- Silver suffered its largest intraday collapse on file after a parabolic rally

- Gold and danger belongings bought off as price expectations reset sharply

- The transfer rippled into crypto sentiment as markets turned defensive

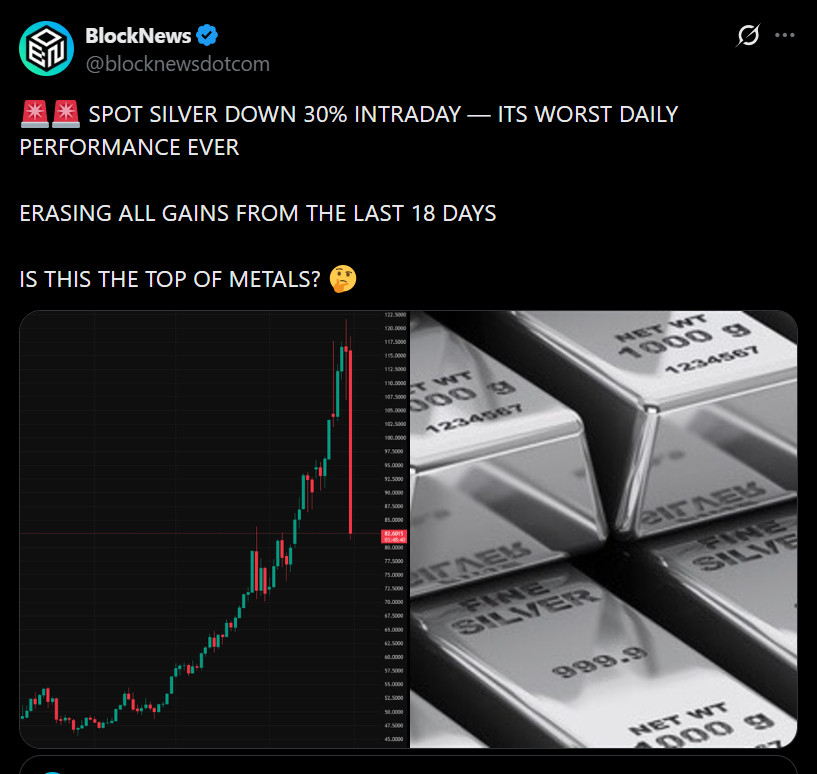

Silver plunged greater than 30% in a single session, briefly falling into the mid-$70s after buying and selling above $120 earlier within the week. Even with a rebound towards $82, the harm was extreme. This marked the most important intraday decline ever recorded for silver and worn out greater than $1.2 trillion in market capitalization. Gold adopted carefully, dropping over 12% after touching file highs above $5,500. What seemed like a relentless treasured metals supercycle all of the sudden hit a wall.

Revenue Taking Meets a Hawkish Macro Shift

The set off was not simply exhaustion. Merchants rushed to lock in income as macro circumstances flipped shortly. President Donald Trump’s determination to appoint Kevin Warsh as the subsequent Federal Reserve chair modified price expectations nearly immediately. Markets interpreted the transfer as a sign towards tighter financial coverage and stronger Fed independence. That repricing hit metals first, the place positioning had turn into crowded and momentum-driven.

Bonds, Greenback, and Threat Property React Collectively

Bond markets mirrored the shift instantly, with the 10-year Treasury yield climbing towards 4.25%. The US greenback index rebounded roughly 0.7% after hitting multi-year lows earlier within the week. This mix created a textbook risk-off atmosphere. When yields rise and the greenback strengthens, belongings that thrived on straightforward liquidity, together with treasured metals and crypto, are likely to undergo collectively.

What This Means for Crypto Markets

Whereas the selloff was centered in metals, the sign issues for crypto. Bitcoin and main digital belongings usually observe broader liquidity circumstances, not inflation narratives alone. The violent reversal in silver highlights how briskly sentiment can flip when macro assumptions change. For crypto merchants, this reinforces that markets are at the moment pricing coverage danger and liquidity above long-term store-of-value narratives.

Conclusion

Silver’s collapse was not random. It was the unwind of an overheated commerce colliding with a sudden macro reset. The lesson extends past metals. In an atmosphere the place positioning is heavy and confidence is fragile, rallies can reverse simply as quick as they type. Crypto markets are watching the identical forces, and the message is obvious: liquidity nonetheless guidelines all the pieces.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.