- IBIT traders are actually underwater after Bitcoin’s sharp 2026 pullback

- Over $900 million has exited BlackRock’s Bitcoin ETF since late January

- The selloff raises questions on whether or not establishments will purchase the dip or step again

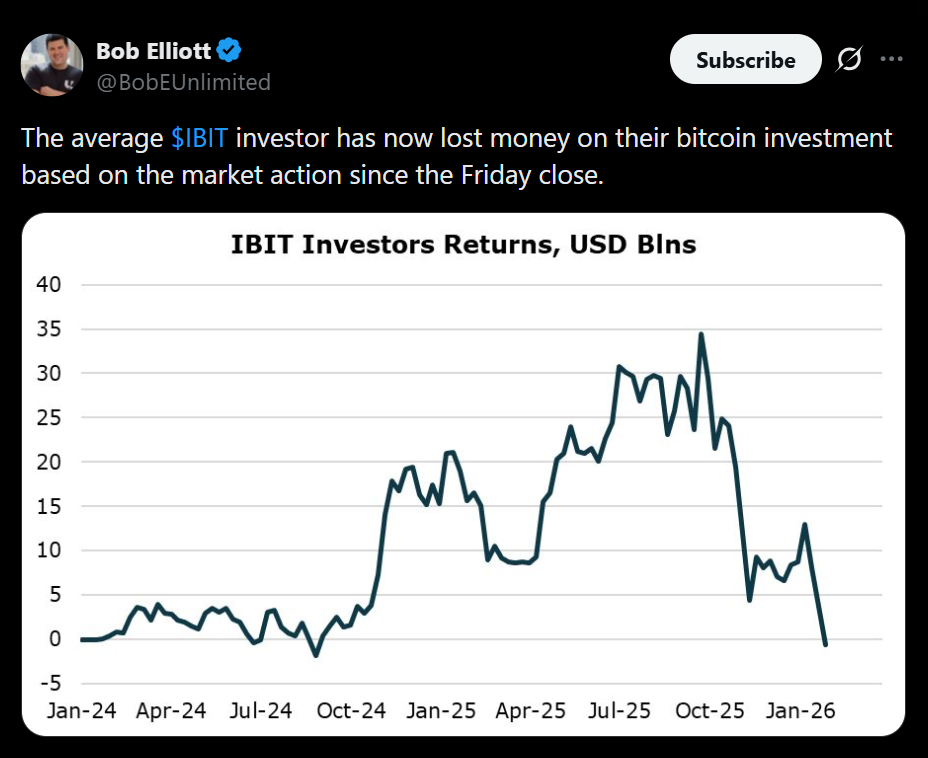

In line with an X publish by Limitless Funds CIO Bob Elliot, the typical investor in BlackRock’s Bitcoin ETF is now sitting on losses after Bitcoin’s newest downturn. Information from Farside Buyers exhibits that greater than $900 million has flowed out of IBIT since Jan. 27, 2026, marking one of many fund’s most difficult stretches since launch. The reversal is notable given how strongly ETFs have been positioned as a gateway for long-term institutional capital into Bitcoin.

Why This Issues for BlackRock and the Broader Crypto Market

BlackRock’s transfer into Bitcoin was broadly seen as a stamp of legitimacy for crypto as an asset class. Heavy outflows don’t change that in a single day, however they do spotlight how delicate ETF traders are to cost volatility. Not like early Bitcoin adopters, many ETF holders entered throughout increased value ranges, making drawdowns tougher to disregard and doubtlessly amplifying short-term promoting strain.

Will BlackRock See This as a Shopping for Alternative

Regardless of the present losses, there’s a actual probability BlackRock views the pullback as a possibility fairly than a risk. CEO Larry Fink has beforehand recommended that digital belongings like Bitcoin might ultimately problem the dominance of the US greenback, signaling long-term conviction fairly than tactical buying and selling. If that view nonetheless holds internally, decrease costs might entice contemporary institutional accumulation as soon as volatility stabilizes.

Macro Stress Is Driving the Concern

The most recent crash has been tied partly to political and macro uncertainty, particularly following President Trump’s determination to appoint Kevin Warsh as Federal Reserve Chair. Whereas Warsh has lately sounded extra open to digital belongings, his previous skepticism towards crypto has unsettled markets. For now, Bitcoin seems to be reacting extra to macro threat and confidence shocks than to fundamentals.

What Analysts Anticipate Subsequent for Bitcoin

Even with bearish momentum in management, a number of main companies stay optimistic about Bitcoin’s longer-term trajectory. Analysts at Grayscale and Bernstein argue that Bitcoin is monitoring a five-year cycle fairly than the normal four-year sample, pointing to a possible new all-time excessive later in 2026. If that thesis performs out, present ETF losses might find yourself trying like a short lived detour fairly than a structural failure.

Conclusion

BlackRock’s Bitcoin ETF outflows spotlight the rising pains of institutional crypto adoption. Brief-term losses are testing conviction, however they don’t seem to be rewriting the long-term thesis simply but. Whether or not BlackRock leans into this drawdown or waits for calmer situations might be an vital sign for a way conventional finance plans to navigate crypto’s volatility going ahead.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.