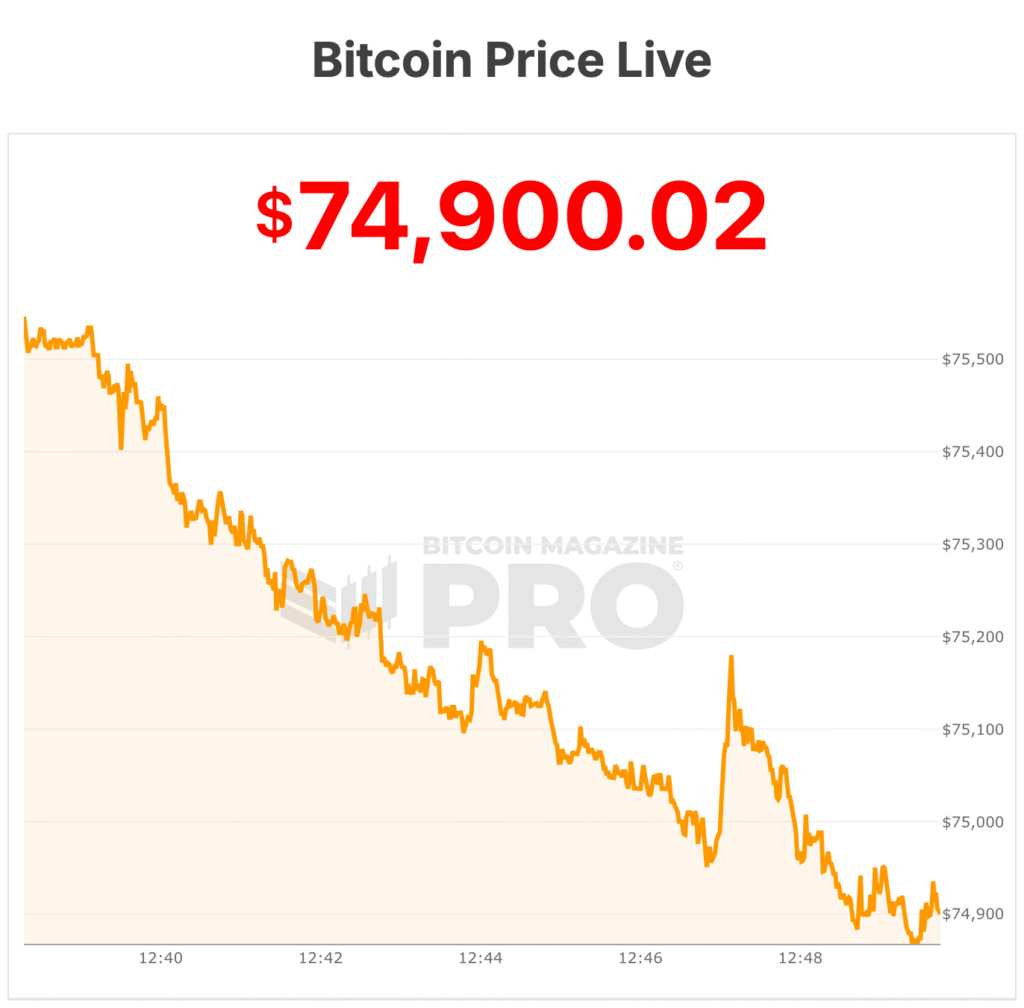

Bitcoin’s value dropped beneath $75,000 as we speak, its lowest degree in practically a 12 months, as international crypto markets endured a sustained wave of promoting triggered by broader monetary stresses and shifting investor urge for food.

The bitcoin value has now retraced greater than 40% from its all‑time highs reached in late 2025. In accordance with Bitcoin Journal Professional information, the one-year low for the bitcoin value is $74,747. Bitcoin is dancing close to that quantity.

Current buying and selling information confirmed Bitcoin value slipping by key technical assist ranges, driving compelled liquidations throughout derivatives markets and intensifying draw back value strain. Over roughly the previous 24 hours, round $2.56 billion in Bitcoin positions have been liquidated, in keeping with market information.

This follows weeks of danger‑off sentiment throughout international asset courses.

The downturn in cryptocurrencies has coincided with stress in different markets like treasured metals, tech sell-offs, and losses in equities.

Institutional gamers report losses as coverage indicators stay doubtful

The market slide has had tangible impacts on key trade members. Galaxy Digital, a serious crypto funding agency led by Michael Novogratz, reported a $482 million loss for the fourth quarter of 2025, earlier as we speak.

The agency attributed this to the decline in digital asset costs and a pointy drop in buying and selling volumes, which fell greater than 40% from the prior quarter. Galaxy’s inventory traded decrease following the earnings launch, reflecting investor concern in regards to the broader bitcoin value and crypto downturn.

Additionally, Bitcoin value at present trades beneath $76,000, which is roughly the typical value at which Technique acquired a portion of its BTC holdings and nicely beneath the price of a lot of its amassed cash.

Since Technique owns a whole lot of hundreds of bitcoins at greater common buy costs, the present market worth is lower than what was paid for a lot of its stock, leaving a good portion of its holdings “underwater.”

Market members have additionally pointed to U.S. financial coverage developments as a major driver of the promote‑off.

The latest nomination of Kevin Warsh as chair of the U.S. Federal Reserve by President Donald Trump has prompted forecasts of tighter financial circumstances.

A strengthening U.S. greenback in response to financial coverage shifts has additionally weighed on Bitcoin. A firmer greenback usually makes non‑yielding property like Bitcoin much less engaging, lowering inflows from buyers in search of forex‑impartial hedges. Analysts famous that the greenback’s latest efficiency supplied technical headwinds that amplified the crypto market’s decline.

The Trump administration has continued to interact with trade leaders on digital asset coverage, together with efforts to advance regulatory readability by laws such because the Digital Asset Market Readability Act.

This dialogue has actually slowed down during the last couple of months, it has not but translated into stabilizing value motion amid present circumstances.

Bitcoin value in real ‘crypto winter’

Regardless of this, Bitwise CIO Matt Hougan stated in a latest memo that the crypto market has been in a real “crypto winter” since early 2025, fairly than experiencing a short-lived correction.

Hougan highlighted that bearish sentiment stays robust, as evidenced by the Crypto Concern and Greed Index, which exhibits close to all-time concern ranges regardless of optimistic developments just like the appointment of a bitcoin-friendly Fed chair.

Hougan famous that institutional flows helped masks the severity of the downturn. U.S. spot bitcoin ETFs and digital asset treasury autos bought over 744,000 BTC throughout this era—roughly $75 billion in demand — cushioning bitcoin value’s drawdown, which he estimated might have reached practically 60% with out this assist.

He in contrast the present atmosphere to earlier downturns in 2018 and 2022, the place markets remained depressed regardless of incremental optimistic information.

Wanting forward, Hougan prompt that crypto winters typically finish not with exuberance however with exhaustion. In his phrases, “It’s all the time darkest earlier than the daybreak.”

Bitcoin value is at present at $74,800, with a 24-hour buying and selling quantity of 55 B. BTC is -5% within the final 24 hours. It’s at present -5% from its 7-day all-time excessive of $78,994.