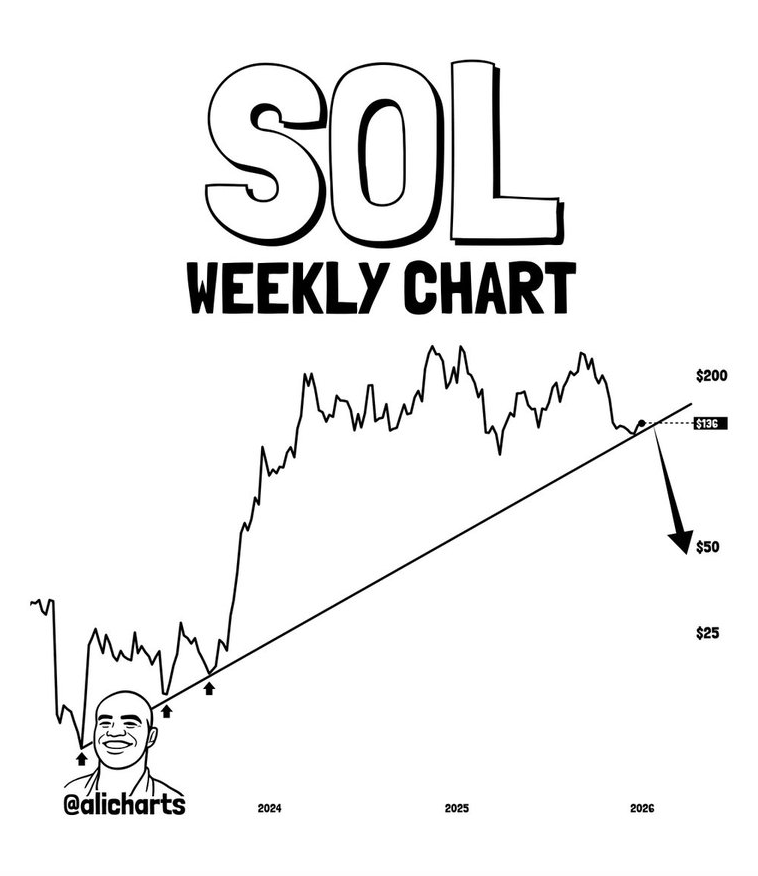

- Solana is testing a key long-term trendline close to $136, with a clear weekly break doubtlessly opening draw back towards $50.

- Regardless of value stress, on-chain exercise has surged as AI-driven memecoin creation boosts community utilization and costs.

- The following main transfer relies on whether or not SOL holds long-term help or confirms a structural breakdown.

A key trendline on the Solana chart has instantly develop into the road everybody’s watching. In response to one high crypto analyst, a clear break beneath it might reopen the door to a lot decrease costs, with $50 now again within the dialog. It’s not a base case, however it’s not off the desk both.

On the identical time, one thing attention-grabbing is going on beneath the floor. Solana’s on-chain exercise has surged, pushed largely by a recent wave of memecoin launches made simpler by new AI instruments. So whereas value is underneath stress, community utilization is transferring in the wrong way, which complicates the image a bit.

Will Solana Worth Actually Drop to $50?

The main focus proper now could be a rising trendline that has outlined Solana’s uptrend since 2024. Crypto analyst Ali_charts identified that this degree is basically the market’s make-or-break level. On the weekly timeframe, SOL remains to be buying and selling inside a protracted, clear uptrend, and that very same trendline has acted like a ground all through the transfer.

Every time value leaned into it previously, consumers confirmed up and pushed SOL greater. For the time being, that help sits across the $136 space on the chart. So long as Solana holds above it on a weekly closing foundation, the broader construction stays intact, and the latest pullback can nonetheless be seen as a reset relatively than a breakdown.

If that holds, the upside reference stays the $200 area, which stands out as the following main zone the place promoting stress might reappear. It’s not assured, however structurally, the trail would nonetheless be open.

The chance reveals up if SOL breaks beneath that trendline and fails to reclaim it. A clear weekly shut underneath long-term help tends to alter sentiment quick. As soon as that occurs, the chart reveals a large air pocket beneath, with the following significant goal zone sitting close to $50. In easy phrases, if the ground provides approach, there is probably not a lot help till considerably decrease ranges.

For now, the playbook is fairly easy. Watch how Solana behaves across the $136 space and that rising help line. The response there possible decides the following main transfer.

Solana Community Exercise Jumps Sharply

Whereas value motion grabs headlines, Solana’s on-chain knowledge tells a distinct story. Every day lively addresses surged previous 5 million within the second half of the month, signaling a pointy enhance in community utilization. Much more persons are clearly interacting with the chain proper now.

That leap got here as memecoin creation picked up pace once more, helped by the launch of Anthropic’s Claude Cowork, an AI agent that may function a consumer’s desktop. With the barrier to launching tokens decrease than ever, builders utilizing the Solana Baggage launchpad ramped issues up quick.

The impression confirmed up in charges. On January 16, Solana generated roughly $4.5 million in day by day charges, an enormous leap in comparison with the last few months. From September by way of December, day by day charges usually stayed beneath 5 figures, generally dropping to just some hundred {dollars}.

Over the identical interval, Baggage additionally pulled forward in output. Extra tokens had been efficiently launched on the platform, overtaking volumes seen on different Solana-based memecoin factories like Pump.enjoyable. It was a brief burst, however an intense one.

Ethereum Exercise Picks Up Too

Ethereum wasn’t not noted of the exercise surge. By late December, the community had moved forward of main layer-2s like Base and Arbitrum in day by day lively addresses. Then in January, that exercise climbed one other 25%, exhibiting the momentum carried into the brand new 12 months.

This enhance adopted key community upgrades, together with expanded blob capability, which helped push charges sharply decrease. By January 29, common Ethereum charges had dropped to underneath one cent. That wasn’t only a beauty enchancment.

Decrease charges align with Ethereum’s longer-term purpose of turning into a community that may function effectively at scale. Even so, regardless of rising exercise throughout each chains, the most recent Solana value predictions have reignited debate over the place SOL heads subsequent. For now, value and fundamentals are telling barely completely different tales, and the trendline within the center could resolve which one wins.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.