- XRP stays range-bound as consumers defend key help however fail to interrupt resistance

- Whale accumulation has elevated regardless of combined on-chain exercise and value strain

- Institutional flows and bettering liquidity distinction with ongoing macro uncertainty

XRP is hovering close to an vital help zone whereas repeated makes an attempt to reclaim resistance maintain dropping steam. The token stays caught in consolidation following the broader market dip, and value motion feels heavy, not damaged, simply undecided. Merchants are caught weighing clear chart ranges in opposition to combined on-chain alerts that don’t totally agree with one another.

What’s added a little bit of pressure is large-holder conduct. Pockets knowledge reveals an increase in so-called millionaire addresses, whilst XRP struggles to regain the $2 stage. It’s the type of divergence that makes short-term merchants nervous, however long-term watchers quietly listen.

Vary-Certain Construction Defines the Close to-Time period Outlook

XRP has repeatedly defended a help space that continues to draw consumers on dips. Pushes beneath that zone have up to now failed to supply significant follow-through, suggesting demand continues to be current, even when it’s cautious. Brief-term charts present value compressing, with tighter candles and shrinking volatility.

Provide, nonetheless, has been simply as constant. Rallies maintain stalling close to a descending trendline, and momentum indicators aren’t providing a lot steering both method. Till value breaks cleanly above resistance or decisively loses help, XRP stays caught in a ready recreation.

Assist and Resistance Proceed to Dictate Strikes

Shopping for curiosity has clustered between the mid-$1.70s and round $1.80, a zone that has triggered a number of short-lived rebounds. Every bounce has been met with promoting strain, although, preserving the broader construction unchanged. These reactions recommend lively buying and selling, however not conviction.

Overhead resistance sits alongside a descending trendline and a wider distribution band that XRP has struggled to shut above on increased timeframes. Worth stays beneath the $2 psychological stage after sliding through the latest market drawdown, briefly dipping towards $1.79, a stage final seen throughout a previous pullback. For now, these boundaries stay the important thing set off factors.

Whale Accumulation Grows as On-Chain Indicators Keep Blended

On-chain knowledge paints a extra nuanced image. Glassnode knowledge reveals XRP’s market capitalization stabilizing after earlier corrections, aligning with the present consolidation section. Capital outflows have slowed, which regularly occurs when markets pause relatively than development.

On the identical time, community exercise has been uneven. Lively addresses rose earlier within the interval, then fell sharply, whereas transaction counts produced temporary spikes with out sustained progress. Regardless of this, giant holders continued accumulating. Santiment reported a internet enhance of 42 wallets holding a minimum of 1 million XRP this month, bringing the overall to 2,016, the primary rise since September 2025, whilst XRP is down roughly 4% up to now in 2026.

Institutional Flows and Macro Stress Collide

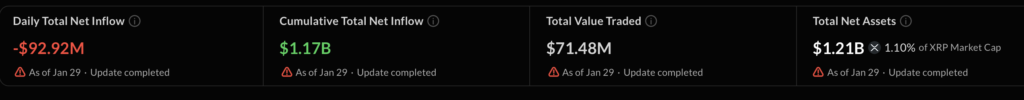

Nansen knowledge additionally pointed to good cash accumulation rising greater than 11% over the previous 30 days, preserving institutional positioning a part of the dialog. Spot XRP ETFs recorded internet inflows of $91.72 million this month, pushing whole internet inflows to $1.26 billion since launch. Month-to-month inflows have remained constructive since November, with sturdy contributions reported late final 12 months as effectively.

Macro strain hasn’t helped sentiment. XRP is down almost 12% since mid-January, weighed by broader risk-off strikes following renewed tariff warnings from US President Donald Trump towards the European Union and Canada. Even so, XRP Ledger liquidity traits have stayed constructive. Stablecoin liquidity climbed from $85 million earlier in 2025 to $406 million, with Ripple’s RLUSD accounting for almost all. Trade knowledge additionally suggests XRP was moved off platforms throughout a lot of the macro stress interval.

Ripple has continued constructing on the product aspect, not too long ago saying Ripple Treasury, a unified dashboard combining crypto, money, and treasury administration. In the meantime, asset supervisor 21Shares outlined a bull-case state of affairs concentrating on $2.69, citing ETF demand and rising institutional curiosity in issuing real-world belongings on the XRP Ledger.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.