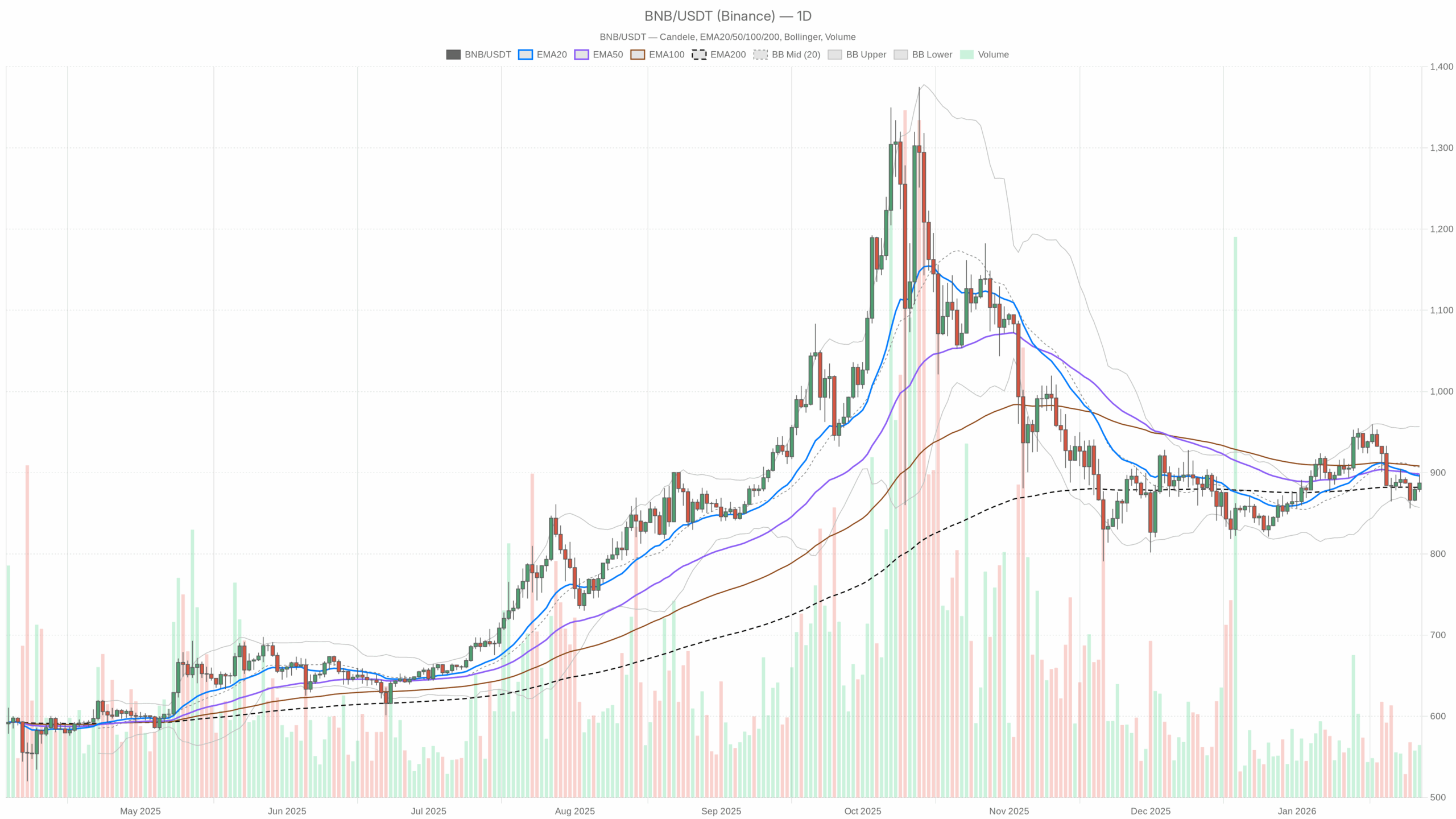

Worth is compressing a development as BNB trades in a impartial day by day construction whereas short-term charts lean bullish and put together for a possible breakout or deeper pullback.

