- Tokenized copper is gaining early traction on Solana, led by Remora Markets

- Buying and selling knowledge suggests widening participation slightly than remoted hypothesis

- Rising platform income may feed straight into STEP buybacks and worth stress

Copper-linked real-world property are nonetheless small in absolute phrases, however current knowledge is beginning to get seen. On Solana, Remora Markets’ tokenized copper product, CPERr, pushed to an all-time excessive close to $619,433 in late January, lining up with a transparent uptick in buying and selling exercise. It’s not huge but, nevertheless it’s sufficient to place tokenized copper again on the radar, particularly as RWAs achieve momentum throughout crypto.

This shift stands out as a result of copper has largely been lacking from on-chain markets. Till now, most metals exercise has stayed concentrated round gold and silver, the place liquidity, familiarity, and belief are already established.

Tokenization Strikes Past Gold and Silver

Tokenization has re-emerged as a core crypto theme heading into 2026, and it’s slowly increasing past the same old property. Gold and silver nonetheless dominate metal-based RWAs, largely as a result of they’re straightforward to know and already properly built-in into conventional finance. Copper, against this, has seen restricted consciousness and capital allocation on-chain.

That hole, nevertheless, is beginning to slender. As infrastructure improves and platforms supply clearer market construction and transparency, merchants seem extra prepared to experiment with much less typical property. Copper is beginning to profit from that shift, even when it’s early days.

Remora Markets Reveals Early Indicators of Traction

Remora Markets, a Solana-based platform providing tokenized shares and metals, gives a helpful case research. Since launch, the platform’s income has reportedly crossed $110 million, rising from seven figures into eight as demand for tokenized NASDAQ shares and metals picked up.

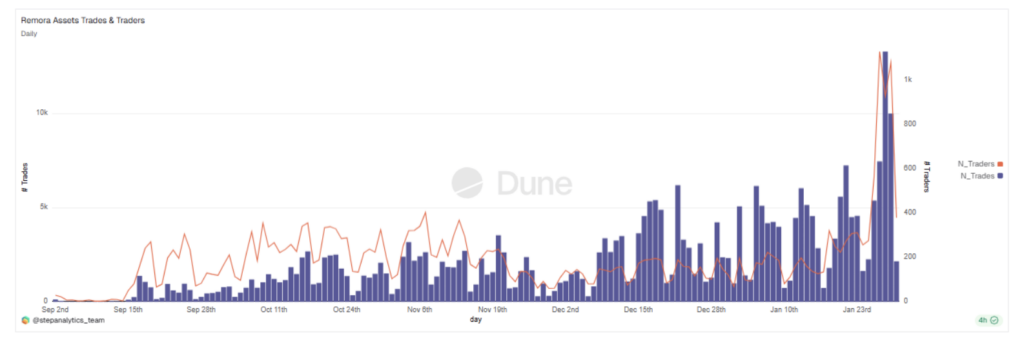

On-chain knowledge helps that progress. Dune dashboards present each spot and perpetual volumes changing into extra constant. On January 28, mixed exercise jumped to roughly $8.5 million, with over 13,300 trades and greater than 1,000 energetic merchants. That type of unfold suggests participation is broadening, not simply pushed by a handful of wallets.

Copper Begins Climbing the Ranks

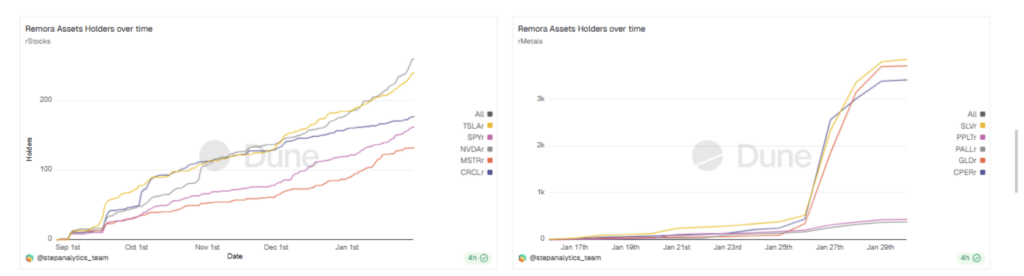

Inside Remora’s product lineup, gold and silver nonetheless lead by a large margin in each worth and variety of holders. That hasn’t modified. What has modified is copper’s place. CPERr has moved into third place, overtaking different metals which have seen slower progress.

