In a cautious crypto market, Bitcoin Money (BCH) right now is caught in a tactical stalemate as short-term bulls take a look at a drained however nonetheless constructive higher-timeframe construction.

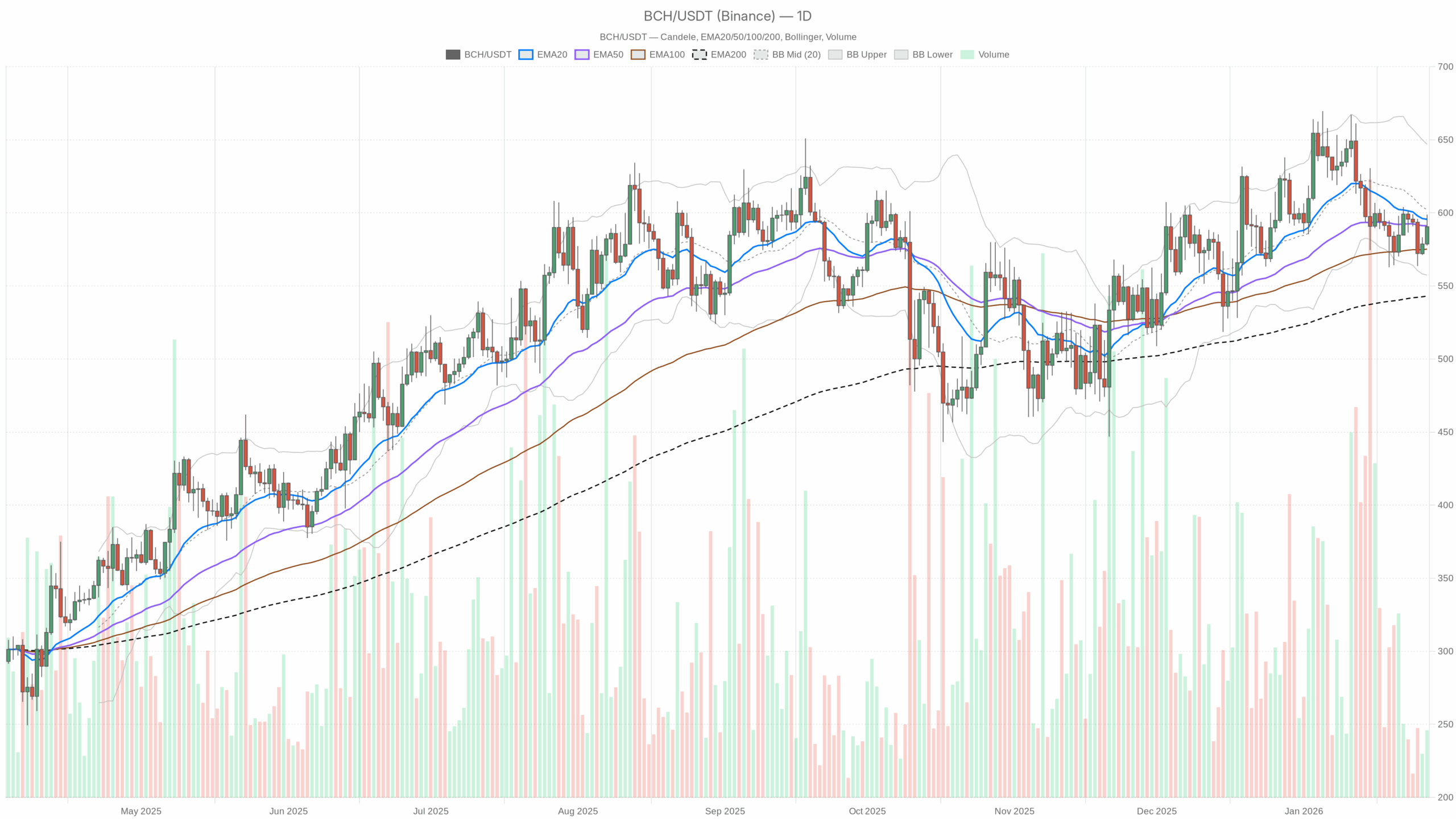

BCH/USDT every day chart with EMA20, EMA50 and quantity”

BCH/USDT every day chart with EMA20, EMA50 and quantity”loading=”lazy” />

Each day Construction (D1): Impartial with a Barely Heavy Tone

The principle situation on the every day timeframe is impartial, leaning mildly bearish within the brief time period however not structurally damaged.

