The late-January crypto market crash reignited considerations round leverage, liquidity, and alternate stability throughout the trade. For a lot of merchants, it additionally revived recollections of October’s huge sell-off, bringing renewed scrutiny again to Binance and its ecosystem.

As criticism resurfaces, consideration is shifting towards how Binance ecosystem tokens are behaving underneath stress.

Their value motion and on-chain exercise might now reveal whether or not confidence is rebuilding or quietly fading.

Sponsored

Sponsored

PancakeSwap (CAKE)

PancakeSwap is the most important decentralized alternate on BNB Chain and one of the vital Binance ecosystem tokens out there. Though it now operates throughout a number of chains, it’s nonetheless native to the Binance community. This makes CAKE intently tied to sentiment round Binance and its ecosystem.

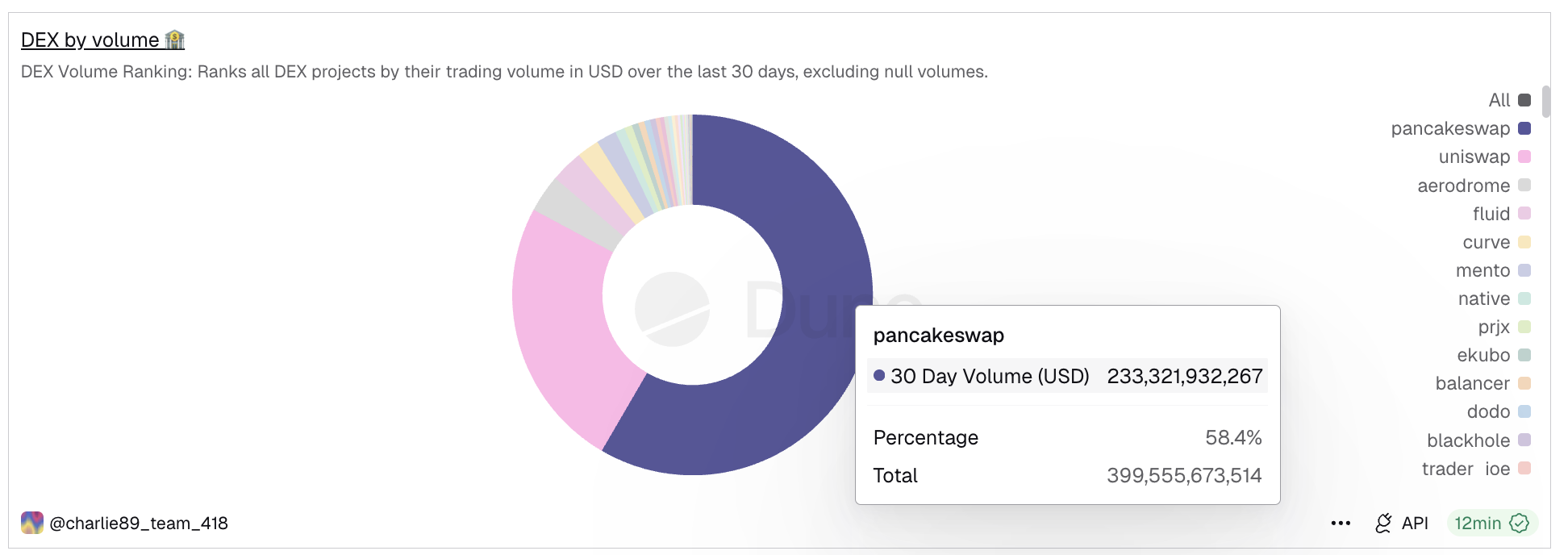

Regardless of current criticism round Binance and the January market crash, PancakeSwap continues to dominate decentralized buying and selling exercise. Over the previous 30 days, it has managed round 58.4% of complete DEX quantity, far forward of Uniswap’s roughly 24%.

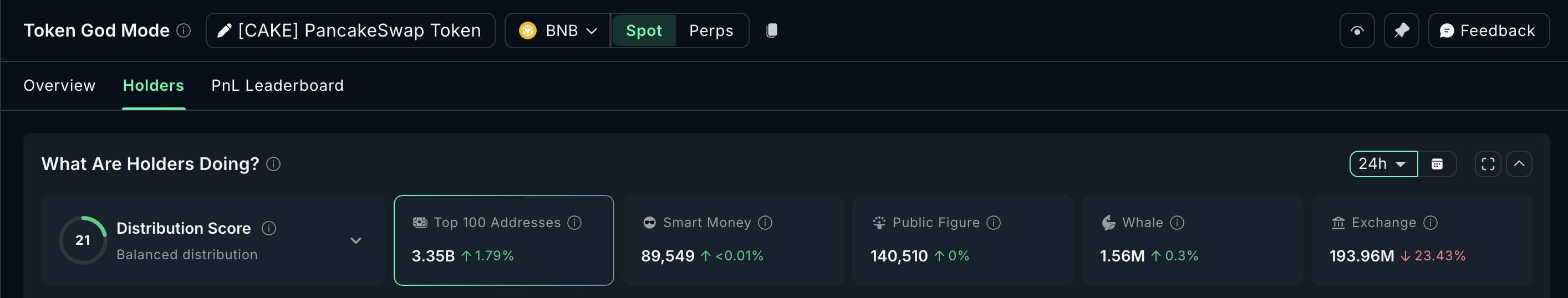

On-chain knowledge additionally factors to regular accumulation. Over the previous 24 hours, the highest 100 addresses elevated their holdings by about 1.79%, whereas alternate balances fell by almost 23.4%. This implies each whales and presumably retail buyers are quietly positioning in CAKE.

Capital circulation knowledge helps this development. The Chaikin Cash Move (CMF), which measures whether or not cash is getting into or leaving an asset utilizing value and quantity, has been trending larger since mid-January. Between January 17 and February 3, CAKE’s value moved decrease, however CMF rose, now above the zero line. This bullish divergence signifies that giant buyers had been accumulating in periods of weak spot, not simply over the previous 24 hours.

From a technical perspective, CAKE faces clear resistance close to $1.59. A powerful 12-hour shut above this stage may open a transfer towards $1.88 after which the psychological $2.00 zone. On the draw back, $1.42 stays crucial assist. A breakdown beneath this stage would weaken the bullish construction.

Total, PancakeSwap’s dominant DEX quantity, bettering capital flows, and rising whale participation hold it among the many strongest Binance ecosystem tokens to look at in February 2026. Nevertheless, a confirmed breakout above $1.59 continues to be wanted to show accumulation right into a sustained bounce.

Sponsored

Sponsored

Aster (ASTER)

Amongst Binance ecosystem tokens, Aster stands out as one of the straight linked to Changpeng Zhao’s affect. The decentralized perpetuals and spot buying and selling platform operates closely on BNB Chain and has acquired public backing from CZ.

It’s also supported by YZi Labs and former Binance-linked executives, making it intently tied to Binance’s broader ecosystem narrative.

