- BitMine Immersion is going through over $6B in paper losses after ether costs slid sharply

- The agency now holds roughly 4.24M ETH, making it extremely uncovered to market swings

- Ongoing deleveraging and liquidation stress proceed to weigh on ETH costs

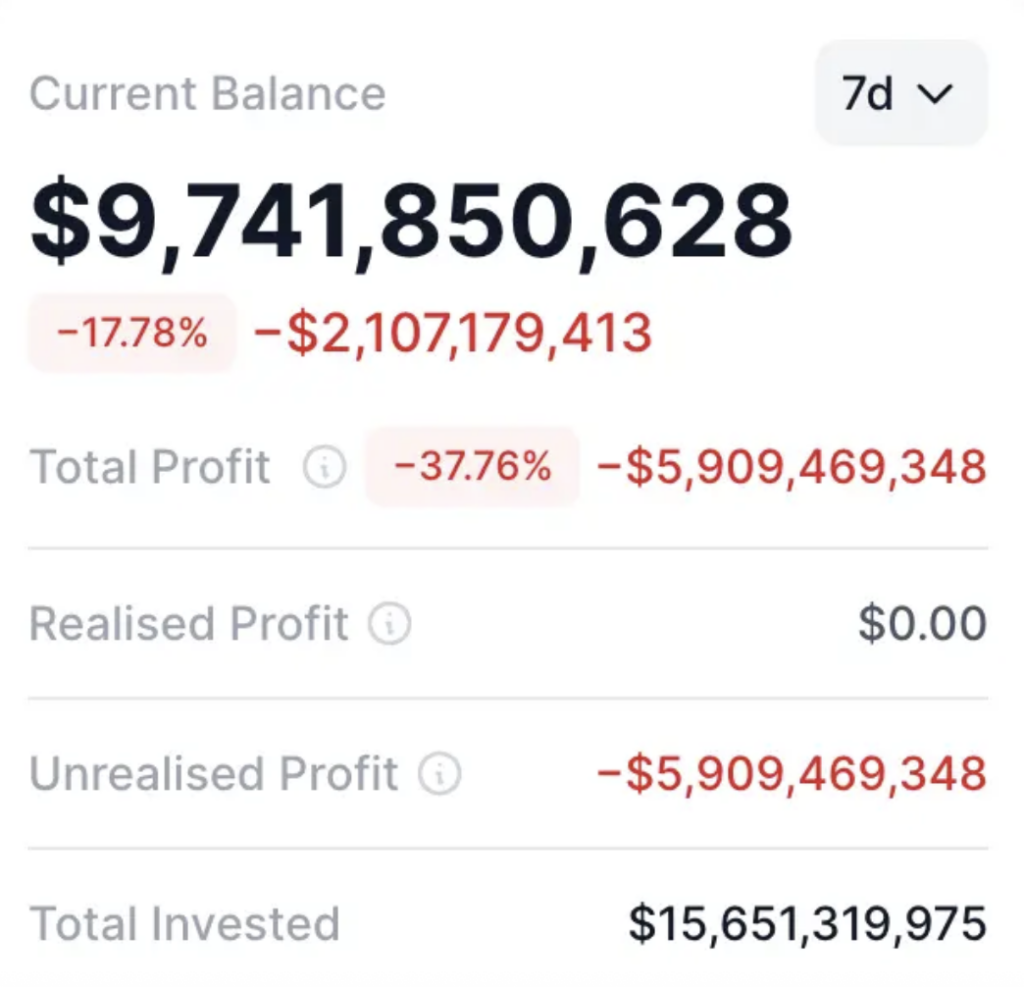

BitMine Immersion’s aggressive push into ether has out of the blue gone the incorrect means. After the newest leg down in crypto markets, the corporate is now sitting on greater than $6 billion in paper losses tied to its ETH holdings, a pointy reversal from the place issues stood only a few months in the past.

The publicly traded agency added over 40,000 ether simply final week, pushing its whole steadiness to roughly 4.24 million ETH, based on portfolio knowledge tracked by Dropstab. On the time, the transfer regarded assured. Since then, value motion has performed the other of cooperate.

Falling Costs Drag Treasury Worth Decrease

As promoting picked up throughout the market, ether slid arduous, pulling the worth of BitMine’s holdings all the way down to round $9.6 billion. That’s a steep drop from practically $14 billion on the October highs, and it places the size of the drawdown into perspective rapidly. On Saturday, ETH dipped towards the $2,300 degree as draw back stress intensified throughout main tokens.

The timing hasn’t helped. Company crypto treasuries have grow to be a defining characteristic of this cycle, however they lower each methods. Massive positions can amplify upside when markets run, and simply as simply amplify losses when bids skinny out and sentiment turns chilly.

Deleveraging Provides Gasoline to the Decline

The broader market atmosphere has solely made issues harder. As ether slid, compelled promoting rippled by derivatives markets, including momentum to the transfer decrease. Liquidations throughout main venues picked up alongside ETH’s drop, compounding stress on spot costs and making rebounds more durable to maintain.

That suggestions loop, falling value, liquidations, extra promoting, has been a well-recognized sample throughout this downturn. For companies with heavy balance-sheet publicity, there’s little room to cover as soon as it will get going.

A Extra Cautious Tone From the High

Firm chairman Tom Lee has lately struck a noticeably extra cautious tone on the near-term outlook. Whereas nonetheless constructive over the long term, he’s warned that the market is in the midst of a broader deleveraging section and that early 2026 may stay uneven earlier than circumstances really stabilize.

In a current interview, Lee pointed again to October’s sharp sell-off, which worn out roughly $19 billion in market worth throughout crypto, as a key reset second. That break, in his view, cleared extra positioning but additionally set the stage for continued volatility because the market digests it.

Staking Income Helps, However Solely So A lot

BitMine has beforehand stated {that a} portion of its ether holdings are staked, producing estimated annual staking income of round $164 million. That earnings stream gives some cushion, however it comes with limits. Staking yields fluctuate with community circumstances, and through quick drawdowns, they barely register in opposition to multi-billion-dollar value swings.

For now, BitMine’s ether technique stays intact, however the current transfer decrease has introduced renewed consideration to the dangers that include operating a leveraged guess on crypto costs. On this market, conviction can repay, however timing nonetheless issues, typically greater than anybody expects.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.