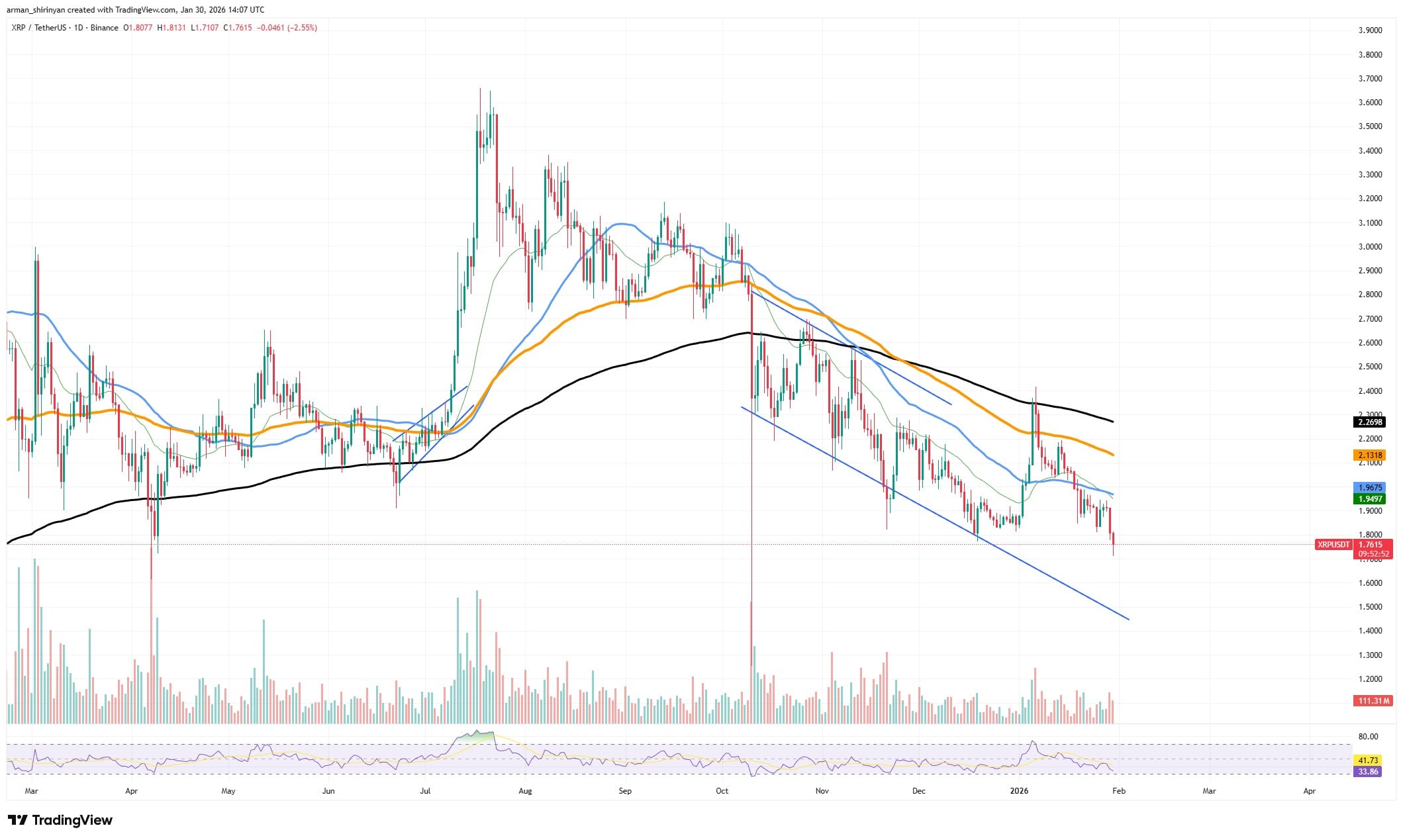

The construction that’s growing on a number of crypto charts signifies that the market is about to enter a transition section, and multimonth downtrends look to be nearing exhaustion. The character of the decline has modified, regardless that the worth continues to be technically under the most important shifting averages.

