Matt Hougan, the chief funding officer at Bitwise Asset Administration, mentioned he thinks Solana might plausibly grow to be a trillion-dollar asset inside 5 years—an consequence that will roughly translate right into a ~$1,600 SOL value on a easy market-cap-per-token foundation, relying on circulating provide.

Hougan made the remarks on the Jan. 29 episode of When Shift Occurs, framing his Solana view by way of what he known as a “two methods to win” setup: development within the addressable market (stablecoins and tokenized property), plus an rising share captured by Solana versus competing networks.

Why Solana Might Hit $1,600+ Inside 5 Years

Hougan argued that the “infrastructure market” for stablecoins and tokenization is increasing rapidly sufficient that giant, liquid L1s must be valued much less like area of interest crypto experiments and extra like enabling rails for conventional finance. “The US Secretary of Treasury expects the stablecoin market to 12x over the following 4 years,” he mentioned, including that Larry Fink has described a future the place “each asset, each fund, ETF, inventory, bond, actual property will likely be tokenized.”

From there, his Solana thesis leaned closely on relative positioning. Ethereum stays the incumbent in stablecoins and tokenization, Hougan mentioned, however Solana is “a legit competitor with an fascinating technological differentiation,” and crucially “it’s terribly straightforward to make use of and the group has a ship first perspective.”

Associated Studying

That usability level, in his view, is underpriced by traders who give attention to benchmark-style comparisons. “I feel ease of use is a killer app that’s underrated by traders,” Hougan mentioned. “Buyers like to speak about throughput and so they like to speak… TPS… who cares about this? …For an finish consumer who’s buying and selling, who’s on-ramping, ease of use is the killer app. And Solana is simply straightforward to make use of, simply lifeless straightforward to make use of.”

Hougan additionally acknowledged a standard investor blind spot: token provide dynamics can separate value motion from market cap development. He famous that Solana’s market worth can rise meaningfully even when the token value revisits prior highs, and prompt staking yield partially offsets dilution, citing “roughly like 7% a 12 months.”

One other thread within the dialogue was how regulation formed institutional conduct. Hougan mentioned Solana’s footprint in stablecoins and tokenization was constrained through the prior US regulatory atmosphere, arguing that establishments “couldn’t construct on Solana” in the event that they believed it sat “outdoors of the regulatory perimeter.” With that cloud lifting, he mentioned, mandates are beginning to broaden.

He additionally described why the ETF wrapper issues extra for a smaller asset. “You place slightly little bit of inflows into an ETF package deal and so they’re chasing a comparatively small provide of Solana,” Hougan mentioned. “It’s probably the greatest setups for an asset that I’ve ever seen as a result of you may have this small constrained dimension, you may have vital institutional demand, you may have stablecoins and tokenization… you set all that collectively and it looks as if a winner.”

Nonetheless, he prevented onerous value targets and as an alternative stayed in market-cap phrases. “In 5 years I feel it may very well be a trillion greenback asset. I feel that’s comparatively straightforward to think about,” he mentioned. “It’s onerous to present a exact goal as a result of it is dependent upon the tempo of development on stablecoins and tokenization. It is dependent upon whether or not Congress passes the Readability Act. It is dependent upon the kind of crypto market cycles.”

E156: @Matt_Hougan from @BitwiseInvest – $6.5M Bitcoin and the strongest Solana setup ever?

This is likely to be essentially the most bullish but rational episode we’ve accomplished on the way forward for crypto: why debasement, institutional flows & tokenization are simply getting began.

Timestamps:

0:00… pic.twitter.com/WMqvKL7pCj

— MR SHIFT 🦁 (@KevinWSHPod) January 29, 2026

On easy market-cap math, a $1 trillion Solana valuation implies a four-figure token value relying on provide. The connection is easy: token value equals market cap divided by provide. Utilizing Solana’s circulating provide of roughly 566 million SOL, a $1 trillion market cap works out to about $1,766 per SOL ($1,000,000,000,000 ÷ 566,000,000).

Associated Studying

In case you as an alternative use a completely diluted-style denominator nearer to 619 million SOL, the identical $1 trillion market cap implies roughly $1,615 per SOL ($1,000,000,000,000 ÷ 619,000,000). In different phrases, Hougan’s “trillion-dollar asset” framing maps to one thing just like the mid-$1,000s per token on right this moment’s provide assumptions, with the precise quantity transferring as provide modifications.

Notably, Hougan’s Solana name sat alongside a broader macro narrative he returned to repeatedly: financial debasement pushing traders towards scarce and non-sovereign shops of worth. On Bitcoin, he argued the “two methods to win” are the store-of-value market increasing and Bitcoin taking share from gold, an arc he mentioned might drive multi-million-dollar BTC over many years if the final 10–15 years of adoption tendencies persist.

For Solana, the equal is much less about being “digital gold” and extra about changing into a main venue for stablecoin flows and tokenized securities. If these rails scale and if Solana continues gaining share as a high-velocity, institution-friendly community, Hougan’s trillion-dollar state of affairs implies the market continues to be pricing the chance too conservatively.

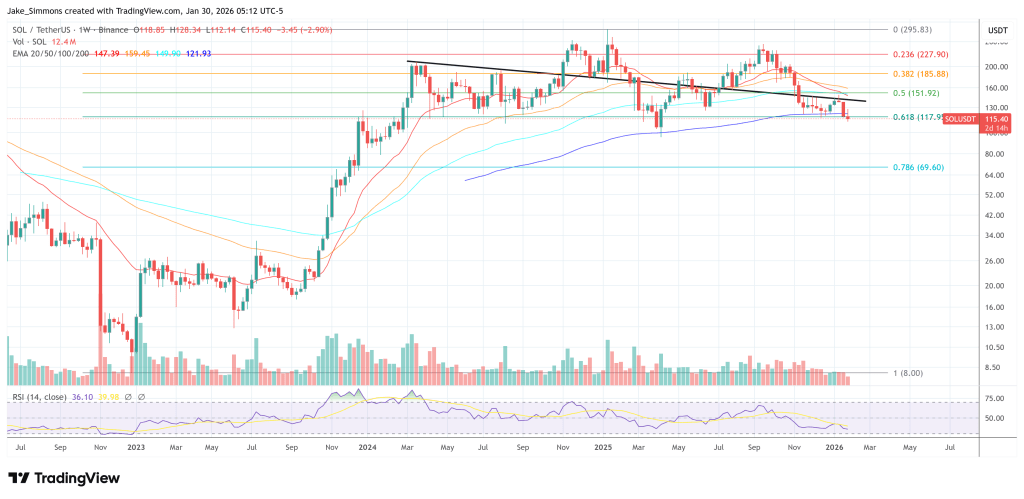

At press time, SOL traded at $115.40.

Featured picture created with DALL.E, chart from TradingView.com