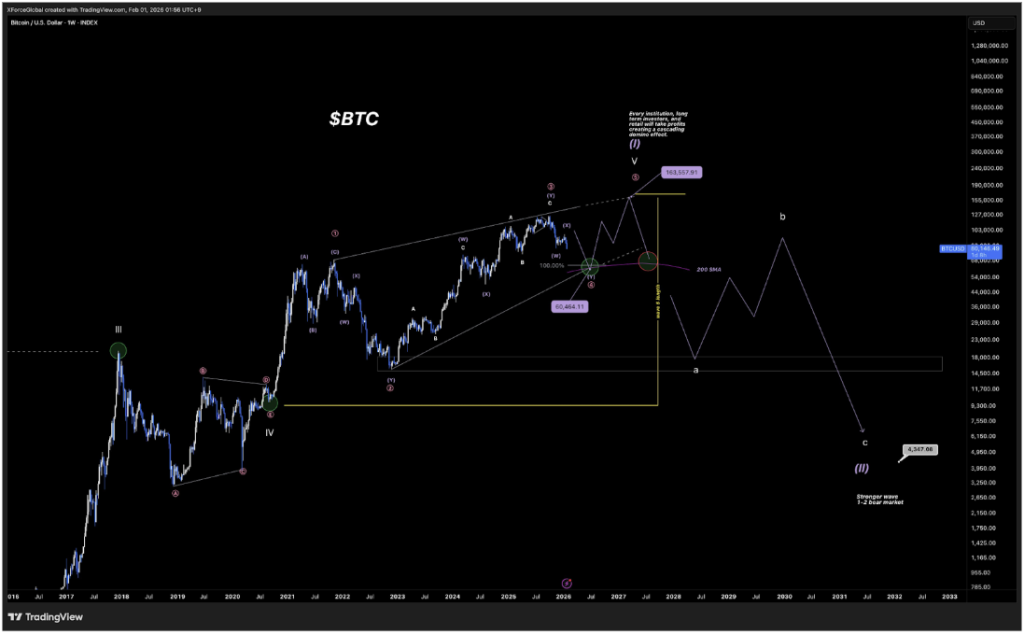

Bitcoin’s value motion has fallen into bearish territory after dropping beneath an vital earlier low that had supported the rally for months. On the time of writing, Bitcoin is buying and selling at $78,560 after falling to as little as $77,082 prior to now 24 hours, a transfer that crypto analyst XForceGlobal says represents a big change within the technical construction.

In accordance with his detailed Elliott Wave evaluation shared on X, the worth motion has now invalidated the bullish framework many merchants have been counting on, and decrease ranges have gotten extra doubtless within the coming weeks and months.

Associated Studying

Breakdown Beneath Earlier Low Modifications Major Wave Depend

In accordance with XForceGlobal, Bitcoin had been working via a posh sideways construction, particularly a WXY mixture that was anticipated to resolve via distribution relatively than outright breakdown.

Bulls managed to finish three of the 5 required elements of this triangle-like construction, however the failure to defend the prior low was the sign that led to a structural shift. This prior low refers back to the $82,000 low in November 2025. Bitcoin bulls did not defend this low when the worth motion broke beneath $80,000 in the newest 24 hours.

As soon as that degree gave method, the first wave rely might not be maintained. When it comes to the Elliott Wave rely, that decrease low implies that value motion from the all-time excessive ought to now be handled as separated and corrective, not a part of a wholesome continuation. This restructuring provides the present decline extra room to develop from a Fibonacci extension perspective and adjustments how minimal and most draw back targets ought to be evaluated.

Bitcoin Worth Chart. Supply: @XForceGlobal On X

Two Bearish Eventualities Level To The Identical Zone

The ensuing evaluation exhibits two predominant eventualities of how Bitcoin’s value motion can proceed from right here, each of that are converging on related draw back ranges. The primary is a flat correction, the place Bitcoin is at present unfolding a C wave. Though XForceGlobal describes this because the least engaging possibility, it might nonetheless indicate a full distribution vary that invalidates a bullish construction and drags the Bitcoin value to as little as $60,000.

The second state of affairs is a macro ending diagonal structured as a WXY transfer to the draw back. This state of affairs makes use of the October 2025 all-time excessive above $126,000 as a reduce level to enhance wave separation of the present value motion. Apparently, the worth projection from this state of affairs additionally aligns with targets in the identical $60,000 space. Regardless of completely different technical paths, each interpretations level to comparable draw back threat over the medium timeframe.

Associated Studying

Now that the bigger construction is now compromised, XForceGlobal says it is smart to undertake a shorter-timeframe bearish bias whereas reorganizing the subsequent wave rely. The outlook is that Bitcoin continues its decline to no less than $60,000 earlier than rebounding to stage a return above $100,000.

Featured picture from Pixabay, chart from TradingView