- Chainlink has elevated its reserve holdings by 377% since This autumn 2025

- On-chain charges reached file highs, signaling robust community utilization

- Worth weak point might replicate market sentiment fairly than deteriorating fundamentals

Provide squeezes have a behavior of exhibiting up late, however after they do, they have a tendency to matter. From a purely technical angle, locking away a bit of complete provide naturally pushes the worth of every remaining unit greater. Add rising demand to that equation, and also you’ve obtained the elements for a scarcity-driven transfer that may shock folks.

It’s not nearly charts and math, both. Provide shocks typically strengthen holding conviction. When tokens are being pulled out of circulation, it reinforces the concept that somebody, someplace, sees long-term worth. The query proper now could be whether or not Chainlink’s current accumulation really helps that thesis, particularly given how weak LINK’s value motion has regarded.

Chainlink Quietly Tightens Provide

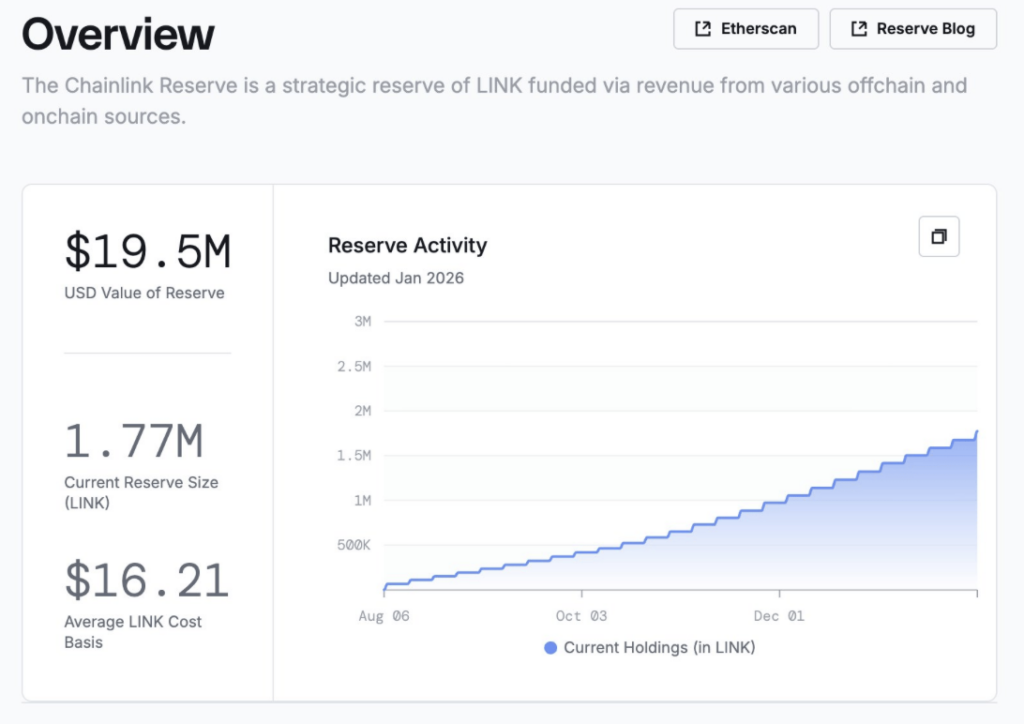

Chainlink not too long ago disclosed that its reserve added 99,103 LINK, the most important single accumulation it’s made thus far. That pushed the overall quantity of LINK locked in reserves to roughly 1.77 million, tightening provide greater than at any level earlier than.

Zooming out makes it extra fascinating. Previous to This autumn 2025, the reserve held about 371,000 LINK. Since then, roughly 1.4 million LINK has been added, a 377% improve in a comparatively brief window. On paper, that’s a significant provide squeeze.

In value phrases, although, it hasn’t proven up but. LINK hasn’t reacted the best way shortage fashions would counsel, at the very least not thus far.

Income Retains Flowing, Worth Retains Lagging

What provides stress to the setup is how Chainlink funds this accumulation. The reserve is constructed utilizing each on-chain and off-chain income, not token emissions or dilution. That factors to actual adoption and actual utilization, even when the market isn’t rewarding it in the intervening time.

Chainlink’s function as a cross-chain bridge provides it a singular price mannequin. At any time when good contracts depend on its oracles, whether or not it’s a DeFi lending protocol pulling value feeds or a derivatives platform managing danger, charges are generated. Lately, charges throughout 13 completely different chains hit an all-time excessive, with Ethereum alone contributing about $6.8 million. That’s not hype, it’s utilization.

These charges movement straight into LINK’s reserve. And but, value retains dragging.

Undervaluation Can Be a Characteristic, Not a Bug

LINK has been one of many weaker performers over the previous few months, down roughly 39% in This autumn 2025 and one other 11.7% thus far in 2026. On the floor, that appears ugly. Dig slightly deeper, and it begins to resemble broad market FUD fairly than project-specific failure.

In this type of surroundings, underperformance can really be bullish. Sturdy on-chain income, rising demand for providers, and regular provide lockups don’t disappear simply because value is gradual to reply. They have an inclination to point out up later, generally all of sudden.

If demand accelerates whereas provide stays constrained, LINK may flip from ignored to scarce in a short time. For affected person traders, this stretch might find yourself trying much less like weak point and extra like accumulation in disguise.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.