Bitcoin’s print for January reveals a 5.53% return for the month. We’re closing in on $82,853 and pushing nearer to the $80,600 assist that has not been examined because the April 2025 cooldown.

However whereas January 2026 has left a nasty style in everybody’s mouths, February could possibly be the restoration month. The reason being not simply blindsided bull hope; it’s the worth historical past of the cryptocurrency, as per CryptoRank.

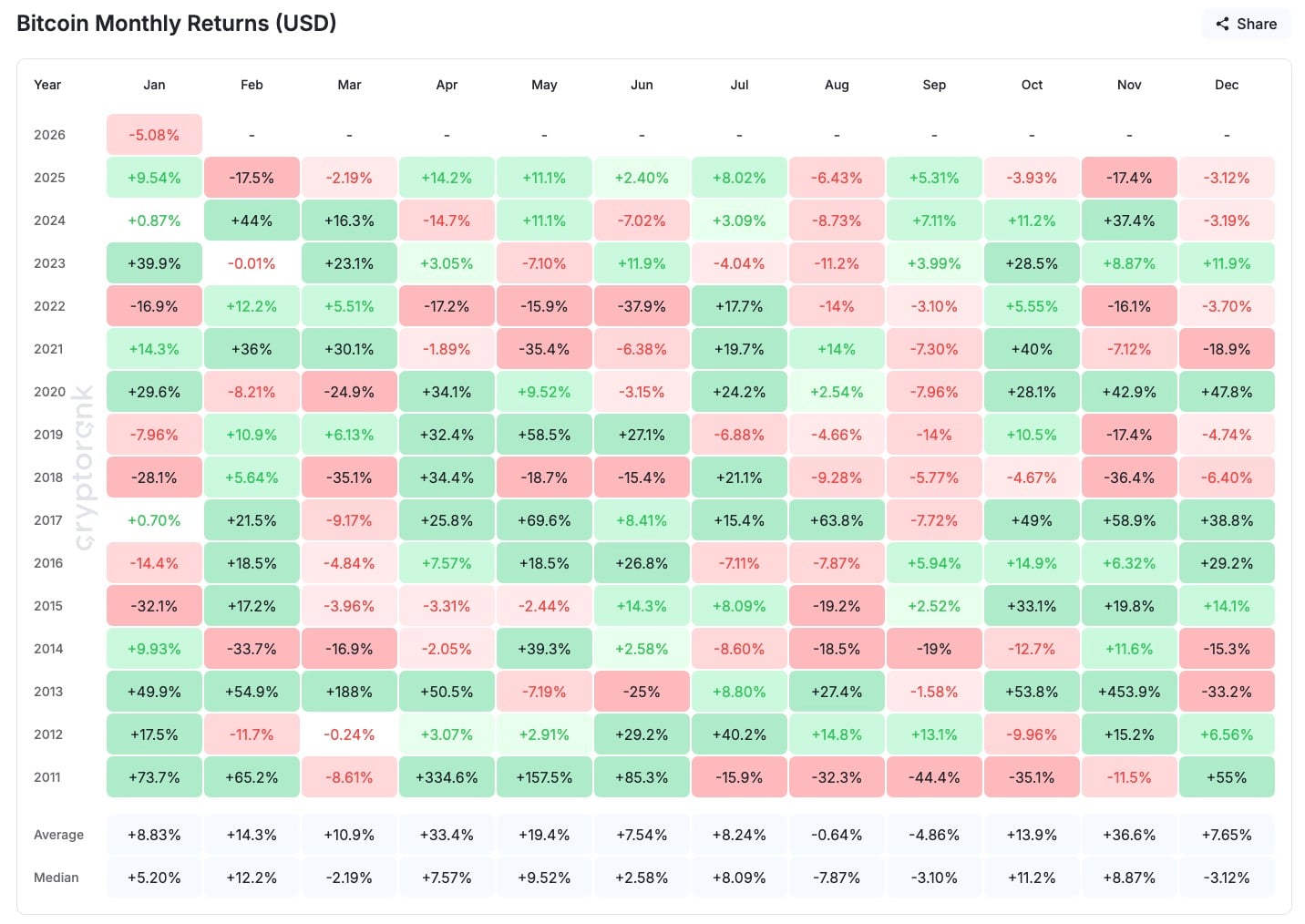

In case you have a look at the final 13 years of Bitcoin’s historical past, you will note that February has been a great month in 9 of these years. The common achieve is +14.3%, and even the extra established median determine is +12.2%.

We’re not simply speaking a couple of seasonal sample right here. Even in 2023’s bear market rebound, February nonetheless noticed +12.2% development. In 2021, midbull part? +36%. Again in 2014, proper earlier than the collapse? -33.7% — however that was the outlier.

Bitcoin worth historical past proves that crimson January results in inexperienced February

Bitcoin’s worst Januarys usually flip into inexperienced Februarys. In 2022, there was a -16.9% change in January, adopted by a +12.2% in February. In 2020, it dropped 8.21%, however then it bounced again with a 21.5% rebound. The 12 months 2015 was tough with a -32.1% loss, nevertheless it was adopted by a +17.2% achieve. Even in 2018, after the blowoff, BTC nonetheless added +5.64% in February.

From one perspective, Bitcoin simply dipped beneath $85,000 once more, however from the opposite, it’s nonetheless holding inside the similar $80,600-$107,000 vary it has largely been in since Q2, 2025.

The -2.12% each day drop we simply noticed isn’t just a one-time factor; it’s a large deal, and it may completely change how issues go in February. The ETF bleed remains to be occurring, however the by-product stress is easing up. If $80,600 holds, a bounce again into the $90,000s is just not solely potential however statistically possible.

The market strikes on construction, not slogans. And February’s slogan, over 13 years, remains to be trying good. Sure, the chart’s fairly unhealthy, however the historic precedent is just not.