February kicks off with hassle for XRP and Ethereum, however Cardano is likely to be on the point of shock. XRP simply misplaced a key technical stage that now could result in -77%. Ethereum bought hit by a $242 million deposit from a whale that was current for the reason that Satoshi period, proper earlier than its value slipped underneath $2,420.

However ADA? It’s getting into what has traditionally been its greatest month, and no one is speaking about it.

TL;DR

- XRP loses month-to-month mid-Bollinger band, places $0.37 draw back on the menu.

- ETH drops 8.5% as 100,000 ETH value $242.7 million lands on Binance from an old-school whale.

- ADA heads into February with a hidden +24.4% common return file.

XRP prompts -77% situation: Bollinger Bands warn

XRP’s month-to-month chart simply triggered a pink flag as for the primary time in over a yr, it closed beneath its mid-Bollinger Band. To place it merely, it’s a stage that traditionally separates energy from weak point.

Now as this occurred the principle situation for the XRP value is to go to $0.37, which is 77% beneath the present value level.

The following massive stage to observe is the decrease Bollinger Band, sitting down at $0.374. That may be a good distance from the present value of $1.64, however with bull momentum from 2024-2025 gone and bulls lacking key help at $1.93, the chart bias flips with none argument.

What worsens the scenario is that the sign is not only technical, it’s psychological too. The mid-band on month-to-month Bollinger charts usually acts as a confidence anchor for the long-term. As soon as the value breaks underneath it with a full candle shut, pattern merchants flip defensive. That’s what simply occurred.

XRP hit $3.60 at its peak in 2025, however has now misplaced over half of that worth. And with no robust reversal indicators in place, this appears to be like just like the gradual bleeding will proceed. Notably, this transfer mirrors the construction from the 2021-2022 breakdown, the place the value slid from $1.90 to $0.30 over 4 brutal months.

Order e-book knowledge additionally reveals sell-side liquidity clustering across the $1.7-$1.75 zone, including to upside rejection strain. Except patrons reclaim the $1.93 stage quick and switch this complete dip right into a fakeout, the decrease band magnet may pull the value down towards $1.45, then $0.37.

Satoshi-era Bitcoin whale simply dumped 100,000 ETH on Binance

One of many oldest wallets on the blockchain tied to early Bitcoin mining days (from 2010-2011) dumped precisely 99,999 ETH — value $242.7 million — straight into Binance a couple of minutes in the past.

The pockets, tagged by Arkham as “BTC OG $BTC to $ETH,” has been dormant for years. Now, all of a sudden, it’s lively once more — and its first transfer is to drop a large bag of ETH into an change scorching pockets.

That transfer didn’t go in isolation. Ethereum fell over 8.5% prior to now 24 hours and now trades at $2,411. The day by day chart confirms a sell-off after breaking beneath the $2,700 zone earlier this week. No help is holding for now.

The whale’s whole portfolio nonetheless holds 472,643 ETH, together with 31,609 BTC valued at $2.49 billion, plus 180,827 AETHWETH and some smaller altcoin exposures. However it’s Ethereum that bought hit, and exhausting.

The market has already been underneath strain from ETF outflows and macro risk-off indicators. An enormous Binance influx from a dormant OG pockets doesn’t simply set off headlines — it triggers algo-driven spot and futures reactions. A number of desks famous quick positioning growing minutes after the influx alert went stay.

