- PEPE stays trapped in a descending channel as whale promoting accelerates throughout broader market weak spot

- Giant holders offloaded over 4.25T PEPE, reinforcing bearish momentum and aggressive spot promoting

- Technical indicators keep oversold, with draw back danger towards $0.0000043 until $0.0000051 is reclaimed

Pepe has been caught inside a descending channel ever because it was rejected close to $0.00000688 about two weeks in the past. What began as a gradual fade turned sharper after the latest market-wide crash, pushing the memecoin all the way down to an area low round $0.0000044. On the time of writing, PEPE is buying and selling close to $0.000004541, down roughly 5.6% on the day and increasing a downtrend that’s now stretched throughout your entire week.

Worth motion hasn’t proven a lot aid. Every bounce try has been weaker than the final, and sellers proceed to step in early, retaining stress firmly tilted to the draw back.

Whale Dump Provides to Bearish Stress

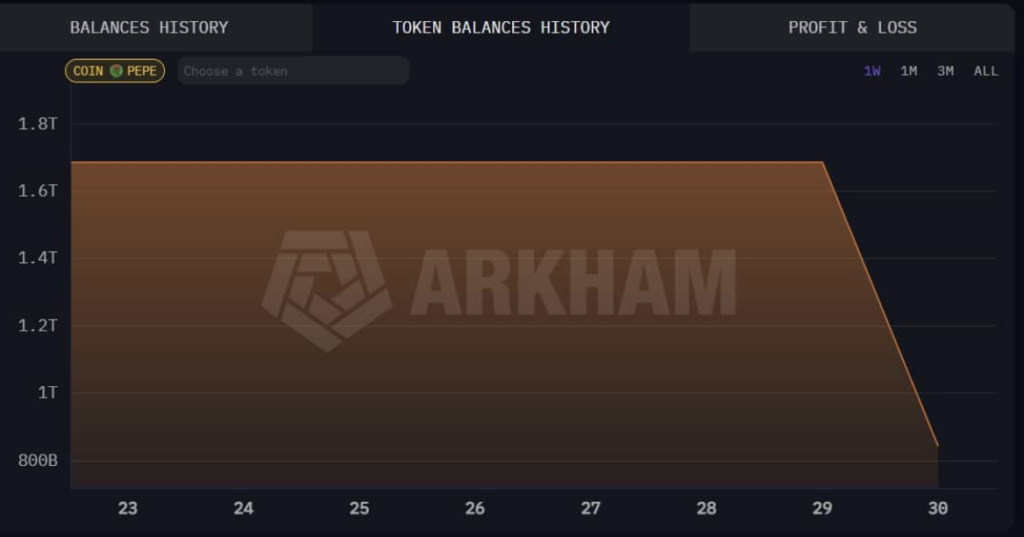

As PEPE struggled, a long-term whale resurfaced and determined it was time to promote. After holding roughly 1.7 trillion PEPE tokens since October, the whale offloaded 858 billion tokens value about $3.88 million. That transfer alone was sufficient to lift eyebrows, given the pockets had been inactive on the promote facet because it started accumulating again in 2023.

Even after the sale, the whale nonetheless holds round 842 billion PEPE, valued at roughly $3.82 million, based on Arkham information. Nonetheless, the timing issues. Promoting into weak spot hardly ever boosts confidence, and this transfer didn’t occur in isolation.

Nansen information reveals that high holders collectively offloaded round 4.25 trillion PEPE following the broader market dip. That sort of outflow factors to rising nervousness amongst giant holders, not quiet accumulation. When whales begin trimming throughout a downtrend, it often displays worry of deeper losses somewhat than profit-taking at energy.

Promoting Dominates Spot Movement

Quantity information reinforces the bearish image. On January 30, PEPE’s promote quantity dipped barely to about 4.46 trillion, down from 6.56 trillion the day earlier than. Over the identical interval, purchase quantity got here in at roughly 3.79 trillion and 5.72 trillion, respectively. Regardless of some fluctuation, promote stress continued to outweigh shopping for.

The end result was a unfavorable buy-sell delta throughout each days, a transparent signal that aggressive spot promoting stays in management. As extra provide hits the market, worth struggles to stabilize, not to mention get better. Whale-driven promoting solely provides gasoline to that dynamic.

Momentum Alerts Level Decrease

Momentum indicators aren’t providing a lot consolation both. Following the broader market drop, PEPE’s Stochastic RSI made a bearish crossover and slid to round 13.5, pushing deeper into oversold territory. Oversold doesn’t routinely imply a bounce, particularly when promoting stress stays this constant.

PEPE can also be buying and selling under its short- and long-term shifting averages, together with the 20, 50, 100, and 200 EMAs. That alignment displays sustained bearish management somewhat than short-term weak spot. So long as worth stays below these ranges, rallies are prone to get offered into rapidly.

If sellers, particularly whales, proceed to dominate, PEPE dangers slipping additional towards the $0.0000043 space. For any significant bullish shift, the memecoin would want a each day shut above $0.0000051, with the 20 EMA performing as instant resistance. Till then, the trail of least resistance nonetheless factors down.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.