Be part of Our Telegram channel to remain updated on breaking information protection

Bitcoin pared some features after the Federal Reserve stored rates of interest regular as extensively anticipated, retreating from the $90,000 mark after reclaiming it for the primary time since final Friday, and dropping beneath $88,000.

The world’s largest cryptocurrency by market capitalization was down 1.2% within the final 24 hours, buying and selling at $87,862 as of 03:53 a.m. EST, with a 13% leap in buying and selling exercise and buying and selling quantity hovering to $49.7 billion.

The drop got here amid a 1.1% decline in crypto market capitalization to $3.06 trillion.

Because of the sudden transfer, complete liquidations totaled $345.63 million, with BTC longs at $112.36 million, in line with Coinglass knowledge.

Fed Pauses Curiosity Price Cuts

The USA Federal Reserve left rates of interest unchanged this month, retaining them at 3.50%-3.75% following the newest Fed assembly, which concluded on Wednesday. In December, the Fed minimize rates of interest by 25 foundation factors.

Fed officers really useful a wait-and-see strategy given sticky inflation and a good labor market. Typically, increased rates of interest enhance the chance price of holding yield-bearing property corresponding to U.S. Treasury securities.

🚨FED pauses price cuts for the primary time since mid 2025.

Inflation nonetheless elevated, uncertainty excessive, easing cycle probably close to its finish. pic.twitter.com/HtM1Py2flg

— Wall Avenue Gold (@WSBGold) January 28, 2026

This, in flip, reduces the enchantment of risk-on property corresponding to Bitcoin and equities, which seems to be the case over the previous 24 hours.

Alternatively, decrease rates of interest usually help non-yielding property corresponding to Bitcoin by decreasing the chance price of holding them.

Futures contracts for the S&P 500 Index, for example, dipped by as a lot as 0.52% on Jan. 29, mirroring Bitcoin’s decline on the identical day.

Geopolitics Provides To The Threat-Off Temper, As Buyers Flip To Secure-Haven Property

Tensions between the US and Iran escalated this week, after the US President Donald Trump advised Tehran time was operating out and that a large armada was shifting shortly in direction of the nation “with nice energy, enthusiasm and objective”.

Trump mentioned: “Hopefully Iran will shortly ‘Come to the Desk’ and negotiate a good and equitable deal – NO NUCLEAR WEAPONS – one that’s good for all events. Time is operating out, it’s really of the essence!”

It was the starkest indication but from Trump that he intends to mount some type of navy strike imminently if Iran refuses to barter a deal on the way forward for its nuclear programme.

