The crypto market is coping with loads of points on the finish of the work week. An XRP glitch put a bizarre $126 price ticket on dwell CNBC TV, Peter Brandt got here up with a spooky $25,000 goal for Bitcoin and OKX unlocked 41.12 billion SHIB although there have been heavy outflows.

With $1.7 billion in liquidations and BTC testing new two-month lows, sentiment continues to deteriorate into panic and excessive concern.

TL;DR

- XRP briefly hit $126 on CNBC, triggering a social media craze.

- Peter Brandt confirms $25,000 BTC retracement zone, however it’s theoretical for now.

- OKX strikes 41,128,246,331 SHIB in main cold-to-hot pockets rotation.

$126 for XRP on CNBC: What occurred?

In probably the most surreal visible errors in crypto tv historical past, CNBC’s Crypto World aired a pricing ticker for XRP that briefly confirmed the token at $126.01 — an astonishing 6,532% larger than its precise market worth on the time. The error occurred when Solana’s worth was mistakenly pasted into the XRP line.

The glitch amused many. It reawakened the XRP group’s longstanding fascination with “ghost prints” and mispriced ticker anomalies, which have fueled speculative narratives about “hidden” XRP valuation paths. CNBC corrected the graphic with out remark, however screenshots of the show — displaying XRP at $126.01, up $124.32, or 6,532% — quickly went viral.

This incident occurred when XRP’s precise worth collapsed almost 15% from latest highs. It’s now quoted close to $1.76 after dipping as little as $1.60 after broader market liquidations.

However, the glitch was sufficient to reignite discuss of the “three-digit XRP” thesis – a long-standing meme in XRP circles relationship again to pre-2020 discussions about institutional utility, settlement layers and cross-border banking rails.

The truth that the error got here from a mainstream media outlet added gas to the hearth. XRP loyalists instantly speculated whether or not it was only a slip-up or one thing extra sinister.

The timeline, nonetheless, couldn’t have been extra ironic, occurring throughout per week when XRP’s precise worth broke construction and almost triggered a 10x liquidation cascade for overleveraged longs.

Legendary dealer Brandt updates his $25,000 Bitcoin (BTC) worth outlook

Veteran dealer Peter Brandt has up to date his macro thesis for Bitcoin as soon as once more, doubling down on the potential of a retracement to $25,000 following the breakdown of the earlier parabola construction.

In a considerably humble-yet-aggressive be aware, Brandt stated that “in idea, breaking the final parabola ought to deliver costs again to $25K,” however added that “costs within the $50s would not shock me,” and that he thinks they may keep in a sideways “chop” till late summer season.

This week, Bitcoin broke beneath the $84,000-$86,000 help band, dropping as little as $81,000 in one of many sharpest 24-hour declines since Q3, 2025. This coincides with excessive macro uncertainty, together with a possible U.S. authorities shutdown on Jan. 31 and right now’s $8.8 billion choices expiration, each of that are fueling draw back volatility.

Brandt’s technical chart consists of key resistance at $102,233 and a failed help zone at $98,944, in addition to midrange consolidation round $92,000-$95,000. His projected goal of $63,254.79, highlighted in a secondary breakdown zone, displays a worst-case state of affairs triggered by failed diagonal help relationship again to mid-2025.

Importantly, Brandt clarified that he “gained’t be ashamed” if he’s incorrect and emphasised that he’s incorrect “50% of the time.” Nonetheless, his legacy of precisely predicting Bitcoin worth peaks and troughs nonetheless carries weight.