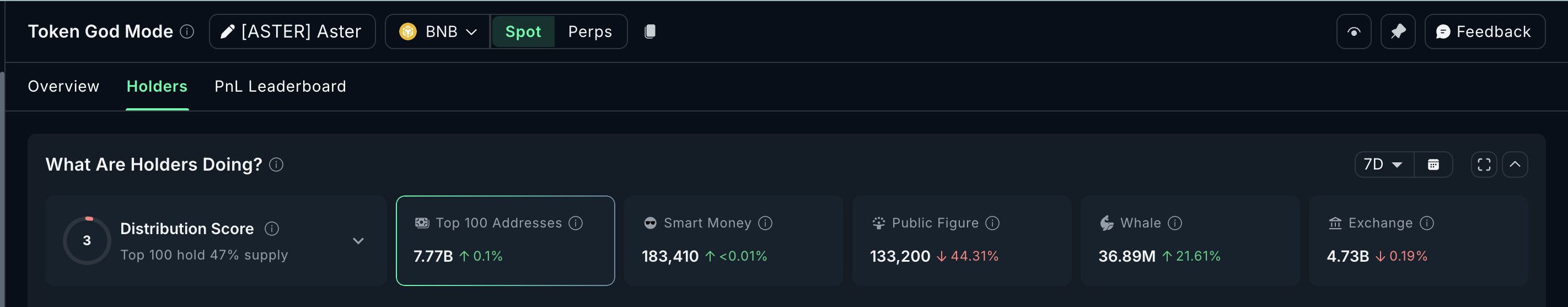

Regardless of renewed criticism round Binance after the late-January market crash, Aster has quietly attracted massive consumers. Over the previous seven days, whale holdings have elevated by round 21.61%, whilst “public determine” wallets decreased publicity. This implies that whereas seen influencers stepped again amid criticism, bigger non-public holders had been accumulating. That divergence factors to rising confidence amongst massive buyers.

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto Publication right here.

Worth motion helps this shift.

Sponsored

Sponsored

After hitting late-January lows, ASTER has rebounded almost 18%, aligning with broader market stabilization. Extra importantly, a bullish divergence has shaped on the each day chart. Between January 19 and January 31, the value made a decrease low, whereas the Relative Power Index (RSI) shaped the next low. RSI measures momentum on a 0–100 scale. When value weakens, however RSI strengthens, it usually alerts fading promoting stress and early development reversal.

This confirms why whales have been accumulating.

For the reversal construction to stay legitimate, ASTER should reclaim $0.72, a serious resistance zone. A sustained break above it might open the trail towards $1.06, adopted by the $1.21–$1.40 vary. These ranges align with earlier breakdown factors.

On the draw back, $0.50 stays crucial. A breakdown beneath this stage would invalidate the bullish divergence and weaken the buildup thesis.

BNB (BNB)

Amongst all Binance ecosystem tokens, BNB stays crucial benchmark. It’s the native token of Binance and BNB Chain, used for charges, staking, and ecosystem exercise. This makes BNB extremely delicate to shifts in sentiment round Binance and CZ.

Sponsored

Sponsored

In current weeks, that sensitivity has been seen. BNB is down round 12% over the previous month. It now trades close to $776, after peaking near $1,370 in October. This locations BNB roughly 43% beneath its all-time excessive.

But, not like many large-cap cryptocurrencies, BNB stays resilient on an extended timeframe. It’s nonetheless up about 26% year-on-year, outperforming Bitcoin and Ethereum. This exhibits that capital continues to deal with BNB as a core infrastructure asset throughout the Binance ecosystem.

The principle weak spot comes from sentiment. Constructive social sentiment rating round BNB has fallen to round 1.44, a six-month low, down from peaks close to 196 in October. Traditionally, native sentiment spikes have preceded bounces. This metric tracks the quantity of optimistic social media mentions round BNB.

For instance, a December sentiment peak was adopted by a rally from $842 to $954, a 13% surge, in January. The present collapse in sentiment helps clarify BNB’s current underperformance. Till sentiment improves, upside momentum might stay restricted.

From a technical perspective, $730 is the important thing assist. Holding above this stage retains the construction intact. A break beneath may expose draw back towards $602. On the upside, $882 is the primary main resistance. A sustained transfer above it might sign renewed confidence. Above $882, $1,052 turns into the subsequent psychological goal.

For now, BNB displays cautious confidence. Lengthy-term efficiency stays robust, however weak sentiment and ecosystem criticism proceed to cap short-term upside. Amongst Binance ecosystem tokens, BNB stays the anchor, but it surely wants sentiment restoration to guide once more.