- MicroStrategy’s Bitcoin holdings sparked debate after a brand new BTC buy announcement.

- Business figures defended the legitimacy of Technique’s custodial setup and audits.

- Regardless of short-term strain, institutional curiosity may assist an MSTR rebound.

MicroStrategy shares took successful on Wednesday, Jan. 29, as chatter throughout the crypto group questioned whether or not the corporate’s Bitcoin holdings are as strong as claimed. The sell-off adopted renewed scrutiny after Chairman Michael Saylor introduced one other massive BTC buy, a transfer that normally attracts applause however this time sparked debate as a substitute. Regardless of the noise, Saylor rapidly stepped in to make one factor clear, the corporate buys actual Bitcoin, not paper claims or artificial publicity.

Neighborhood Debate Over Technique’s Bitcoin Publicity

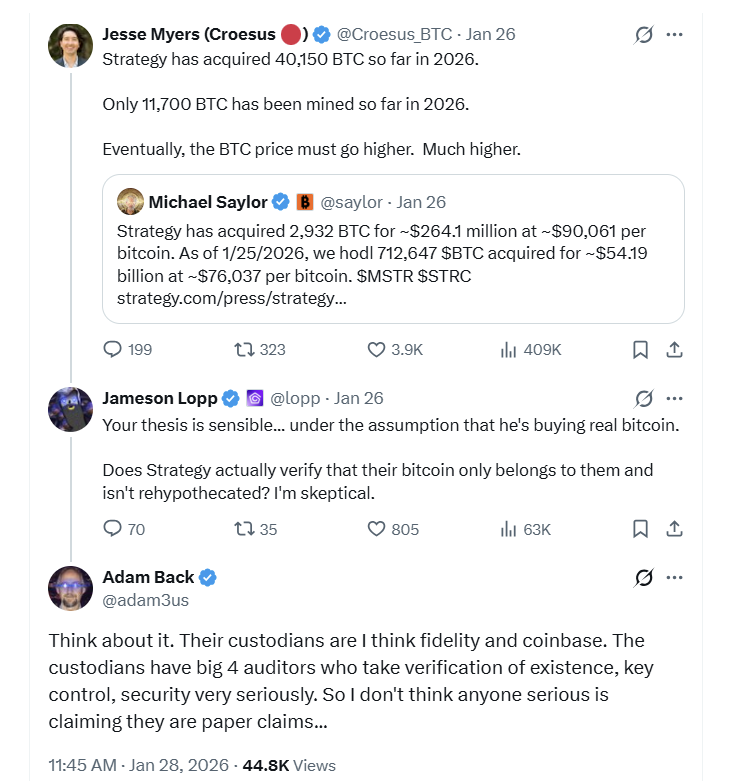

The dialogue gained momentum on X shortly after Saylor revealed that Technique had acquired an extra 2,932 BTC, a purchase order valued at roughly $264.1 million at a mean value close to $90,061 per coin. In keeping with Saylor, the agency now holds 712,647 BTC as of Jan. 25, 2026, amassed at a complete value of about $54.19 billion, or roughly $76,037 per Bitcoin. These numbers alone are staggering, and so they naturally entice consideration, typically skeptical consideration.

Jesse Myers, Head of Bitcoin Technique, added gas to the bullish facet of the argument by stating that Technique has already acquired 40,150 BTC in 2026, whereas solely round 11,700 BTC have been mined to date this yr. To him, the imbalance is clear and helps the next BTC value over time. Nonetheless, not everybody was satisfied, with some voices asking whether or not the holdings have been absolutely owned and managed, or if rehypothecation was quietly in play.

Custody, Audits, and the “Actual Bitcoin” Query

Bitcoin developer Jameson Lopp acknowledged the logic behind the availability argument however made his assist conditional on one key situation, that Technique really controls actual, on-chain Bitcoin. He raised issues round custody buildings and whether or not the BTC might be encumbered in much less clear methods. That prompted a swift response from cryptographer Adam Again, who pushed again laborious on the skepticism.

Again highlighted that Technique’s custodians embody Constancy and Coinbase, each broadly considered institutional-grade operators. He famous that these corporations endure strict audits from Huge 4 accounting corporations, with particular consideration paid to asset existence, key management, and general safety practices. In his view, claims of widespread paper BTC merely don’t maintain up when credible custodians and auditors are concerned, although critics nonetheless argue that transparency in custody isn’t good.

Saylor Pushes Again as MSTR Appears for a Bounce

As the talk rolled on, Saylor addressed the issues straight, stating plainly that Technique doesn’t rehypothecate and that its Bitcoin holdings are professional and on-chain. Further commentary from trade figures steered that enormous parts of Technique’s BTC are held throughout Coinbase Custody, Anchorage Digital, and Constancy, with some balances more durable to hint as a consequence of how sure custodians combination shopper funds. Even so, no concrete proof of rehypothecation has surfaced to date, which has cooled a few of the louder accusations.

Available on the market facet, MSTR inventory has been beneath strain, buying and selling close to latest lows after dropping 1.94% up to now 24 hours to round $158.45. The inventory is down roughly 3.5% over the past 5 days, although it stays up modestly on a month-to-month and year-to-date foundation. As standard, MSTR continues to maneuver intently with Bitcoin, and up to date BTC weak point has weighed on sentiment. Nonetheless, with institutional gamers like Vanguard reportedly constructing sizable positions, some traders imagine the inventory could also be organising for a restoration as soon as Bitcoin finds its footing once more.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.