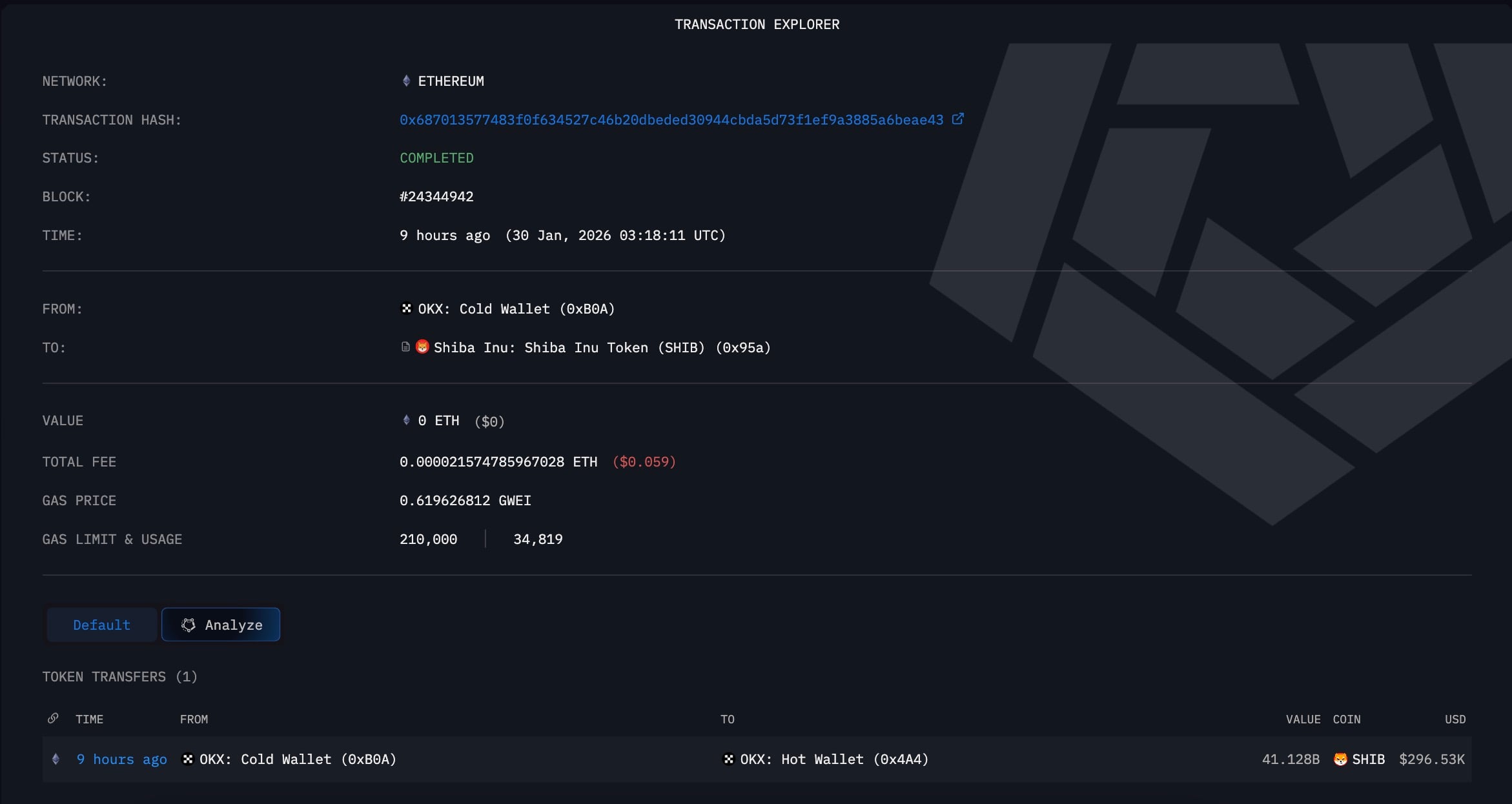

41,128,246,331 SHIB unlocked by main trade

Late final night time, OKX executed a switch of 41,128,246,331 SHIB from a chilly pockets to a scorching pockets, equal to just about $296,530 at present market costs. This transaction was recorded on the Ethereum blockchain as funds moved from an OKX Chilly Pockets (0xB0A) to a Scorching Pockets (0x4A4).

Though the quantity appears small, this transfer coincides with Shiba Inu’s rising pockets exercise amid a declining worth development. On the 12-hour chart, SHIB has damaged beneath $0.00000750 and is approaching $0.00000731, nearing ultimate help at $0.00000699.

This follows an reverse chilly storage maneuver by Binance earlier this week, signaling potential market-making reshuffling, scorching pockets provisioning for pending withdrawals or unspoken liquidity preparation. With sentiment at native lows and on-chain flows displaying rising token mobilization, this mix is making SHIB whales nervous.

SHIB’s worth setup remains to be a bit shaky. SHIB didn’t handle to get again above the 200-day shifting common at $0.00001018 earlier this month, and now it’s buying and selling nearly 32% beneath that. Until February brings in some seasonal buying and selling or a shock occasion, SHIB may enter one other interval of sluggish accumulation.

Viewers are divided between the “unlock equals promote” narrative and the view that it’s a backend ops adjustment. However on this market, even routine rebalances spark panic, particularly once they coincide with main ETF outflows and system-wide leverage flushes.

Crypto market outlook: Deep concern

Right now’s $8.8 billion choices expiry may trigger extra volatility relying on how the choices are settled and the way a lot hedging is completed, whereas the looming Jan. 31 U.S. authorities shutdown danger stays unresolved, with prediction markets displaying a excessive probability of disruption.

- XRP: $1.89 is the principle structural cap and $2 is the psychological reclamation line. Help begins at $1.60, then $1.53, and $1.45 marks the flush danger space.

- Bitcoin: After the breakdown, the $84,000-$86,000 zone is now resistance. $90,500 is required to reset the construction. Draw back ranges are $81,000 and $73,786, with a deeper macro goal of $63,254.

- Shiba Inu (SHIB): Upside stress begins at $0.00000780, adopted by $0.00000900, with the 200-day shifting common at $0.00001018 as the principle development barrier. Help sits at $0.00000699, with $0.00000655 as the ultimate protection.

The market remains to be caught in a bearish mindset with no actual causes to assume it’ll bounce again. Till issues cool down and danger ranges off, the draw back dangers are going to be the principle focus. February is beginning off with loads of concern and uncertainty, and nothing appears to be shifting in a transparent path.