- Binance says most liquidations occurred earlier than any exchange-specific points appeared

- Knowledge exhibits losses had been unfold throughout a number of platforms, not only one venue

- The crash is being framed as a leverage stress check underneath macro stress

Binance has launched an in depth autopsy on the October 10, 2025 crypto flash crash, pushing again on the concept exchange-side failures had been the principle set off. In line with the alternate, the $19 billion liquidation wave was largely pushed by macro shocks and automatic threat controls firing throughout the market, not by any single platform breaking down.

Internally dubbed the “10/10 incident,” the crash unfolded throughout a tough macro backdrop. Commerce-war headlines resurfaced, international bond yields jumped, and fairness markets had been already sliding. That blend, Binance says, set off a fast and aggressive deleveraging throughout crypto derivatives, with positions unwinding virtually in every single place directly.

Clarifying the File After Weeks of Criticism

The report comes after weeks of hypothesis and criticism aimed squarely at Binance. On social media and in analyst commentary, the alternate was steadily named as a attainable supply of the cascade. Merchants pointed to temporary value dislocations, uncommon index habits, and scattered stories of interface glitches as indicators that one thing had gone incorrect on Binance’s facet.

Binance’s response is clearly meant to separate notion from sequence. By laying out a exact timeline, the alternate argues that the majority of liquidations occurred earlier than any Binance-specific points appeared. In its view, the market was already in freefall, and the exchange-level incidents got here later, not first.

Liquidations Peaked Earlier than Platform Points Appeared

In line with Binance, essentially the most violent section of liquidations occurred earlier than 21:36 UTC. By that time, the alternate claims roughly 75% of all business liquidations had already taken place. The 2 technical points Binance later acknowledged solely emerged after that peak window.

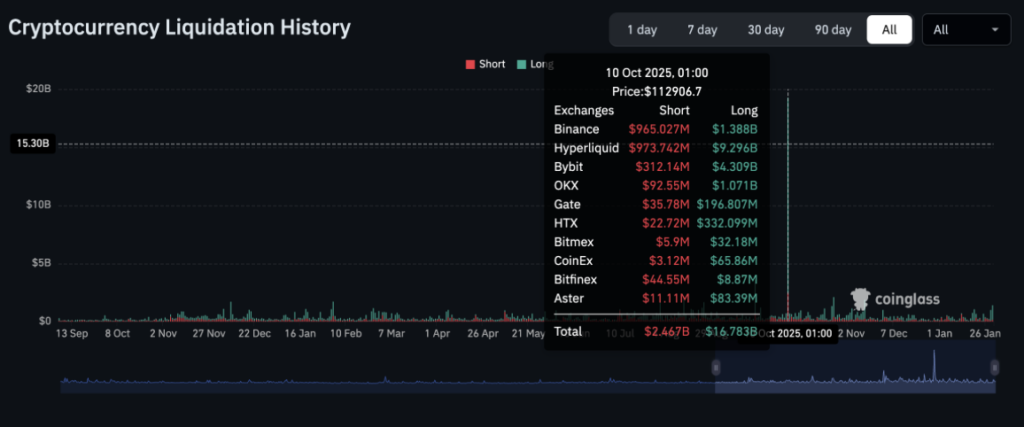

CoinGlass knowledge illustrates simply how widespread the injury was. At round 01:00 UTC on October 10, complete liquidations hit roughly $19.25 billion, with lengthy positions taking the brunt of the hit. Binance itself recorded about $1.39 billion in lengthy liquidations and roughly $965 million in shorts. Hyperliquid noticed a good bigger determine, with $9.29 billion in lengthy liquidations, whereas Bybit logged greater than $4.3 billion and OKX over $1.07 billion.

The losses had been unfold throughout a number of venues, not focused on one alternate. Binance leans closely on that time, arguing the size and distribution level to a systemic leverage unwind fairly than a single level of failure.

Two Incidents Acknowledged, Impression Downplayed

Whereas rejecting blame for the broader crash, Binance did acknowledge two localized points through the volatility window. The primary occurred between 21:18 and 21:51 UTC, when its asset switch system between Spot, Earn, and Futures briefly degraded. The problem was tied to database pressure underneath heavy load. Some customers noticed zero balances within the interface for a brief interval, although Binance says precise funds had been by no means in danger.

The second incident adopted shortly after, between 21:36 and 22:15 UTC. Throughout that window, irregular index value deviations appeared for property like USDe, WBETH, and BNSOL. Binance admitted these deviations doubtless contributed to margin calls and liquidations on sure pairs, particularly the place liquidity was skinny.

Since then, the alternate says it has tightened deviation thresholds, improved cross-exchange reference pricing, and upgraded circuit breakers to cut back the percentages of a repeat.

A Stress Take a look at for Leverage, Not Simply Infrastructure

Binance framed the October crash as a stress check of the crypto market itself, not simply its personal methods. In its view, leverage focus and automatic market-maker threat controls amplified volatility as soon as macro stress hit. When everybody tried to exit directly, the construction buckled, rapidly.

The alternate says it has responded by increasing stress-testing packages, enhancing monitoring of database efficiency throughout volatility spikes, and growing capability planning for future shocks. The message is evident. October 10 wasn’t about one alternate failing. It was a couple of market nonetheless studying how fragile heavy leverage will be when the macro tide all of a sudden turns.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.