Knowledge from the ultimate week of January reveals the whole worth of Remora’s copper product pushing to new highs, although the general figures stay comparatively modest. The sample seems to be much less like mature demand and extra like early positioning, however that alone marks a shift from copper’s close to absence in tokenized markets till lately.

ETF-Type Tokenization Provides One other Sign

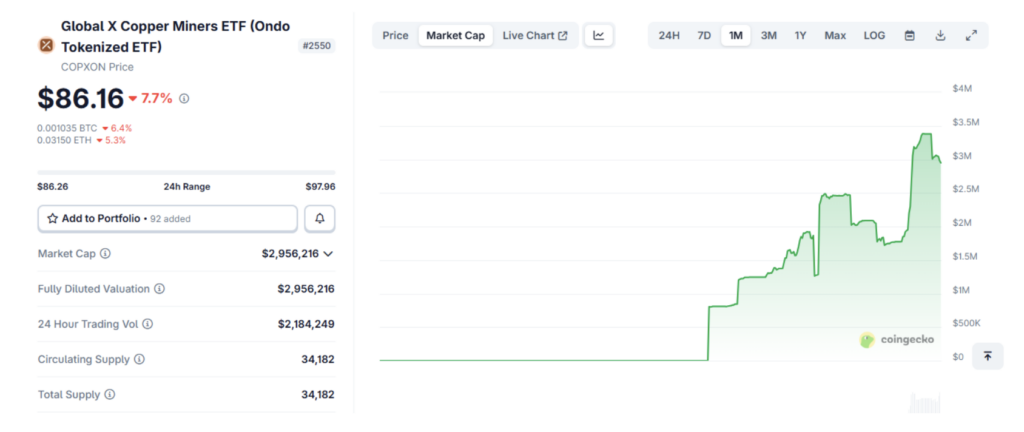

Outdoors of Remora, comparable indicators are rising. Ondo’s tokenized International X Copper Miners ETF, COPXON, reached a market cap of about $3 million inside its first week. That’s nonetheless area of interest, however the pace of uptake suggests crypto-native buyers are testing copper publicity via buildings they already perceive.

In comparison with tokenized gold or silver, copper stays underrepresented. Liquidity is thinner, hedging instruments are restricted, and that retains participation cautious. Nonetheless, the route is notable, particularly given copper’s function in the true financial system.

Structural Demand Strengthens the Narrative

Copper’s significance goes far past hypothesis. Electrification, AI infrastructure, grid upgrades, electrical automobiles, and protection applied sciences all rely closely on copper. Add projected provide constraints over the following decade, and the steel carries a structural demand story that’s exhausting to disregard.

Seen via that lens, tokenized copper isn’t only a short-term commerce. It’s an try and carry real-world shortage narratives on-chain, utilizing infrastructure that Solana more and more helps.

What This Means for STEP

Remora Markets itself doesn’t have a local token. As a substitute, it operates beneath Step Finance, utilizing the STEP token. The workforce has confirmed that each one income generated by Remora Markets might be used to purchase again STEP, straight linking platform progress to token demand.

With Remora’s efficiency bettering, consideration is beginning to flip towards STEP. The token is presently sitting in a important demand zone, and a falling wedge sample is forming on the chart. If a breakout performs out, some merchants are eyeing a transfer as giant as 800%, with upside targets close to $0.20. Momentum indicators like MACD, AO, and RSI are already leaning bullish, although affirmation continues to be wanted.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.