- DeFi TVL dropped sharply whereas whole crypto market cap misplaced practically $500B

- Stablecoin provide barely moved, signaling rotation as an alternative of capital flight

- The subsequent market transfer doubtless hinges on readability, not panic or hype

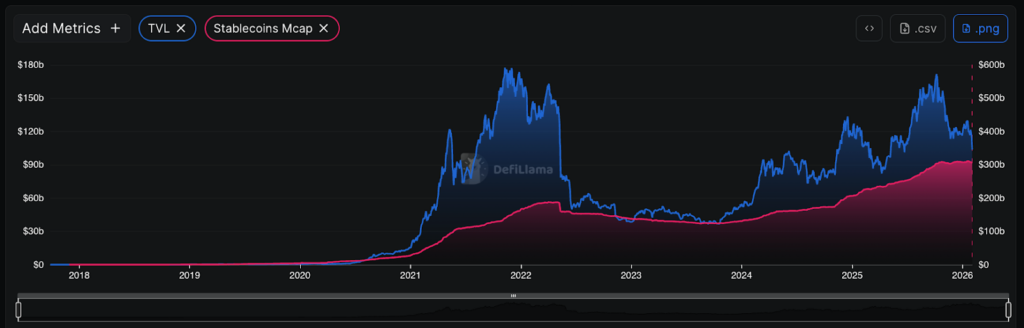

Over a brief stretch, DeFi TVL fell by roughly $16 billion whereas whole crypto market cap shed near half a trillion {dollars}. These strikes look dramatic on the floor, however context issues. This wasn’t triggered by a significant protocol failure or a systemic shock. It resembled a coordinated step again, with individuals decreasing publicity as uncertainty piled up throughout macro and regulatory fronts.

Why Stablecoins Change the Learn

A very powerful sign is what didn’t occur. Stablecoin provide remained largely flat after months of volatility. If capital have been exiting crypto fully, stablecoin market caps can be shrinking quick. As an alternative, funds seem to have rotated into cash-like positions on-chain. That means warning, not worry. Capital stayed within the system, ready quite than working for the exits.

What This Conduct Alerts

When costs fall however money stays put, it normally factors to indecision. Traders will not be satisfied sufficient to deploy danger, however they’re additionally not satisfied sufficient to depart. This type of pause usually follows sharp drawdowns and might last more than merchants anticipate. It displays a market searching for affirmation, whether or not from coverage readability, macro stabilization, or just time.

What to Watch Subsequent

The true inform won’t be a sudden TVL spike. Will probably be gradual redeployment into lending, liquidity swimming pools, and productive DeFi use. That type of transfer indicators confidence returning. Till then, the market stays in a holding sample, not damaged, simply undecided.

Conclusion

TVL and market cap falling present diminished danger urge for food. Stablecoins holding agency present capital has not left. The market isn’t completed. It’s ready for a motive to maneuver.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.