World Liberty Monetary (WLFI), a crypto mission backed by US President Donald Trump, moved a bit of its Bitcoin publicity into Ethereum this week. Reviews say the group bought wrapped Bitcoin holdings and picked up a considerable amount of Ether in the identical set of transactions.

Associated Studying

WLFI Strikes From WBTC To ETH

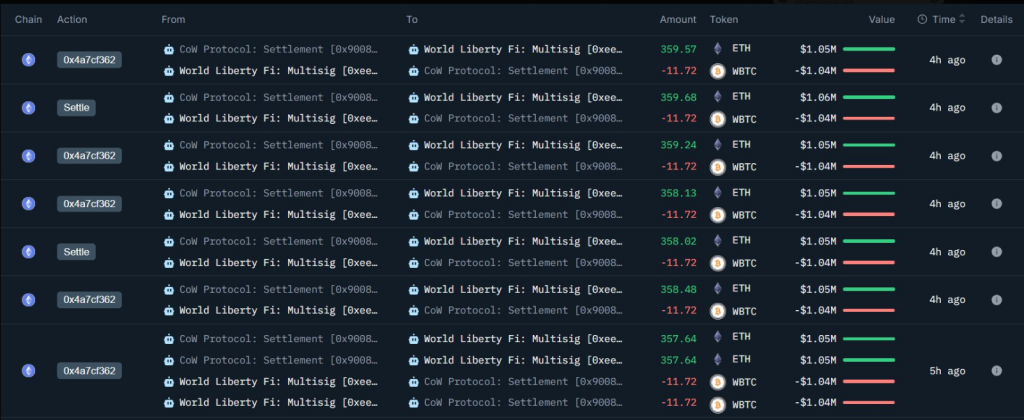

In accordance with blockchain trackers, about 93.77 WBTC was bought, which labored out to roughly $8 million on the time of the swap. The proceeds had been used to purchase round 2,868 ETH, with a median worth of about $2,813 per unit.

The commerce was executed from a pockets that on-chain analysts hyperlink to WLFI’s treasury. That pockets exercise was seen on public ledgers and has been shared throughout a number of crypto information websites and knowledge displays.

Onchain Information And Market Context

Costs had been modestly decrease for ETH when the acquisition occurred, which some merchants see as a shopping for probability. Reviews say this transfer comes as Ethereum buying and selling ranges have made some holders rethink the place to park giant sums.

The World Liberty Finance (@worldlibertyfi) has bought 93.77 $WBTC ($8.07M) for two,868.4 $ETH at a worth of $2,813.

Handle: 0xee7f7f53f0d0c8c56a38e97c5a58e4d321a174dc

Information @nansen_ai pic.twitter.com/yhh7IvYLLz

— Onchain Lens (@OnchainLens) January 26, 2026

WBTC is a tokenized type of Bitcoin that inhabits the Ethereum chain, so swapping it for native ETH modifications how these funds can be utilized inside decentralized finance.

The funds had been moved via a public pockets tied to WLFI. This was confirmed by on-chain proof that was circulated by knowledge platforms.

Strategic Causes Behind The Shift

A number of causes might clarify the swap. Holding ETH offers direct entry to good contracts, staking, and DeFi instruments that WBTC can not provide by itself.

Some market watchers assume WLFI could also be positioning to make use of ETH for on-chain providers, staking, or revenue from future community exercise.

Others recommend it might be a technique to rebalance danger between shops of worth and utility tokens. Reviews say no single motive might be proved from the chain itself, solely the motion of funds.

Response And Broader Alerts

Merchants reacted with curiosity fairly than panic. Costs barely moved on the information, displaying the market might have already priced in related flows.

Smaller buyers watched intently as a result of such a swap by a high-profile, politically linked mission attracts consideration. The pockets exercise was tracked publicly, and analysts famous the timing matched a interval of calmer ETH worth motion.

Associated Studying

What This May Imply For Buyers

Reviews notice that huge reallocations like this could change short-term sentiment, although they don’t all the time result in lasting rallies. For holders preferring simplicity, swapping WBTC for ETH modifications the best way capital can be utilized, transferring from a Bitcoin peg to native community participation.

Featured picture from Unsplash, chart from TradingView