It’s secure to say that the cryptocurrency markets have seen higher days as bitcoin led the best way towards one other substantial crash on Thursday afternoon that culminated hours in the past with new multi-month lows.

Ripple’s cross-border token isn’t any exception, because the asset dumped to $1.70 for the primary time because the early October bloodbath, when it dipped beneath $1.60 on most exchanges and even beneath $1.00 on a couple of.

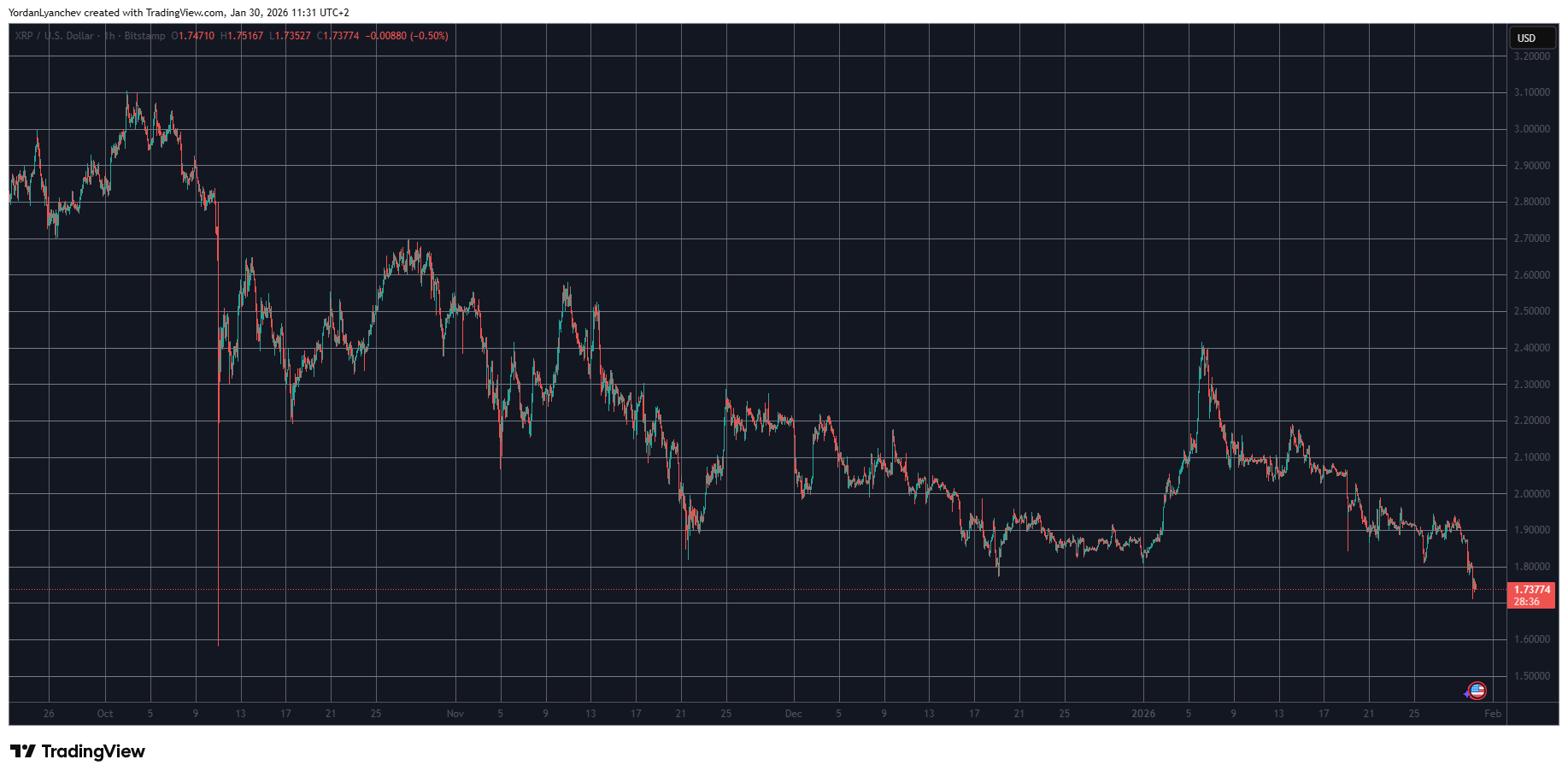

The chart above paints a extremely painful image for Ripple’s token this 12 months. Though it’s laborious to consider now, recall that it skyrocketed within the first week of 2026 to only over $2.40 in instances when the market confirmed minor indicators of revival and the inflows towards the spot XRP ETFs had been regular and spectacular.

Nevertheless, each have modified previously few weeks, maybe pushed by rising geopolitical uncertainty on many fronts, the most recent being between the US and Iran.

As such, one of many two vital causes behind XRP’s newest crash to a multi-month low is the general market-wide state, during which BTC dumped to $81,000, and lots of altcoins plummeted by 8% or extra.

The second, although, could possibly be attributed to the aforementioned ETFs, which recorded their worst single-day net-flow efficiency because the first, Canary Capital’s XRPC, launched in mid-November.

Information from SoSoValue exhibits that the entire internet outflows for January 29 stood at $92.92 million, which introduced the cumulative internet inflows all the way down to $1.17 billion from $1.26 billion. Furthermore, this quantity is sort of as excessive because the earlier internet outflows mixed.

CryptoWZRD weighed in on XRP’s latest efficiency, indicating that so long as the asset stays beneath $1.82, merchants might count on “extra random motion.” A rebound to over that stage, although, might flip the tables in a extra favorable method for the bulls.

The publish Ripple’s XRP Crashes to three.5-Month Low: Right here’s Why appeared first on CryptoPotato.