Each day (D1): Impartial Bias, Sitting on the Fence

On the day by day timeframe, BNB is in a impartial regime. Worth closed at 887.3, basically flat with the day by day pivot at 887.07. This can be a steadiness level, not a trending construction.

EMAs (Development Construction – D1)

• 20‑day EMA: 896.06

• 50‑day EMA: 898.32

• 200‑day EMA: 882.05

• Worth (shut): 887.3

The 20 and 50 EMAs are barely above present value, whereas the 200‑day EMA is simply under it. That places BNB in a light squeeze between quick and medium-term averages overhead and longer-term assist beneath. Brief-term development is leaning soft-bearish, however the longer-term construction is unbroken so long as value holds above the 200‑day. In plain phrases, it is a pullback resting on long-term assist, not a confirmed downtrend.

RSI (Momentum – D1)

• RSI 14‑day: 47.13

RSI is barely under the midline however removed from oversold. Momentum is neither strongly bullish nor strongly bearish, and it displays a market catching its breath. This helps the concept that the latest weak point is extra of a consolidation than a capitulation.

MACD (Development Momentum – D1)

• MACD line: -2.48

• Sign line: 3.42

• Histogram: -5.9

MACD is adverse with a clearly adverse histogram, displaying bears have had the higher hand just lately. Nevertheless, these values are modest, not the type of broad separation you see in a robust development. It confirms that the day by day chart has misplaced upside momentum, however the market shouldn’t be in an aggressive promote part but, extra like a managed drift decrease into assist.

Bollinger Bands (Volatility & Place – D1)

• Center band: 906.95

• Higher band: 956.73

• Decrease band: 857.18

• Worth: 887.3

Worth is buying and selling under the center band however nonetheless comfortably above the decrease band. That locations BNB within the decrease half of its latest volatility vary with out indicators of a volatility spike or an excessive band contact. It’s a basic consolidation zone the place the subsequent transfer could possibly be both a imply reversion again to the mid-band round 907 or a continuation decrease towards the 857 space if assist offers method.

ATR (Volatility – D1)

• ATR 14‑day: 24.35

Each day ATR round 24 factors indicators average volatility: sufficient to make swings significant, however not in panic mode. This measurement of motion signifies that breaks of key ranges by 1–1.5× ATR begin to matter. Something smaller can simply be noise inside the present vary.

Each day Pivot Ranges (Construction – D1)

• Pivot (PP): 887.07

• Resistance 1 (R1): 897.95

• Assist 1 (S1): 876.43

Worth is glued to the pivot, with R1 and S1 framing a decent, roughly 22‑level day by day vary. That could be a market in steadiness: consumers and sellers are testing one another proper at truthful worth. A day by day shut above R1 would begin to shift the bias again to bullish imply reversion, whereas a break and maintain under S1 would verify that the pullback is evolving right into a extra critical downswing.

Each day conclusion: the primary state of affairs on D1 is impartial, tilted barely bearish in momentum however anchored by the 200‑day EMA. The market is ready for a catalyst.

1‑Hour (H1): Brief-Time period Bullish, However Underneath a Larger Cap

The 1‑hour chart reveals a impartial regime label however the construction is short-term bullish. Worth is above the 20 and 50 EMAs, with momentum turning up, but nonetheless beneath the 200 EMA which acts as a cap.

EMAs (Development Construction – H1)

• 20‑EMA: 882.71

• 50‑EMA: 880.16

• 200‑EMA: 891.39

• Worth: 887.45

On H1, value is above the 20 and 50 EMAs however nonetheless under the 200‑EMA. That could be a native intraday up-leg inside a broader capped construction. Bulls have management within the very quick time period, however the 891–892 zone, the place the 200‑EMA sits, is the primary critical ceiling. Till that breaks, it is a rally inside a impartial or pullback context, not a full development reversal.

RSI (Momentum – H1)

• RSI 14‑hour: 58.02

RSI just below 60 reveals wholesome, however not overheated, intraday shopping for strain. Momentum is on the bulls aspect for now, however there may be nonetheless room earlier than intraday situations change into stretched.

