Bullish on Crypto

Roblox was the second-largest detractor, regardless of posting robust third-quarter bookings, as the corporate warned of declining 2026 working margins and confronted added strain from Russia’s platform ban. Regardless of these setbacks, ARK stays bullish on crypto’s long-term potential. In its Massive Concepts 2026 report, the agency initiatives the digital asset market might attain $28 trillion by 2030, pushed largely by Bitcoin adoption and worth progress.

Bitcoin is predicted to account for roughly 70% of the full market worth, with about 20.5 million cash mined by 2030. If this forecast holds, ARK estimates Bitcoin might attain $950,000 to $1 million, fueled by rising institutional participation, company holdings, and the expansion of Bitcoin ETFs.

ARK’s current purchases underscore its long-term confidence in crypto, exhibiting the agency is keen to extend publicity even amid short-term market volatility and sector-wide declines.

Bitcoin Holds Important $87K Assist, Indicators of Reversal Rising

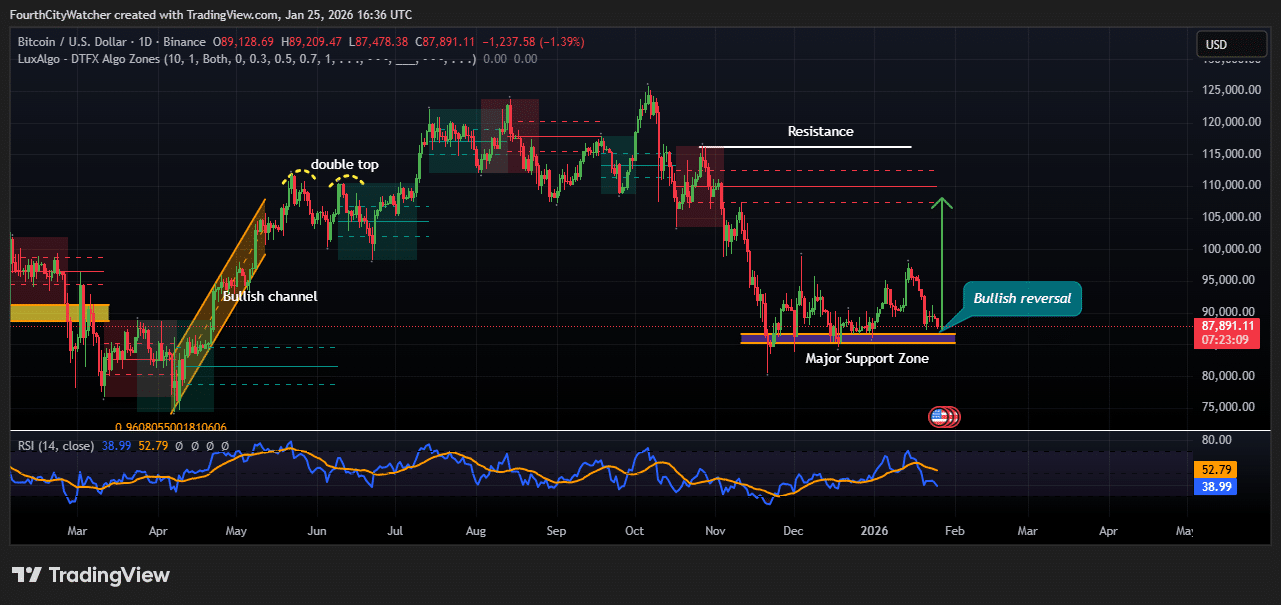

The Bitcoin buying and selling pair exhibits the market testing a vital juncture on the main help zone close to $87,000. After a protracted downtrend ranging from mid-2025, BTC seems to be forming a possible bullish reversal, as highlighted by the chart.

Earlier within the 12 months, Bitcoin skilled a robust bullish channel in April, peaking with a double high across the $120,000–$122,000 stage. The double high marked a big resistance, triggering a pointy correction that led BTC right into a consolidation section with a number of decrease highs by means of mid to late 2025.

At present, the worth motion is consolidating above the foremost help zone, which has traditionally acted as a robust ground. This space aligns with prior rejection factors, suggesting consumers are defending it.

The Relative Energy Index (RSI) studying of round 39 signifies that BTC is in or approaching oversold territory, additional supporting the chance of a bullish reversal. If the help holds, the chart signifies a possible upside goal towards the $105,000–$110,000 area, close to earlier resistance ranges, marking a attainable restoration of over 20% from present ranges.

The broader pattern exhibits warning, as BTC stays under the long-term resistance at roughly $115,000–$120,000. A sustained breakout above this resistance could be obligatory to substantiate a return to the earlier bullish momentum. For now, merchants ought to look ahead to affirmation of the reversal by means of a robust every day shut above the present consolidation zone, mixed with enhancing RSI and quantity alerts. Bitcoin is at a vital pivot, with a possible rebound from $87,000 signaling the beginning of a brand new upward leg, although it should overcome key resistance zones to maintain a long-term bullish pattern.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection