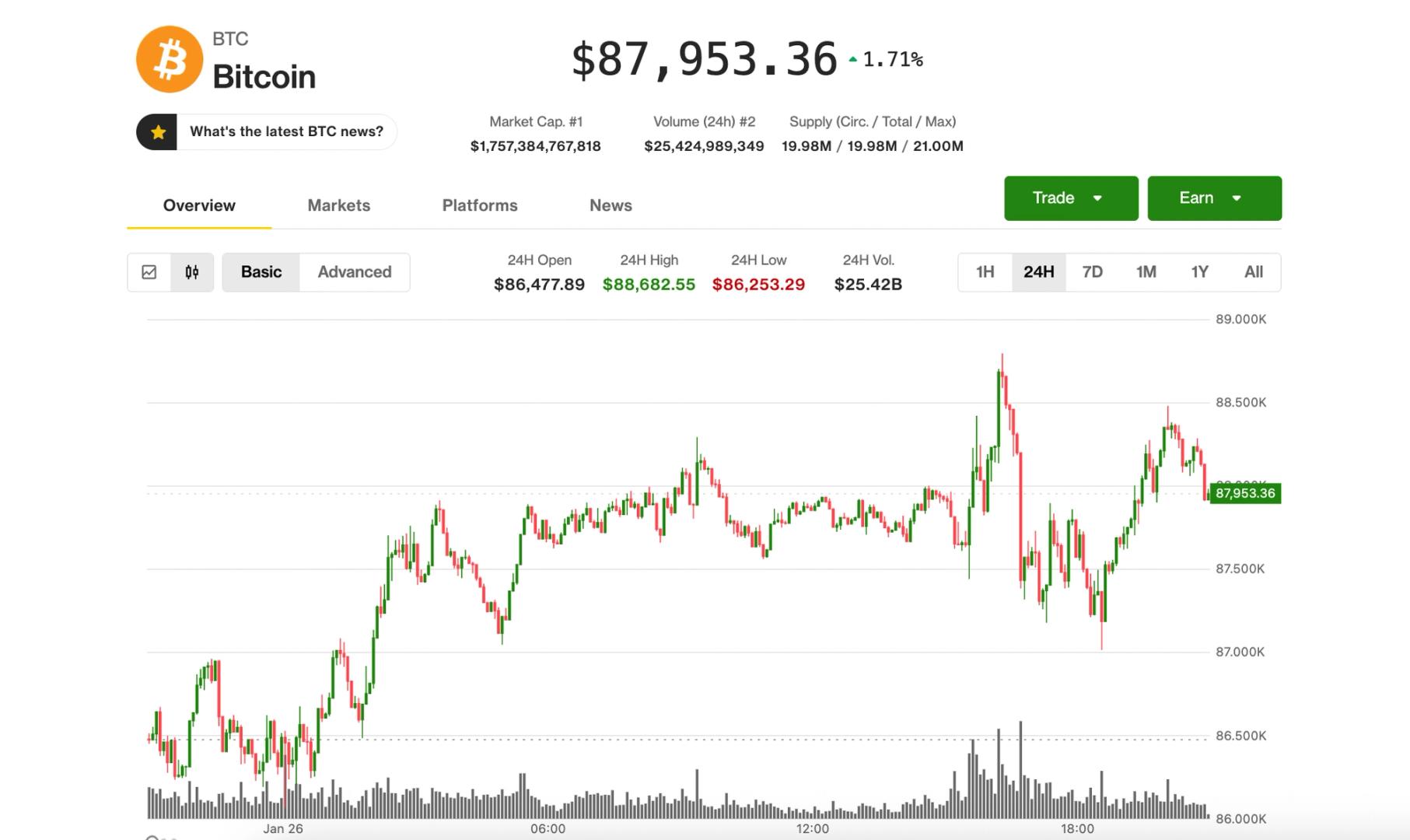

Bitcoin remained caught in limbo at round $88,000 on Monday as gold and silver prolonged their blistering rallies earlier than paring positive aspects.

BTC is up a bit from what’s now turning into a renewed sample of panicky weekend promoting, however down from across the $90,000 late Friday. Rising odds of a authorities shutdown on Jan. 31 — and the crimp on liquidity which may entail — have been among the many main causes for the Sunday selloff.

That very same information, nonetheless, left treasured metals bulls unfazed. Gold soared by means of $5,000 after which $5,100 for the primary time ever on Sunday and Monday, whereas silver raced as excessive as $118. Exhaustion indicators, although, could possibly be setting in. Gold has retreated all the best way again to $5,043 — now up 1.3% for the day — whereas silver has retreated to $108, nonetheless greater by 7%.

“Gold and silver casually including a whole bitcoin market cap in a single day,” wrote well-followed crypto analyst Will Clemente, summing up the temper of bitcoin buyers.

The U.S. greenback index (DXY) rolled over to its weakest degree since September because the U.S. Federal Reserve and Financial institution of Japan reportedly teamed to intervene in foreign money markets in an try to spice up the yen versus the buck. At 154.07 per yen, the greenback is decrease by greater than 1% on Monday.

Bitcoin to stay range-bound

The shortage of bullish follow-through in bitcoin regardless of greenback weak point has turned merchants cautious for the near-term, analysts at Swissblock argued. “Latest worth motion has bolstered the bearish outlook,” they mentioned in a Monday notice.

A decisive breakdown under the $84,500 assist degree might open the door to a deeper correction towards $74,000, they warned. Nonetheless, they flagged that if this assist holds whereas danger metrics cool off, it might provide a compelling entry level for bulls.

Bitfinex analysts echoed the cautious tone, noting BTC is prone to stay range-bound between $85,000 and $94,500. Additionally they pointed to shifts within the choices market, with merchants responding tactically to short-term dangers with out pricing in longer-term volatility.

Meaning merchants are “pricing transitory danger relatively than a sustained disruption to market construction,” the analysts wrote in a Monday notice.

Including to the stress is persistent promoting from spot bitcoin ETFs. Cumulative outflows exceeded $1.3 billion over the previous week, pointing to an absence of danger urge for food amongst buyers.

Authorities shutdown danger for crypto laws

Schwab director of crypto analysis and technique, Jim Ferraioli, sees little cause to anticipate a sustained transfer past present ranges with out a pickup in metrics reminiscent of on-chain exercise, ETF flows or derivatives positioning and miner participation.

A extra important catalyst, in keeping with him, is the passage of the Readability Act, however that could possibly be delayed by the potential for a authorities shutdown. Till the laws is handed, he expects slender buying and selling between the low $80,000s and mid-$90,000s, as main institutional gamers will stay on the sidelines.