XRP’s transition section has been reached

Momentum is fading, promoting strain is now not accelerating and bears are working out of fresh draw back construction to use. XRP printed a collection of decrease highs and decrease lows inside a descending channel for a number of months, and every rally was rejected rapidly, confirming development management by sellers.

There has not been a lot follow-through promoting, and the final leg down didn’t end in a robust continuation candle. As a substitute of enlargement, value is compressing close to a traditionally reactive zone. Even earlier than a reversal turns into obvious, compression following a chronic decline is steadily the primary indication {that a} development is coming to an finish.

This interpretation is supported by quantity habits. Massive spikes accompanied earlier capitulation occasions, however latest draw back makes an attempt are taking place on comparatively lighter participation. When a market traits decrease with declining quantity, it indicators vendor fatigue. There may be merely much less aggressive provide coming into the order e-book. Bears can nonetheless push value decrease within the quick time period, however the power behind the transfer is clearly lowered.

From a structural standpoint, XRP is approaching some extent the place new quick positions’ risk-reward ratio is now not interesting. Many of the apparent promoting has already occurred following a protracted decline, and late bears are coming into at ranges the place bounce chance will increase, not decreases. Even when a full bull development doesn’t begin straight away, this dynamic steadily leads to the downtrend ending.

This doesn’t assure an explosive rally. Seldom do markets go from a pointy decline to a vertical restoration with out first establishing a base. What’s extra seemingly is a interval of stabilization adopted by a aid restoration that resets positioning. An important lesson is that the aggressive downward development is waning.

At present ranges, XRP seems much less like a falling asset and extra like one coming into accumulation territory. The downtrend will not be violently reversing but, however its grip is loosening, and that alone modifications the outlook. Buyers ought to anticipate restoration makes an attempt, or at minimal, a halt in persistent draw back strain.

Shiba Inu takes hit

Shiba Inu continues to commerce below persistent bearish strain, and the chart reveals a market that has not but escaped its broader downtrend. Value motion stays trapped beneath all main shifting averages, that are sloping downward and appearing as dynamic resistance. Each restoration try over the previous months has been offered into, reinforcing the construction of decrease highs that defines the present development.

A tightening triangle near native lows is the newest growth. As a substitute of signaling power, this formation is rising after an prolonged decline, which regularly displays indecision moderately than accumulation. Patrons are current, however their affect is restricted. Every bounce is shallow, and quantity doesn’t present convincing enlargement on upward candles. That imbalance suggests demand is reactive, not aggressive.

The broader construction issues greater than the short-term sample. SHIB has been stair-stepping decrease since its earlier peak, and the market has not produced a clear reversal sign, equivalent to a better excessive or a break above key resistance zones. Till that occurs, rallies are corrective by definition. The shifting averages stacked above value kind a layered ceiling that may require sturdy momentum to reclaim.

Within the close to time period, a short volatility spike is feasible because the triangle resolves. A small aid bounce towards the closest resistance cluster can’t be dominated out. Nevertheless, the dominant development nonetheless favors sellers. With no decisive shift in construction and quantity, upside strikes are prone to be capped and short-term.

Bitcoin is ok for now

Bitcoin is below strain within the quick time period, however the broader construction nonetheless suggests relative stability so long as value holds above the crucial $80,000 zone. The latest drop has pushed BTC towards the decrease boundary of its multiweek vary, but it has not damaged the extent that may sign structural harm. For now, it is a correction inside a bigger consolidation moderately than a confirmed breakdown.

The chart reveals Bitcoin buying and selling under its short-term shifting averages, reflecting weak momentum and cautious sentiment. Sellers clearly have the benefit within the instant time-frame, however their management stays incomplete. The $80,000 space acts as a psychological and technical help stage, bolstered by earlier response lows and heavy historic quantity. Such zones are sometimes vigorously defended by markets, notably following protracted declines.

Bitcoin is unlikely to expertise vital long-term issues until it sharply falls under $80,000. A agency grip on this space may promote vary buying and selling and eventual stabilization, permitting consumers to regain their confidence. For now, Bitcoin sits at a stress check, not a collapse level.

The $80,000 threshold stays the road separating a manageable correction from a extra severe bearish section. A breakdown, nonetheless, would shift the narrative towards deeper draw back exploration.