MACD (Development Momentum – H1)

• MACD line: 2.81

• Sign line: 2.23

• Histogram: 0.58

MACD is optimistic and the histogram is barely above zero. That traces up with the value buying and selling above the quick EMAs: consumers are pushing upward, albeit with modest power. That is in step with a managed grind increased, not an impulsive breakout but.

Bollinger Bands (Volatility & Place – H1)

• Center band: 883.01

• Higher band: 890.82

• Decrease band: 875.19

• Worth: 887.45

Worth is buying and selling between the center and higher band, barely within the higher half of the hourly vary. That’s what you wish to see in a light uptrend: consumers urgent towards the highest of the volatility envelope with out blowing it out. It helps the thought of short-term bullish strain aiming into the 890–892 space.

ATR (Volatility – H1)

• ATR 14‑hour: 4.55

Hourly ATR close to 4.5 factors is modest however tradable. On this timeframe, small strikes of three–5 factors are commonplace noise, and solely pushes past that, particularly previous structural ranges, begin to look significant.

Hourly Pivot Ranges (Construction – H1)

• Pivot (PP): 890.61

• Resistance 1 (R1): 894.56

• Assist 1 (S1): 883.51

Present value at 887.45 is under the hourly pivot at 890.61, regardless of the quick EMAs pointing up. That tells you the intraday bounce continues to be in restoration mode. Bulls have work to do reclaiming the pivot earlier than they’ll critically problem increased resistance. If value can maintain above 883–884 and push by 891–895, the intraday tone turns clearly bullish.

15‑Minute (M15): Bullish Execution Context

The 15‑minute chart is firmly in a bullish regime, and that is the place timing comes into play for energetic merchants.

EMAs (Micro Development – M15)

• 20‑EMA: 886.91

• 50‑EMA: 884.03

• 200‑EMA: 879.97

• Worth: 887.25

Worth is above all three EMAs, with a clear bullish stack the place the 20‑EMA is above the 50‑EMA and the 50‑EMA is above the 200‑EMA. That displays a short-term uptrend the place dip-buyers are more likely to present up close to the 20‑ and 50‑EMA on pullbacks, no less than till this micro construction breaks.

RSI (Momentum – M15)

• RSI 14‑min: 52.48

RSI is sort of completely impartial round 50 regardless of the bullish regime, that means the short-term uptrend shouldn’t be but overextended. Intraday merchants have room on each side: the market can proceed grinding increased or briefly mean-revert with out flashing excessive situations.

MACD (Development Momentum – M15)

• MACD line: 2.73

• Sign line: 1.98

• Histogram: 0.74

MACD is optimistic with a wholesome, however not explosive, histogram. Brief-term consumers have the initiative, and momentum aligns with the EMA stack. For execution, this sometimes favors shopping for dips somewhat than chasing spikes, because the development is up however not vertical.

Bollinger Bands (Volatility & Place – M15)

• Center band: 885.45

• Higher band: 895.66

• Decrease band: 875.24

• Worth: 887.25

Worth is simply above the center band, within the higher half of the 15‑minute vary however nowhere close to the higher band. This factors to a managed grind increased, not a blow-off transfer. Small dips towards the mid-band have been getting purchased to date.

ATR (Volatility – M15)

• ATR 14‑min: 3.73

ATR round 3.7 on M15 signifies {that a} typical 15‑minute bar covers a good chunk of the times ATR. This underlines that intraday swings will be sharp relative to the day by day transfer, so place sizing and stops must account for that noise.

15‑Minute Pivot Ranges (Execution Zones – M15)

• Pivot (PP): 888.8

• Resistance 1 (R1): 890.92

• Assist 1 (S1): 885.12

Worth is buying and selling barely under the 15‑minute pivot, however the regime stays bullish. That mixture usually means a constructive pullback inside an intraday uptrend. S1 close to 885 and the rising 50‑EMA type a right away assist pocket. R1 at 890.92 aligns intently with the hourly resistance band and 200‑EMA, turning the 890–892 zone right into a key intraday determination degree.