Pattern and Transferring Averages (EMA)

– Value: $590.5

– EMA 20: $595.58

– EMA 50: $591.21

– EMA 200: $543.07

Bitcoin Money is buying and selling right now under the 20-day EMA, nearly precisely on the 50-day EMA, and nonetheless clearly above the 200-day EMA. That tells us momentum has cooled and near-term sellers have the higher hand, however the longer-term uptrend is undamaged. Consider the 20-day because the accelerator – it’s not being pressed – whereas the 200-day is the chassis, and that’s nonetheless pointing up. Till value begins residing under $560–$570 and dragging the 50-day decrease, that is extra of a pause or distribution zone than a confirmed high.

RSI (Momentum)

– RSI 14 (D1): 47.75

Each day RSI is just below 50, proper within the impartial band. There isn’t a oversold edge for aggressive dip patrons but, and no overbought hangover both. Momentum has basically flattened out. In follow, this typically precedes a directional transfer as soon as a catalyst seems. For now, it merely confirms that the development is taking a breather moderately than in full reversal.

MACD (Pattern Momentum)

– MACD line: -5.81

– Sign line: -3.08

– Histogram: -2.72

The every day MACD is in unfavorable territory with a widening unfavorable histogram. That could be a clear signal that draw back momentum has been constructing lately. It aligns with the value slipping under the 20-day EMA. Nevertheless, the values will not be excessive, so this appears like a managed lack of momentum moderately than panic promoting. If the histogram retains increasing decrease whereas value begins closing underneath the 50-day EMA, then we’re shifting from a drift decrease to an lively downtrend.

Bollinger Bands (Volatility and Positioning)

– Center band (20 SMA): $602.18

– Higher band: $646.93

– Decrease band: $557.42

– Value: $590.5 (under the mid, above the decrease)

Value is buying and selling between the center and decrease band, hugging the decrease half of the vary however not but testing the intense. This often displays a market that’s leaning bearish however not washed out. Volatility (the band width) is respectable however not explosive, so we’re in a managed vary, not in capitulation or breakout mode. If Bitcoin Money right now will shut close to or under $560 (the decrease band space), you’d count on both a short-term oversold bounce or, if sentiment worsens, a volatility growth decrease.

ATR (Volatility)

– ATR 14 (D1): 22.79

An ATR round $23 on a roughly $590 asset implies {that a} 3–4% every day swing is regular proper now. Volatility is elevated sufficient to matter for danger sizing however not on the extremes you see at macro tops or bottoms. You may be unsuitable by $20–$30 in a day with out something structurally altering; this could information place sizing and cease placement greater than market bias.

Each day Pivot Ranges

– Pivot Level (PP): $588.97

– Resistance 1 (R1): $600.33

– Help 1 (S1): $579.13

Value is hovering nearly precisely on the every day pivot at $589–$590. That reinforces the thought of indecision: bulls and bears are combating at truthful worth. R1 at $600 is the primary intraday line that bulls must clear convincingly to realize traction; S1 round $579 is the close by degree that, if damaged on a every day shut, would present that sellers are beginning to dominate inside this vary.

1-Hour Chart (H1): Brief-Time period Consumers Attempting to Reclaim Management

On the 1-hour timeframe, BCHUSDT appears more healthy than on the every day. There’s a short-term bullish bias, however it’s working towards a impartial, barely heavy every day backdrop.

Pattern and EMAs (H1)

– Value: $590.3

– EMA 20: $587.08

– EMA 50: $585

– EMA 200: $588.43

On H1, value is above all three EMAs, and the shorter EMAs (20, 50) are pushing above the 200. That could be a clear intraday bullish construction: pullbacks into $585–$588 are getting purchased. Brief-term merchants are attempting to construct a ground, even whereas the every day chart remains to be digesting prior beneficial properties.

RSI (H1)

– RSI 14 (H1): 58.34

Hourly RSI is within the higher impartial to delicate bullish zone. Momentum has shifted in favor of patrons, however we aren’t overbought. That is usually the type of RSI you see in a constructive intraday development the place dips can nonetheless be purchased with out chasing stretched circumstances.

