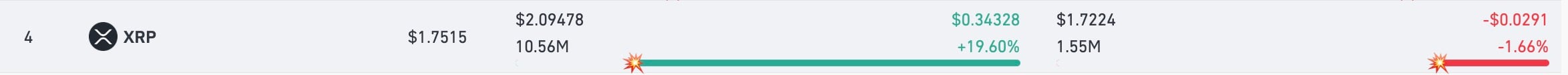

After a wild week, XRP is now actually near a full lengthy leverage reset, however the bear facet of the market appears to have missed this element amid all of the turbulence of the “crypto winter” in January. As CoinGlass information proves, with a present value of about $1.74, XRP is simply 2.14% away from hitting its “max ache” threshold of $1.7224.

On the opposite facet is a 20.13% climb towards the max ache of the quick sellers proper on the “candy” spot of $2.09478 per XRP. Contemplating the essence of the $2 threshold for XRP, and crypto marker’s previous prophecy — “essentially the most entertaining end result is the most certainly” — stage appears to be set for the altcoin to set off hundreds of thousands price of bears’ margin calls in February.

As a matter of truth, quick positions at the moment are virtually 10 occasions bigger than longs, making a powder keg below any upside impulse.

XRP could also be behind Solana, Ethereum and Bitcoin by way of internet ache metrics however has one of many tightest lengthy proximity triggers on the chart. Whereas bears are getting snug, the hazard isn’t from a collapse; it’s from a grind greater that resets every little thing.

Bear euphoria meets XRP value math

XRP misplaced the $1.89 structural degree this week and rejected twice beneath $1.93. However as an alternative of collapsing, the chart is accumulating across the $1.72-$1.76 liquidity band, refusing to flush additional. Squeeze rallies have a tendency to begin with a stall, adopted by a pointy breach as soon as gas accumulates. On this case, “gas” means quick margin publicity.

If the XRP value hits $2 in February, it will be the best quantity for bears in a month. If the worth even faucets $2.0947 once more, it’s going to unwind 20.13% of the short-side stress in a single wave.

The one factor lacking is a steady funding charge and optimism available on the market. As soon as these situations are set, the bears’ lead could rapidly get recalculated in max ache math.