- Retail traders are capitulating as short-term holders lock in losses under value

- Whales proceed to build up, pushing large-wallet provide to a four-month excessive

- Ongoing loss realization is conserving Bitcoin range-bound between key help and resistance zones

Bitcoin’s on-chain information is beginning to inform a really uneven story. As volatility picked up, retail conduct shifted quick, with panic promoting accelerating as drawdown fears crept again in. Brief-term holders started exiting positions under their value foundation, locking in losses and reflecting a transparent slide in sentiment. Throughout this stretch, the availability held by short-term holders in loss expanded sharply, a traditional signal of capitulation quite than calm repositioning.

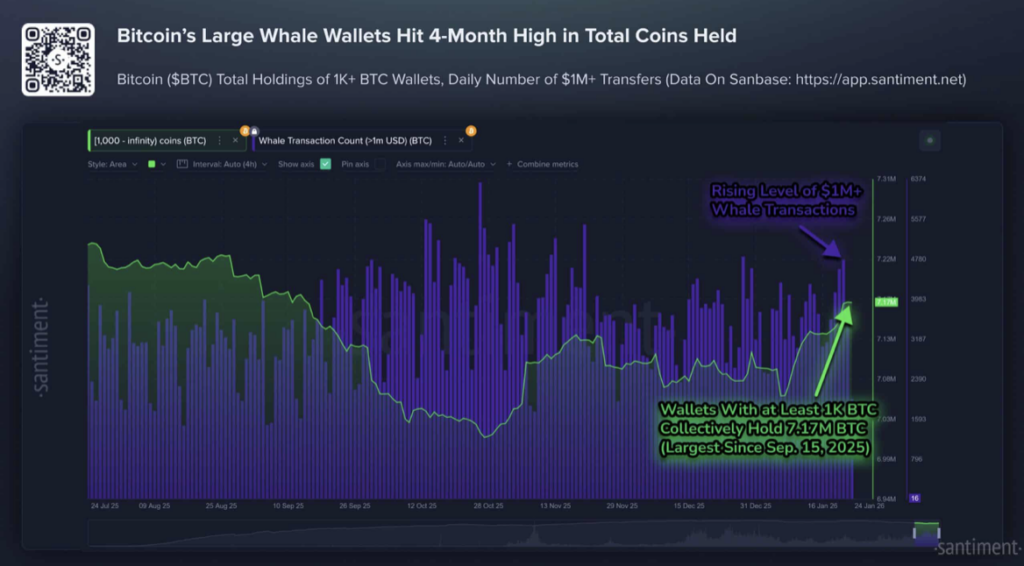

Whereas smaller gamers rushed for the exit, bigger wallets quietly moved the opposite method. Whales, outlined as holders with not less than 1,000 BTC, have been accumulating steadily for weeks. Mixed balances throughout these wallets elevated by roughly 104,340 BTC, a 1.5% rise, pushing complete whale-held provide to about 7.17 million BTC. That determine now sits at a four-month excessive, which is tough to disregard.

On the similar time, day by day transfers exceeding $1 million climbed to a two-month peak. That exercise factors to energetic accumulation quite than distribution, suggesting good cash is absorbing provide as retail promoting begins to skinny out. It’s the sort of dynamic that tends to look late in corrective phases, as soon as weaker fingers are largely flushed.

Brief-Time period Holders Lock in Losses as Stress Lingers

Bitcoin’s Internet Realized Revenue and Loss information reveals that the roughly $4.5 billion in realized losses didn’t hit suddenly. As a substitute, they constructed up by repeated draw back spikes, indicating extended stress quite than a single panic occasion. As worth stalled close to latest highs, distribution intensified, and short-term holders continued promoting into drawdowns.

Macro uncertainty performed a job right here, alongside ETF outflows and fading upside momentum. These components mixed to maintain stress on latest consumers, who had been already positioned poorly after failed breakouts above $90,000. Traditionally, related NRPL flushes appeared in 2018, 2020, and late 2022. The final comparable case noticed Bitcoin hovering close to $28,000 earlier than getting into an extended basing part, not an instantaneous rebound.

Trying on the 30-day realized web revenue and loss in BTC phrases provides one other layer of readability. This metric slipped under zero in late 2025, marking the primary sustained detrimental studying since September 2023. Importantly, the promoting seems gradual, not abrupt, which factors to pressure-driven exits quite than full-blown panic. Most of those losses are coming from short-term holders, as latest entrants hand over after momentum did not comply with by.

Vary-Certain Worth Motion Takes Form

This regular realization of losses has formed Bitcoin’s present construction. Worth stays caught inside a large consolidation vary, with promoting under value including provide throughout each rebound. That conduct has repeatedly capped upside makes an attempt close to the $95,000 to $100,000 resistance zone, making breakouts tough to maintain.

On the draw back, stress has eased across the $85,000 to $88,000 space. Consumers have constantly stepped in there, absorbing provide and stopping deeper pullbacks. The result’s a uneven, sideways market quite than a clear development in both path. For a significant breakout to happen, realized losses seemingly want to say no whereas spot demand strengthens.

If loss realization ticks up once more, although, help may weaken rapidly and open the door to a different retest of decrease ranges. For now, Bitcoin sits in a ready part, formed by exhaustion on one facet and quiet accumulation on the opposite.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.