MACD (H1)

– MACD line: 2.64

– Sign line: 2.64

– Histogram: 0

MACD on H1 is optimistic however flat, with the road on high of the sign and the histogram at zero. That factors to a fading however nonetheless intact bullish part. The sturdy push increased has paused; now the market is deciding whether or not to increase the transfer or revert again into the earlier vary.

Bollinger Bands and ATR (H1)

– Center band: $586.39

– Higher band: $598.34

– Decrease band: $574.45

– ATR 14 (H1): 4.66

Value is sitting above the center band and under the higher band on H1, reflecting a modestly bullish drift inside a standard volatility envelope. An hourly ATR of about $4.7 says typical hourly swings round 0.8% are commonplace. That’s sufficient noise that breakout trades close to $600 want room to breathe, however not sufficient to name this a high-volatility regime intraday.

Hourly Pivot Ranges

– Pivot Level (PP): $590.1

– R1: $592.5

– S1: $587.9

Value is hovering on the hourly pivot as properly, with very tight intraday ranges. The near-term micro battle is between R1 at $592.5 and S1 at $587.9. A clear push above R1 with sustained buying and selling would open the trail towards $598–$600; a slip under S1 would drag the pair again into the $582–$585 congestion space.

15-Minute Chart (M15): Micro Bullish, Good for Execution Not for Course

The 15-minute chart is flagged as bullish, which principally issues for execution timing moderately than bigger-picture bias.

Pattern and EMAs (M15)

– Value: $590.3

– EMA 20: $589.79

– EMA 50: $588.57

– EMA 200: $584.99

Value is buying and selling simply above the 20- and 50-EMA and comfortably over the 200-EMA. Brief-term patrons are nonetheless in management, however the distance to the fast-paced averages is small, so momentum is just not explosive; it’s extra of a grind increased. For lively merchants, this favors shopping for pullbacks close to $588–$589 if the construction holds, moderately than chasing power into resistance.

RSI and MACD (M15)

– RSI 14 (M15): 52.48

– MACD line: 0

– Sign line: 0.05

– Histogram: -0.05

RSI on M15 is nearly precisely mid-range, and MACD is successfully flat with a tiny unfavorable histogram. Micro momentum has cooled off, matching the concept that BCH is consolidating intraday after a brief push increased. The 15m development remains to be up, however there isn’t a instant power; it is a pause, not a transparent continuation or reversal but.

Bollinger Bands and ATR (M15)

– Center band: $590.31

– Higher band: $593.4

– Decrease band: $587.23

– ATR 14 (M15): 1.49

Value is glued to the center band on the 15-minute chart, proper at $590, inside a comparatively slim band. That matches low intraday volatility and a stability between micro patrons and sellers. A 15m ATR of about $1.5 exhibits {that a} $2–$3 wiggle is totally regular noise on this timeframe, so micro ranges may be hit with none change within the broader intraday image.

15-Minute Pivot Ranges

– Pivot Level (PP): $590.73

– R1: $591.17

– S1: $589.87

On the execution facet, the 15m pivot cluster round $590–$591 is a magnet. Brief-term scalpers can be watching whether or not BCH can maintain above $589.9–$590 on dips. Repeated failures to get again above this micro pivot could be an early signal that intraday patrons are shedding steam.

Reconciling the Timeframes

There’s a clear stress right here:

- Each day (D1): Impartial regime, value under the 20-day EMA with unfavorable MACD and sub-50 RSI – a market that has misplaced upside momentum and is prone to drifting decrease if macro sentiment worsens.

- Hourly and 15m: Brief-term bullish bias with value above EMAs and constructive RSI, however flattening MACD and tight consolidation round pivots.

In different phrases, short-term merchants are attempting to push BCH increased inside a bigger, drained construction. Till the every day chart confirms, any intraday power needs to be seen as a tactical transfer, not but a full development resumption.

Bullish State of affairs for Bitcoin Money Right this moment

For a convincing bullish case, BCH wants a number of circumstances to align.

1. Each day reclaim of the short-term development

A every day shut again above the 20-day EMA at $595–$600 could be the 1st step. That might put value above each the 20- and 50-day EMAs and again over the every day pivot R1 ($600.33), signalling that the current dip was corrective, not the beginning of a deeper downtrend. You’d need to see every day RSI transfer again decisively above 50 and the MACD histogram begin shrinking in unfavorable territory or ticking again towards zero.