Market Context & Sentiment

Broad crypto market cap is modestly up, round 0.16% on the day, with a notable drop in 24h quantity of about -24.4%. BTC dominance above 57% reveals flows are concentrated in majors, not high-beta altcoins. In the meantime, the Concern & Greed index at 29 (Concern) signifies traders are nonetheless defensive, not euphoric.

For BNBUSDT, this backdrop normally means restricted speculative extra. Strikes are typically cleaner however much less explosive until a robust catalyst seems. DeFi price traits present combined exercise, with PancakeSwap AMM charges sharply increased over 30 days, hinting that some on-chain exercise is returning, however not but in a sustained risk-on wave.

Eventualities

Major Bias: Impartial on Each day, Bullish Intraday

The upper timeframe on D1 requires a impartial essential state of affairs, with value trapped between short-term bearish momentum and long-term assist. Intraday, nonetheless, each the 1‑hour and 15‑minute charts present constructive bullish construction pushing value again towards resistance.

Bullish Situation

Within the bullish path, the intraday up-move continues, and BNBUSDT reclaims and holds above the cluster of resistance round 890–895:

• 15m R1 at 890.92 will get cleared and holds as assist.

• H1 pivot at 890.61 and H1 R1 at 894.56 are damaged and retested from above.

• Worth regains the H1 200‑EMA close to 891.39 and begins closing hourly candles above it.

If this performs out, the subsequent logical magnet is the day by day Bollinger mid-band round 907, with room towards the higher band close to 957 if volatility expands. On the way in which, the day by day 20 and 50 EMAs between 896–898 flip from overhead resistance into assist. RSI on D1 would wish to push again above 50 and the MACD histogram to shrink towards zero, displaying that draw back momentum has light.

This bullish state of affairs is invalidated if BNBUSDT fails repeatedly on the 890–895 zone and breaks again under 876–880 with robust quantity, particularly if day by day closes begin forming beneath the 200‑day EMA round 882. That may verify the intraday power was only a dead-cat bounce.

Bearish Situation

Within the bearish end result, the intraday bounce runs out of steam beneath the 200‑EMA on H1, and sellers press value by native assist:

• M15 assist at 885.12 and the 50‑EMA give method.

• H1 S1 at 883.51 fails, resulting in a take a look at of the day by day S1 at 876.43.

• Each day closes begin printing under the 200‑day EMA round 882.

Underneath this strain, day by day MACD would probably prolong deeper into adverse territory, and RSI may slide decisively under 45, indicating momentum is transferring from impartial to outright bearish. Technically, that opens a path towards the decrease Bollinger Band round 857, and doubtlessly decrease if broader market risk-off accelerates.

This bearish state of affairs is invalidated if value shortly reclaims and holds above the 890–895 resistance zone, flips the 200‑EMA on H1 into assist, and day by day RSI recovers again above 50. In that case, the promoting strain can be higher learn as a accomplished pullback somewhat than the beginning of a bigger downtrend.

Methods to Assume About Positioning Now

BNBUSDT presently sits in a tactical tug-of-war. The day by day chart is sideways and indecisive, whereas intraday construction favors the bulls however proper right into a dense cluster of resistance round 890–895. That makes this area a real determination zone somewhat than a spot to type robust directional convictions with out affirmation.

For brief-term merchants, the bottom line is respecting the multi-timeframe stress. The 15‑minute and 1‑hour charts counsel shopping for dips so long as value stays above roughly 883–885, however the day by day chart insists that till the market clears the 896–900 space, that is nonetheless only a rally inside a broader consolidation. For swing merchants, the higher-probability entries normally come after the market reveals whether or not the 200‑day EMA at 882 holds or fails decisively.

Volatility is average on all timeframes, which suggests breakouts will be tradable however are much less forgiving in the event that they flip into fakeouts. With market sentiment in Concern and BTC dominance excessive, the setting nonetheless rewards danger management and suppleness over aggressive, one-sided bets.

Open your Investing.com account

This part incorporates a sponsored affiliate hyperlink. We might earn a fee at no extra price to you.

All market views expressed listed here are informational and academic in nature. They mirror a technical interpretation of present knowledge and should not a suggestion to purchase, promote, or maintain any asset. Markets are risky and unpredictable; at all times contemplate your personal danger tolerance and time horizon.