Ethereum is getting into February 2026 on unstable floor. After slipping under key ranges, the asset is hovering close to zones that merchants have been watching. Strain is constructing, and market consideration is now on whether or not ETH can maintain its floor or if additional losses are forward.

Key Ranges in Focus

The $2,710 degree has been an essential help since December. Ethereum not too long ago dipped under it, elevating issues {that a} deeper transfer might observe. Crypto analyst Ardi described this zone as “very essential” and mentioned if ETH fails to carry right here, “the $2,620 swing low is the subsequent hunt.”

If $2,620 fails, consideration will possible shift to the $2,450 degree, which acted as a robust base in mid-2025. Based on Ardi, this space ought to function “the principle line of defence” on a bigger transfer down. “Beneath that will get extraordinarily ugly,” they mentioned, referring to the shortage of close by help beneath this zone.

$ETH / Ethereum

Very essential space for the chart right here. Lose this $2710 help and the $2620 swing low is the subsequent hunt.

~$2450 must be the principle line of defence on the macro transfer down. Beneath that will get extraordinarily ugly.

ETH/BTC additionally trending down aggressively. Seems to be like… pic.twitter.com/PKX4U3O6z8

— Ardi (@ArdiNSC) January 30, 2026

In the meantime, Ethereum is buying and selling at round $2,730 with a 24-hour quantity of $45.3 billion. The worth is down 7% within the final 24 hours and nearly 7% over the previous week (per CoinGecko’s knowledge). For the month of January, ETH misplaced practically 7%, at the moment buying and selling effectively under the degrees seen initially of the yr.

Over the previous day, the worth has ranged between $2,700 and $2,940. Ethereum is now 45% under its all-time excessive of $4,950 reached in August 2025.

Outflows from ETFs Add Strain

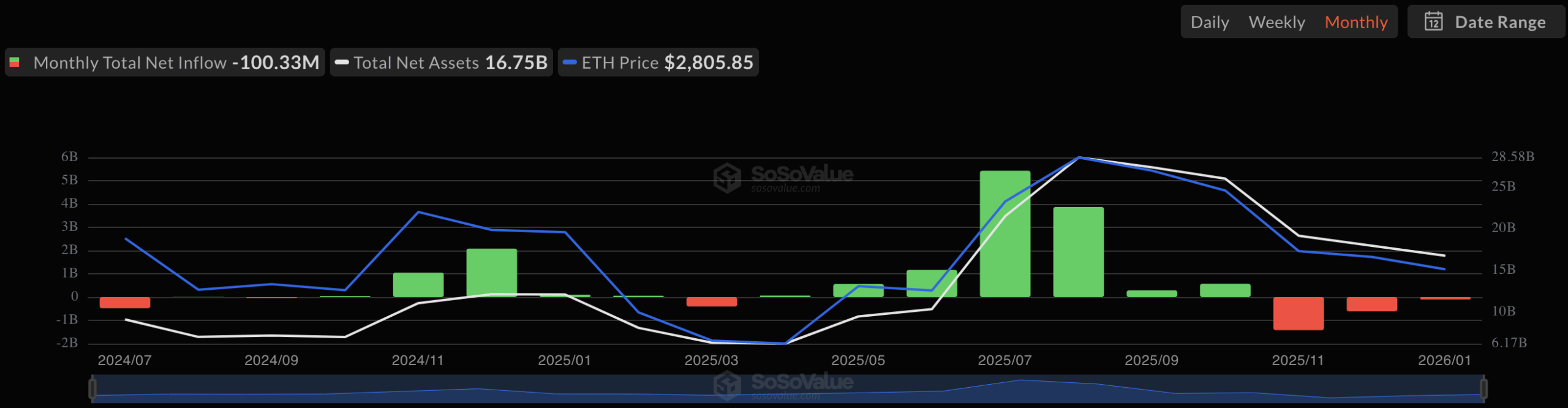

Investor flows into Ethereum ETFs proceed to indicate weak spot. January noticed a internet outflow of greater than $100 million. This adopted heavier outflows of $617 million in December and practically $1.5 billion in November. The constant exit over three months suggests decreased institutional curiosity.

One other analyst, Ted, commented that ETH has misplaced the $2,800 zone, pointing to the $2,500–$2,600 vary as the subsequent possible help. “That is probably to carry within the quick time period for any bounce,” he mentioned. Nonetheless, the sample of combined ETF flows has saved some merchants cautious.

Whereas the development has weakened, some analysts imagine situations are forming for a reversal. Bryant famous ETH is displaying a “triple bullish divergence,” the place worth kinds decrease lows and RSI kinds greater lows.

“It is a a lot stronger sign for a reversal,” they mentioned.

Others are watching long-term trendlines. Kamran Asghar identified that ETH is testing a help that has held since 2022, asking if this could possibly be a “buy-the-dip” space. In the meantime, Sykodelic projected a longer-term goal of $10,000, calling it a “cheap minimal” if a full restoration builds.

The publish The ‘Ugly’ ETH Situation: What Occurs If Ethereum Loses $2,620 appeared first on CryptoPotato.