2. Intraday continuation by way of resistance

On the decrease timeframes, bulls must push and maintain above H1 R1 at $592.5 after which the higher Bollinger Band space round $598–$600. If value can consolidate above $600 on H1 with EMAs following beneath as help, the trail towards the mid-Bollinger area on D1 round $602–$610 opens up. Above that, the higher band zone towards $640–$650 turns into a medium-term magnet.

3. Macro: danger stabilisation

With the broader crypto market in concern and BTC dominance excessive (round 57% as of 2024), a extra assured transfer in BCH seemingly requires at the very least stabilisation in Bitcoin and a halt to the broader risk-off tone. If BTC can maintain its personal with out one other leg decrease, capital can begin rotating again into large-cap alts like BCH.

What invalidates the bullish situation?

A every day shut again under $579–$580 (D1 S1), particularly if accompanied by an additional drop in RSI towards the low 40s and an increasing unfavorable MACD histogram, would argue that the bounce try failed and the market is transitioning right into a extra directional downtrend. Weak intraday rallies that hold stalling under $595–$600 would additionally weaken the bull case, suggesting sellers are utilizing each bounce to exit.

Bearish State of affairs for Bitcoin Money Right this moment

The bearish path focuses on the concept that the every day construction is rolling over and intraday power is simply distribution.

1. Failure on the $595–$600 ceiling

If BCH repeatedly exams and fails to reclaim the 20-day EMA and the every day R1 close to $600, intraday EMAs on H1 and M15 will seemingly begin flattening after which rolling over. That might present that short-term patrons are out of firepower. Persistent rejection round $595–$600 is commonly how a high quietly varieties in a uneven atmosphere.

2. Break of near-term help and drift to the decrease band

On the draw back, a clear transfer under $579–$580 (D1 S1) after which into the $560–$565 zone (near the every day decrease Bollinger Band) would verify bears are gaining management. With MACD already unfavorable and RSI under 50, that type of transfer would seemingly push momentum right into a extra decisive bearish regime. ATR tells us such a $20–$30 every day drop is properly inside regular volatility.

3. Macro risk-off extension

If Bitcoin continues to battle and international danger urge for food weakens additional, capital may retreat additional into BTC and stablecoins, leaving BCH with out sturdy sponsorship. In that context, every decrease excessive on the every day chart turns into extra significant, and a retest of the 200-day EMA round $540–$545 would come again into view as a medium-term goal.

What invalidates the bearish situation?

A sustained every day shut above $605–$610, with RSI again above 55 and MACD histogram turning optimistic, would undercut the bearish argument. That might imply not solely regaining the short-term shifting averages but additionally clearing the mid-range and displaying actual momentum, suggesting the market is able to goal the higher Bollinger space once more moderately than roll over.

Positioning, Danger, and Uncertainty

BCHUSDT right now is just not a clear development commerce on the upper timeframe; it’s a vary market with conflicting alerts: impartial every day regime, slight draw back bias in momentum, and constructive however weak short-term construction. In markets like this, sturdy directional conviction tends to be punished until you may have a transparent catalyst.

For merchants, that often means one in all two approaches: both mean-reversion round clear intraday ranges (the $580–$600 band) with tight danger controls, or ready for a break and retest of key every day zones (under $560 or above $605–$610) earlier than committing measurement. Given the present ATR ranges, each every day and intraday, danger sizing and cease distances ought to replicate the fact that 3–4% every day swings and 1% intraday strikes are regular noise, not essentially a change of regime.

Volatility is reasonable, sentiment is cautious, and Bitcoin Money right now is caught between a still-supportive long-term uptrend (above the 200-day EMA) and a cooling short-term momentum profile. Till that stress resolves, the sting lies extra in execution and self-discipline than in a powerful directional wager for Bitcoin money right now.

Open your Investing.com account

This part accommodates a sponsored affiliate hyperlink. We could earn a fee at no extra value to you.

Disclaimer: This evaluation is for informational and academic functions solely and displays a technical view of the market knowledge offered. It isn’t funding, monetary, or buying and selling recommendation, and it doesn’t have in mind your private monetary state of affairs or danger tolerance. Cryptoassets are extremely unstable and you must solely commerce with capital you’ll be able to afford to lose.