Bitcoin Worth Nonetheless in an Indecision Section

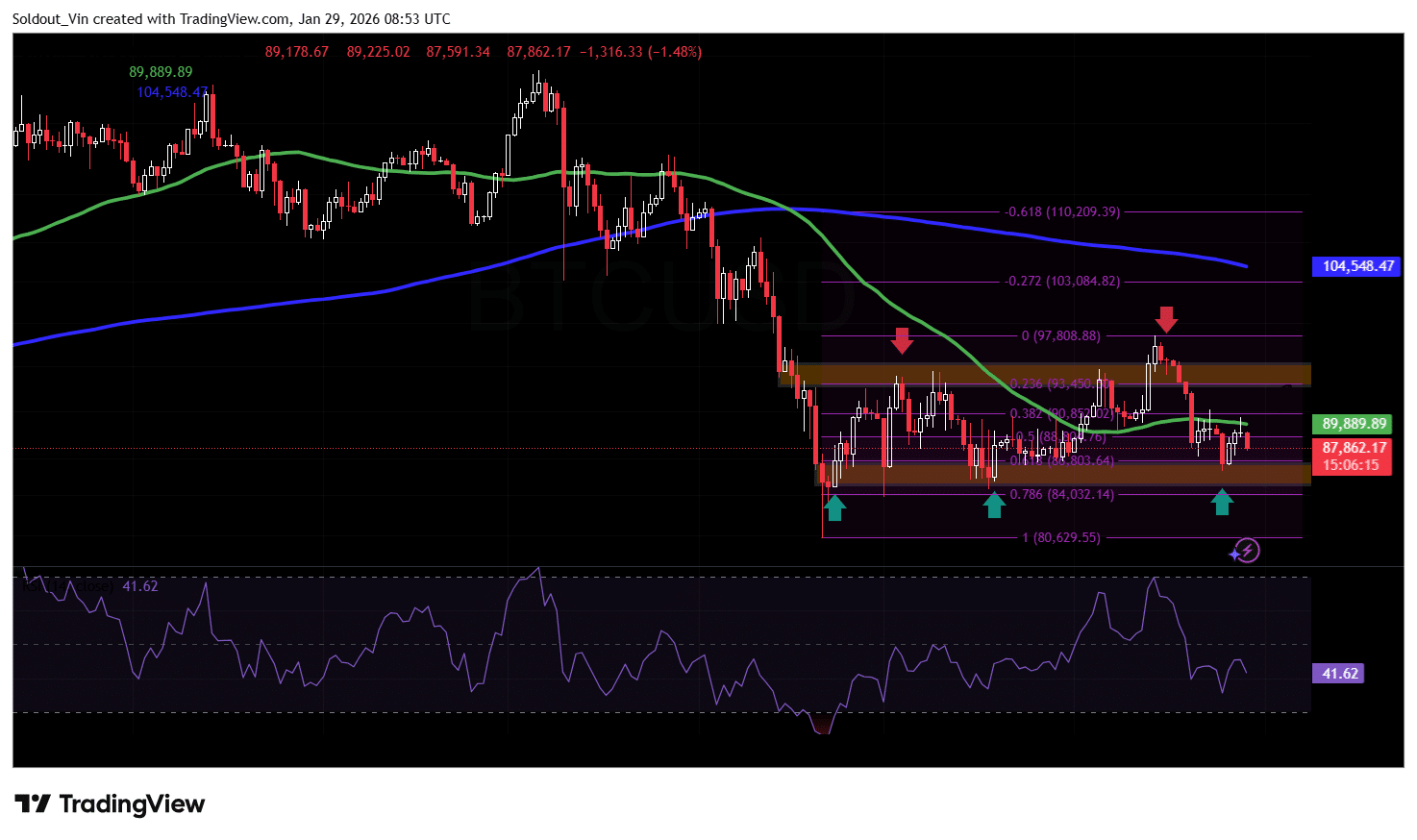

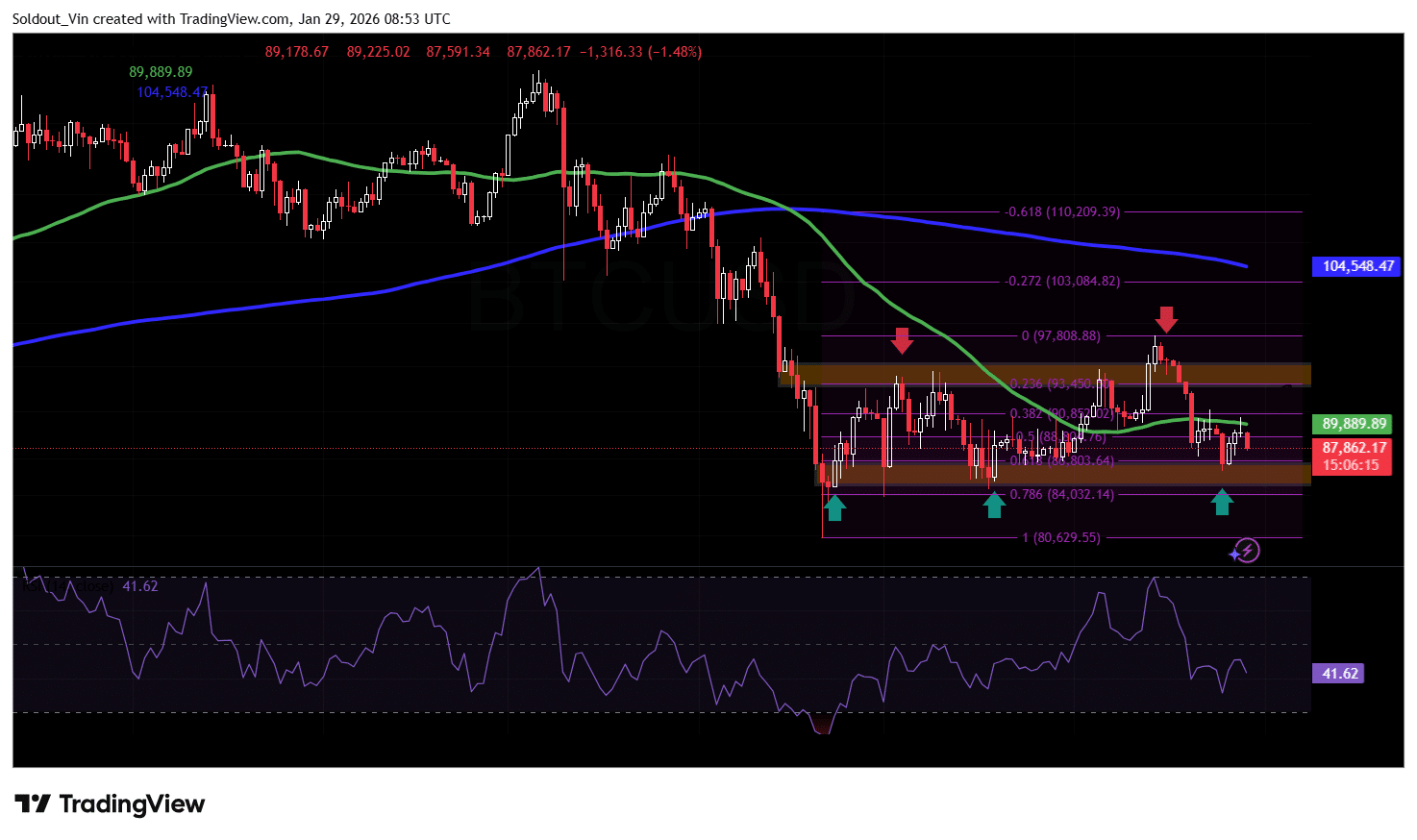

After reaching the $126,200 all-time excessive in early October, the Bitcoin worth fell right into a sustained decline, reaching the long-term help space round $80,629. This stage then turned a robust demand space, pushing the worth as much as a restoration across the $95,500 stage.

This space now acts as a robust barrier to the upside, serving as a cushion towards downward stress, with the BTC worth now held inside a sideways sample.

After hitting the $97,808 resistance on January 14, Bitcoin pulled again, with the 0.618 Fibonacci stage ($86,803) now offering help.

The current drop has pushed the worth of BTC down beneath the 50-day Easy Transferring Common (SMA), supporting the present bearish outlook, however nonetheless above its present help space.

Furthermore, the Relative Power Index (RSI) has been buying and selling between 37 and 47, indicating continued indecision amongst buyers.

BTC Worth At A Crucial Juncture

Bitcoin seems to be at a important juncture, with worth motion consolidating inside a spread following a pointy corrective transfer.

The market is presently holding above a key demand space close to the lower-range help, suggesting that patrons are nonetheless defending this zone regardless of the present bearish stress. If BTC can stabilize above the 88,000–89,000 area and reclaim short-term resistance, a reduction transfer towards the 93,000–95,000 space turns into more and more probably as sellers lose momentum.

Conversely, failure to carry present help would weaken the consolidation construction and enhance the chance of continuation towards decrease help ranges close to the prior vary lows.

On this case, if BTC drops beneath the 0.618 Fib stage, the subsequent doable help is on the 0.786 Fib stage round $84,302, adopted by the $80,629 stage.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection