Hong Kong stablecoin licenses coming quickly

Hong Kong expects to subject its first batch of stablecoin licences within the first quarter of this 12 months, the town’s finance chief mentioned on the World Financial Discussion board in Davos.

Monetary Secretary Paul Chan Mo-po mentioned Hong Kong views digital property as a type of monetary innovation that must be embraced, however solely inside a framework that protects monetary stability, market integrity and traders, in line with closed-door remarks reported by the South China Morning Put up.

Hong Kong is rising as one of many first main worldwide monetary facilities to formally regulate fiat-backed stablecoins, as international policymakers tighten oversight of digital cost tokens. In Asia, Japan has already launched a licensed stablecoin pegged to its native foreign money.

Hong Kong’s personal stablecoin regime is extensively seen as an offshore complement to China’s state-led digital yuan, providing a regulated venue for experimentation below mainland capital controls.

Whereas China’s digital yuan stays targeted on home funds and tightly managed cross-border pilots, a licensed stablecoin framework in Hong Kong might help worldwide settlement, tokenised property and institutional use instances that fall outdoors the mainland’s closed-loop design.

Beijing has beforehand used Hong Kong as an offshore venue to pilot monetary infrastructure via schemes resembling Inventory Join and Bond Join, and has additionally participated alongside Hong Kong in initiatives such because the mBridge cross-border funds challenge.

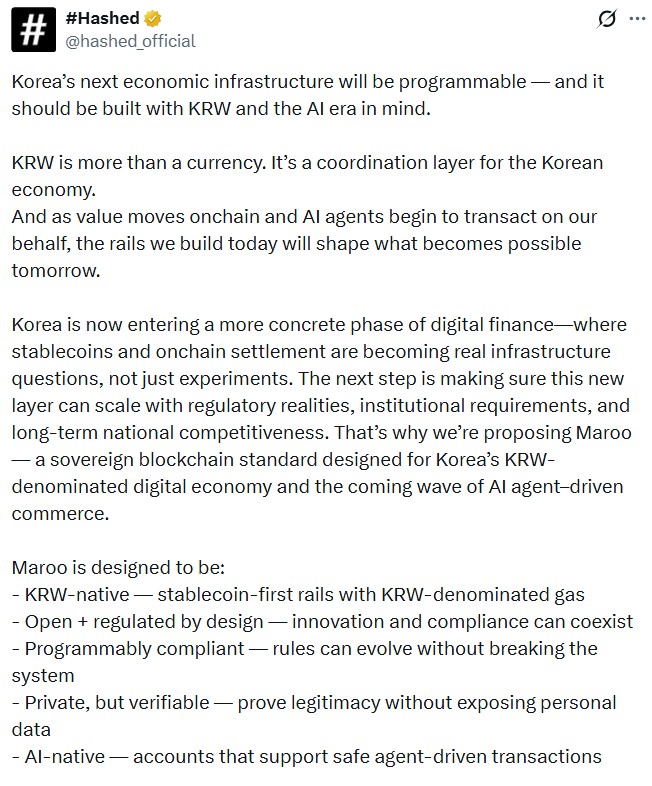

Influential South Korean crypto VC to launch personal blockchain for stablecoins

South Korean crypto funding agency Hashed has unveiled Maroo, a blockchain designed round a Korean received stablecoin.

Hashed described its new community as rails for institutional settlement and AI agent-driven funds.

One key function is that community charges are paid within the KRW stablecoin, moderately than a local cryptocurrency. Hashed mentioned pricing gasoline in KRW phrases makes prices simpler to forecast for firms, which might finances in a well-known unit as an alternative of absorbing token volatility.

The launch comes as South Korea strikes towards the second part of its digital asset framework, which is predicted to introduce a proper regime for stablecoin issuance.

Coverage debates stay unresolved, significantly over who must be allowed to subject stablecoins. The Financial institution of Korea has pushed for a bank-led issuance mannequin, drawing resistance from crypto companies and a few lawmakers involved about competitors and innovation.

Learn additionally

Options

Why Digital Actuality Wants Blockchain: Economics, Permanence and Shortage

Options

Escape from LA: Why Lockdown in Sri Lanka Works for MyEtherWallet Founder

India arrests two in post-Bitconnect kidnapping case

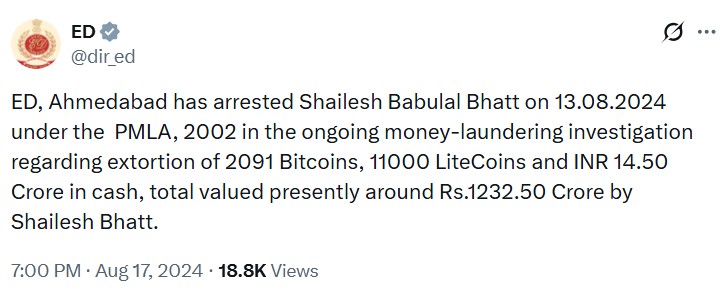

Indian authorities have arrested two males in reference to laundering cryptocurrency extorted within the aftermath of the BitConnect Ponzi collapse.

The Enforcement Directorate mentioned Thursday it arrested Nikunj Bhatt and Sanjay Kotadiya. The pair allegedly helped transfer and conceal crypto property that had been recovered in 2018 via kidnapping and extortion linked to BitConnect.

The arrests don’t contain the unique BitConnect operation. As a substitute, they relate to occasions that adopted the platform’s collapse, when some restoration efforts turned violent.

In 2018, businessman Shailesh Bhatt allegedly orchestrated the kidnapping of two associates of BitConnect’s founders. Authorities say the extortion yielded greater than 2,200 Bitcoin, 11,000 Litecoin and 145 million rupees ($1.58 million) in money. Investigators allege Nikunj Bhatt was concerned within the kidnapping.

Shailesh Bhatt was additionally kidnapped in a separate case involving corrupt law enforcement officials and a former state lawmaker who had discovered he recovered a few of his misplaced funds. The accused had been later convicted and sentenced to life imprisonment.

Not one of the arrested people is accused of operating BitConnect.

BitConnect was based by Satish Kumbhani, who promoted a so-called lending program from 2016 to 2018. In February 2022, US prosecutors indicted Kumbhani on prices together with wire fraud, commodity value manipulation and worldwide cash laundering, describing BitConnect as a $2.4 billion international fraud. Kumbhani is believed to be a fugitive.

Learn additionally

Options

11 important moments in Ethereum’s historical past that made it the No.2 blockchain

Options

Is the cryptocurrency epicenter shifting away from East Asia?

Japan plans to formalize crypto ETF push

Japan’s Monetary Companies Company is reportedly planning so as to add cryptocurrencies to its checklist of property eligible for exchange-traded funds.

Based on Nikkei, Nomura Holdings and SBI Holdings are among the many monetary teams positioning themselves to launch Japan’s first crypto-linked ETFs as early as 2028, pending regulatory developments and approval.

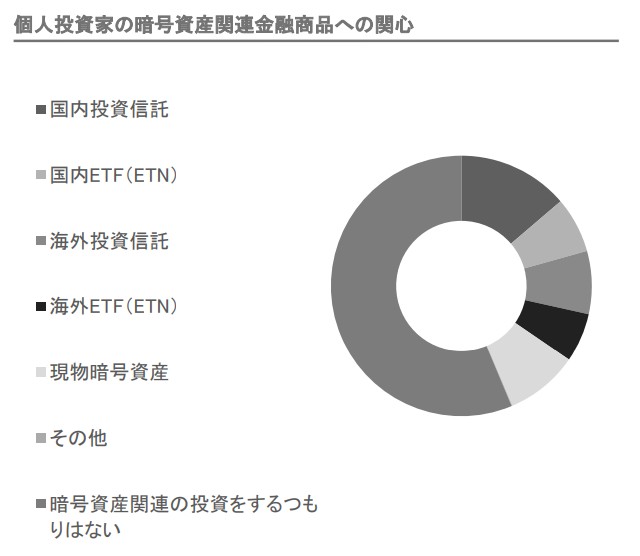

Institutional curiosity in crypto has been rising in Japan, significantly amongst firms which have adopted Bitcoin or different digital property as a part of their treasury methods. Nevertheless, retail crypto participation stays comparatively modest.

The FSA reported in September that Japan has round 12 million registered crypto buying and selling accounts, equal to roughly 10% of the inhabitants. Regardless of that headline determine, greater than 80% of private accounts maintain lower than 100,000 yen, or about $650.

A separate Nomura examine printed in July 2025 discovered that the majority Japanese retail traders mentioned they’d little interest in crypto-related funding merchandise. Amongst those that did specific curiosity, the choice skewed towards regulated autos resembling funding trusts and ETFs moderately than direct possession of digital property.

Excessive taxation has additionally slowed retail crypto demand. Positive factors from cryptocurrency buying and selling are at the moment taxed at as much as 55%, considerably increased than the charges utilized to shares and different monetary merchandise. Japan is contemplating decreasing the tax burden to a flat 20%, which might align crypto with conventional investments.

Finance Minister Satsuki Katayama just lately mentioned in a neighborhood media interview that she expects the revised tax framework to additionally take impact round 2028.

Katayama additionally mentioned in her New Yr’s inventory market opening ceremony that crypto ETFs are more and more used as inflation hedges, and Japan ought to pursue comparable initiatives.

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan (Hyoseop) Yun is a Cointelegraph employees author and multimedia journalist who has been masking blockchain-related subjects since 2017. His background consists of roles as an project editor and producer at Forkast, in addition to reporting positions targeted on expertise and coverage for Forbes and Bloomberg BNA. He holds a level in Journalism and owns Bitcoin, Ethereum, and Solana in quantities exceeding Cointelegraph’s disclosure threshold of $1,000.