Cardano may outrun market in February, forgotten 25% file proves

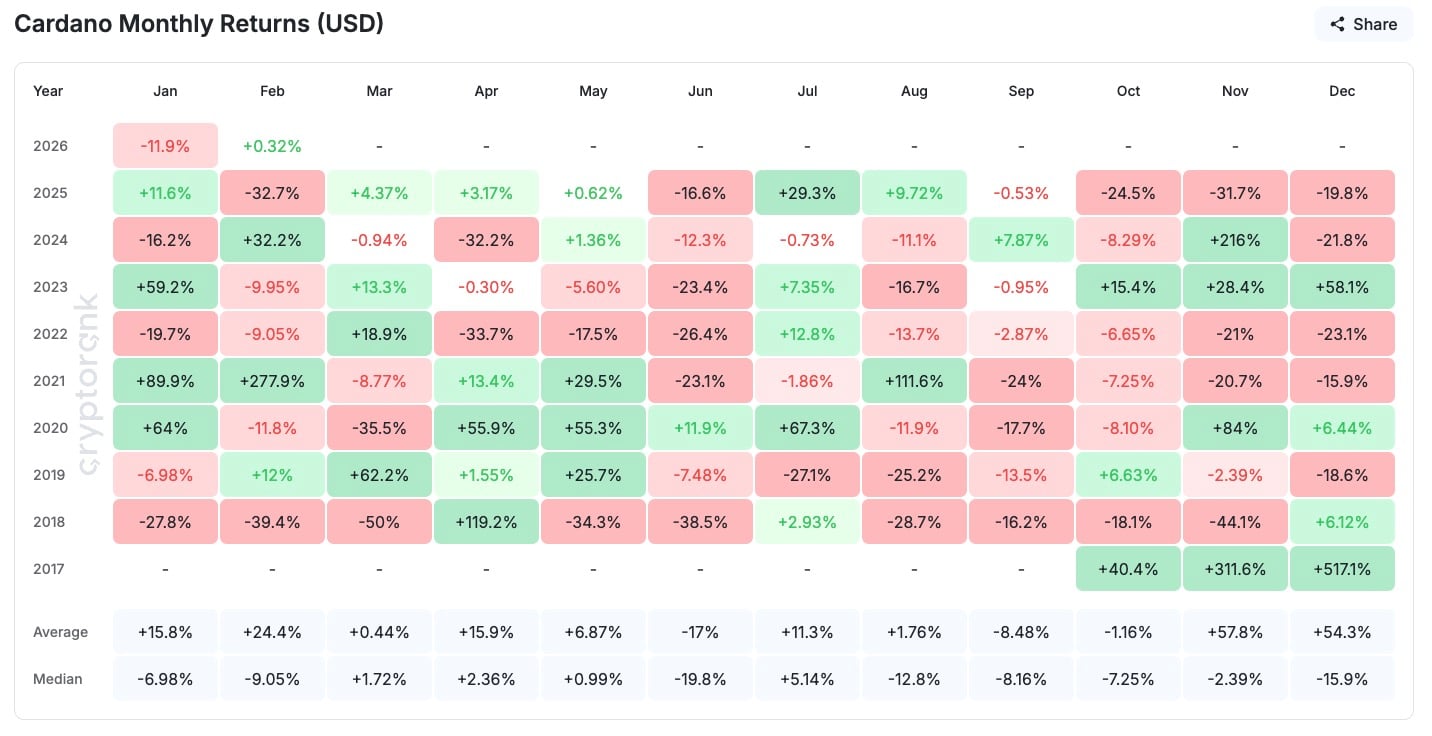

Whereas the remainder of the market froze in crypto winter vibes, Cardano is likely to be on the verge of a bullish under-the-radar transfer. its value historical past by CryptoRank, February is one in every of ADA’s greatest months by far, with a mean return of +24.4% and a monster +277.9% acquire again in 2021.

For comparability: Ethereum’s median return in February is detrimental (-9.05%), and XRP’s is worse. Cardano, then again, has a monitor file of delivering many times on this explicit month.

It began February with only a +0.12% uptick, however that’s how previous runs started too. Traditionally, the ADA value tends to comply with BTC’s pattern with a lag. So if Bitcoin stays range-bound, ADA is likely to be the primary to bounce.

The worth motion in ADA additionally tends to speed up late within the month. In a number of years — 2021, 2023, 2024 — early February was flat or down earlier than the value moved right into a breakout sample. That setup appears to be repeating.

This is likely to be the most effective “quiet” setup within the high 20 proper now. Whereas ETH and XRP take care of panic, Cardano is drifting sideways right into a month the place it tends to get up.

Crypto market outlook: Key ranges to observe for XRP, BTC, ETH and ADA

The market’s tone proper now’s cautious, however not collapsed. Eyes are on whether or not XRP finds a lifeline or continues towards breakdown territory, if Ethereum’s whale dump is a one-off or a pattern and whether or not Cardano lastly will get its “flowers“ this month.

Issues may shift mid-February if ETF flows return or if macro catalysts set off renewed threat urge for food. Till then, count on chop, a “crab market“ and remoted setups like ADA to face out whereas the majors recalibrate.

- Bitcoin (BTC): at $78,777 with short-term resistance at $81,300 and help at $73,786. Take into accout the $63,254 stage, the place Peter Brandt already set a flush goal.

- Ethereum (ETH): at $2,411.69 with upside capped at $2,700 and a wider resistance line close to the 200-day MA at $3,002. First help sits at $2,200, adopted by $2,060 as a macro-level protection.

- XRP (XRP): at $1.64, having did not reclaim the $1.93 mid-Bollinger line and with a key psychological resistance at $2.00. Structural help now at $1.45, with $0.374 because the month-to-month decrease band goal ought to the breakdown proceed.

- Cardano (ADA): historic February setups level to +24.4% common returns. Resistance sits at $0.40, with breakout targets at $0.48 and $0.53. Closest help at $0.34. Look ahead to a late-month rally.