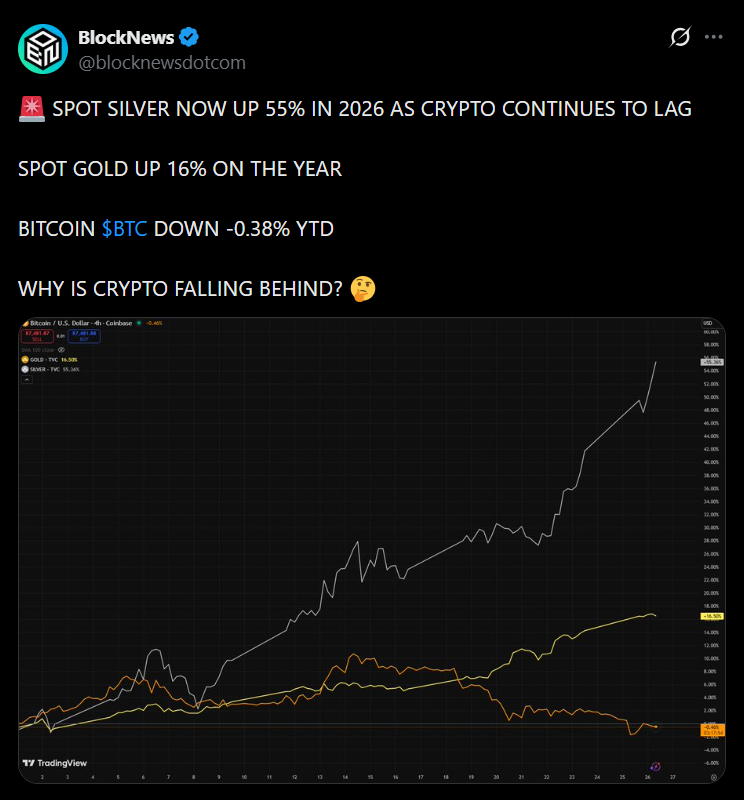

- Silver surged almost 12% to a brand new file, sharply outperforming most threat belongings

- Gold pushed above $5,000 as traders favored arduous belongings amid macro uncertainty

- Tight provide and momentum shopping for are reshaping cross-asset positioning

Silver surged to a recent all-time excessive above $115 per ounce, posting almost double-digit positive aspects in a single session and decisively outperforming gold and most threat belongings. The transfer displays a mixture of tight bodily provide, sturdy retail participation, and aggressive momentum-driven shopping for. In contrast to gold, silver’s twin position as each a valuable and industrial metallic has amplified value sensitivity during times of provide stress.

Analysts highlighted that Chinese language silver costs are buying and selling at a premium to London benchmarks, a sign that near-term demand stays sturdy. Whereas elevated costs might ultimately stress industrial utilization, present flows counsel momentum stays firmly in management.

Gold Extends Its Run as Macro Stress Builds

Gold continued its regular ascent, reinforcing its position as a major hedge towards geopolitical threat and coverage uncertainty. Costs climbed above $5,000 per ounce and briefly examined the $5,100 stage as capital flowed into conventional shops of worth. Central financial institution shopping for stays a core driver, with establishments persevering with to diversify reserves away from the US greenback.

This sustained demand underscores how preservation-focused capital is behaving in another way from speculative flows, favoring belongings with long-standing financial credibility.

What This Means for Crypto and Threat Property

The metals rally is being intently watched by crypto markets, the place value motion has struggled to maintain tempo with arduous belongings throughout latest volatility. Silver’s management means that traders are prioritizing shortage and provide constraints over progress narratives. For crypto, this divergence highlights a liquidity-driven atmosphere the place preservation belongings outperform till threat urge for food returns.

As commerce tensions, forex intervention hypothesis, and stress on central banks intensify, cross-asset positioning is changing into extra defensive. Silver’s breakout, particularly, alerts that this rotation could have additional room to run.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.