It’s nearly troublesome to think about that simply a few weeks in the past, bitcoin was using excessive above $95,000, and the neighborhood was speculating a few potential run towards a six-digit value territory for the primary time in 2026.

Not solely did that rally fail to materialize, however the bears wakened in the course of winter and initiated a number of consecutive leg-downs that finally crashed BTC to a multi-month low. With that, the general sentiment plummeted as properly.

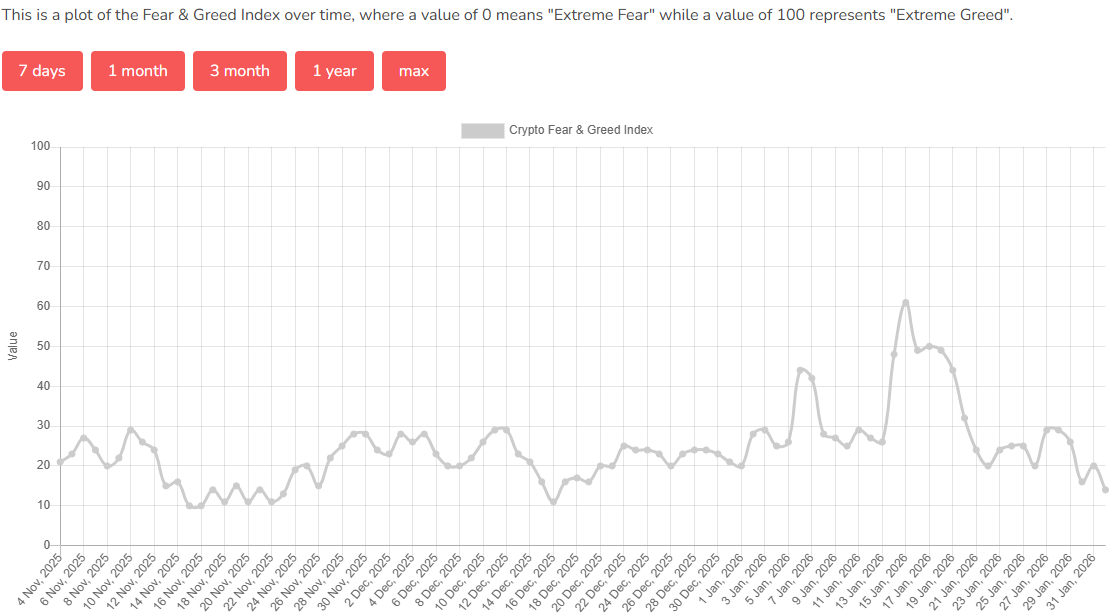

Worry and Greed Goes South

The favored Bitcoin Worry and Greed Index gathers information from varied sources, reminiscent of total volatility, market momentum, BTC dominance, and social media feedback, to find out the present investor and neighborhood sentiment towards the biggest digital asset. Value fluctuations and market momentum are accountable for 50% of the ultimate consequence, which ranges from 0 (excessive worry) to 100 (excessive greed). This makes it slightly logical that the metric has plunged currently.

Because the graph under will clearly show, excessive worry dominates the present market section. It has been under 30 since January 22, when BTC’s correction started. After Saturday’s market-wide crash, by which over $2.5 billion value of leveraged positions have been worn out, the index has gone to 14 – the bottom ranges since mid-December.

When you’ve got missed the occasions that transpired on Saturday, right here’s a fast recap. BTC had recovered some floor to $84,000 after the Thursday crash, however then immediately plunged to $75,500, which turned its lowest price ticket since final April. This meant that BTC had dropped by $20,000 since January 18, when it stood at $95,500. The altcoins adopted swimsuit yesterday with huge declines, as many marked lows not seen in over a 12 months.

Blessing in Disguise?

Earlier than we decide that BTC is lifeless once more, in keeping with the Worry and Greed Index, let’s take you again to the immortal funding phrases by one of many greats, Warren Buffett, who has stated previously that folks needs to be grasping when others are fearful, and vice versa.

If he’s to be believed, and historical past is on his aspect on this, now could be the time to be grasping and enter the ecosystem, proper? Earlier events on which BTC (or different property) have skilled wild swings in investor sentiment have led to nearly speedy reversals.

Robert Kiyosaki additionally weighed in on this matter, outlining the variations between the wealthy and the poor. He believes the primary group goes on a procuring spree when the monetary markets “are on sale” (which means, a crash), whereas the second tends to promote and run.

DIfFERENCE BETWEEN Wealthy Folks and Poor Folks:

When Walmart has a SALE poor individuals rush in and purchase, purchase, purchase.

But when the Monetary Asset Market has a sale….a.okay.a…..CRASH…

the poor promote and run….whereas the wealthy rush in….and purchase, purchase, purchase.The gold, silver, and Bitcoin…

— Robert Kiyosaki (@theRealKiyosaki) February 1, 2026

The publish $20K Bitcoin Drop in 2 Weeks Pushes Traders Into Excessive Worry appeared first on CryptoPotato.