- Solana sustained excessive TPS throughout memecoin surges with out lasting degradation

- Memecoin exercise elevated token deployments whereas community efficiency stayed steady

- Speculative quantity translated into robust DEX exercise and utility income

At first look, Solana’s newest spike in exercise seems like pure memecoin chaos, loud, quick, and closely speculative. However beneath the floor, one thing extra fascinating is going on. The community is being pushed arduous in actual time, and up to now, it’s holding up, testing scalability, charge habits, and throughput in circumstances that really feel something however theoretical.

What stands out is that this isn’t a one-off efficiency burst. Solana’s transaction throughput has been working at production-level consistency, not lab-grade peaks that vanish the second strain hits.

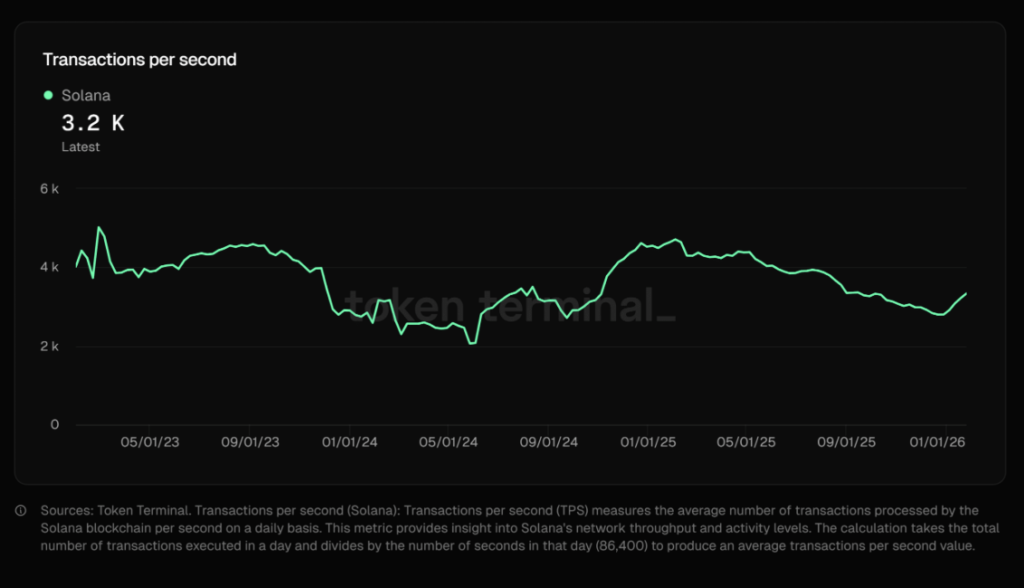

Throughput Holds Regular Underneath Actual Demand

Since 2023, Solana’s transactions per second have persistently landed between roughly 2,000 and 5,000 TPS, with latest readings hovering close to 3,200, even throughout aggressive memecoin launch waves. That issues, as a result of speculative surges didn’t break the system or trigger lingering slowdowns. Throughput spiked, then normalized rapidly, which is precisely what you need to see when actual demand exhibits up.

After dipping towards the two,000 TPS vary in mid-2024, Solana steadily scaled again into 2025. That restoration wasn’t tied to a single occasion or hype cycle, it tracked broader ecosystem progress. Weekly averages now present Solana capturing round 40% of complete Layer 1 transaction throughput, second solely to Web Laptop, which sits close to 4,100 TPS. Most different main chains, together with Ethereum, BNB Chain, and TRON, function far decrease, usually beneath 150 TPS.

Solana’s benefit comes from parallelized execution, low charges, and an optimized networking stack. Excessive exercise doesn’t destabilize the system, it stacks on prime of itself. Minimal degradation beneath stress isn’t a benchmark trick, it’s proof the community works in dwell circumstances, not simply on paper.

Memecoins Are Again, and the Community Isn’t Flinching

Memecoin exercise on Solana has ramped up once more, with every day token deployments pushing previous 40,000, an eleven-month excessive. What’s notable is the timing. This resurgence occurred whereas transaction throughput stayed firmly within the 3,000 to five,000 TPS vary, even throughout peak launch durations.

Excessive-volume token creation didn’t clog the community. As an alternative, constant execution allowed speedy launches, fixed buying and selling, and near-nonstop experimentation. Deployment counts climbed over latest months with out stressing efficiency, confirming that scalability isn’t simply theoretical, it’s getting used.

Launch exercise has additionally unfold out. Somewhat than concentrating on a single platform, a number of launchpads are seeing participation, which factors to broader ecosystem involvement. Excessive TPS lowers friction, invitations hypothesis, and reinforces Solana’s function because the go-to execution layer when memecoin cycles warmth up once more, which they all the time appear to do.

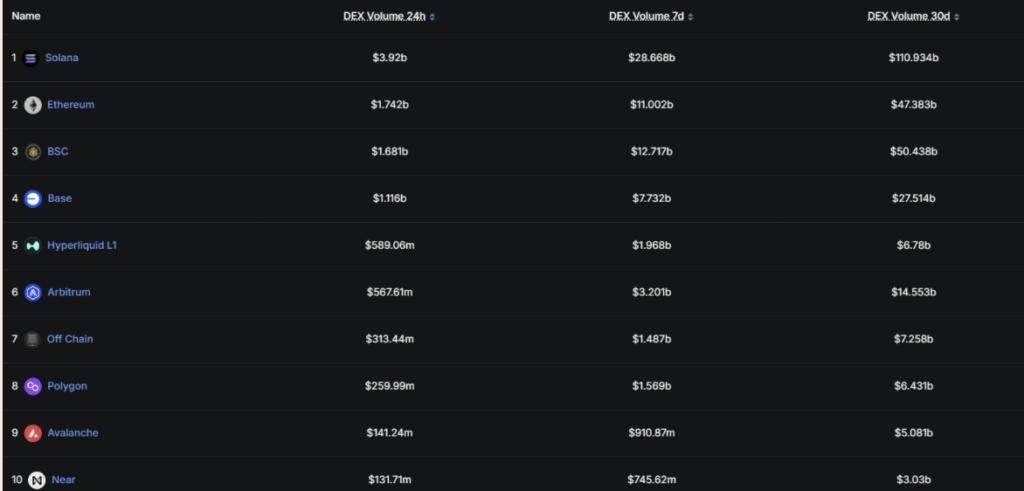

Hypothesis Turns Into Actual Income

What actually shifts the narrative is how hypothesis has translated into precise financial output. Over the previous 30 days, Solana-based DEX quantity topped $110 billion, greater than double Ethereum’s roughly $47 billion throughout the identical interval. That’s not simply noise, it’s sustained buying and selling depth.

Utility income adopted intently behind. Solana generated round $145 million in app income over that window, outpacing friends and validating its capability to seize charges at scale. And this didn’t occur throughout a quiet market stretch, it occurred proper in the course of a memecoin-driven cycle.

As exercise scales, base charges, precedence charges, and MEV extraction all compound. Throughput isn’t hole quantity that disappears with out affect. Utilization pays, and the numbers present it. Solana’s present second might look speculative on the floor, however beneath, it’s confirming one thing extra sturdy, the community can deal with chaos, and it might monetize it too.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.