The Ethereum worth is exhibiting early indicators of stabilization after a pointy sell-off in late January. ETH has rebounded about 4.6% over the previous 24 hours after dipping close to $2,160. On the floor, this appears like a aid bounce inside a broader falling wedge sample.

However on-chain knowledge tells a extra cautious story. Whereas the bullish construction has not totally damaged, long-term holder habits and profit-loss metrics are weakening. Collectively, they counsel that this rebound could lack sturdy conviction. If these traits persist, Ethereum might stay susceptible to a different leg decrease, with even $1,500 in sight.

A 37% Worth Drop Couldn’t Break Sample, However There’s A Catch

Since mid-January, Ethereum has fallen practically 37% to lows round $2,160. The decline adopted a transparent bearish divergence.

Sponsored

Sponsored

Between January 6 and January 14, ETH made the next excessive, whereas the Relative Power Index (RSI) made a decrease excessive. RSI measures momentum on a 0–100 scale. When worth rises, however RSI weakens, it alerts fading shopping for stress. This divergence usually results in development reversals, and Ethereum responded accordingly.

Regardless of the sharp drop, the worth has stayed inside a falling wedge. A falling wedge types when the worth makes decrease highs and decrease lows inside narrowing trendlines. It’s normally a bullish construction that alerts weakening promoting stress.

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto Publication right here.

So structurally, Ethereum has not totally damaged down. Nevertheless, one thing extra vital has weakened: long-term holder conviction.

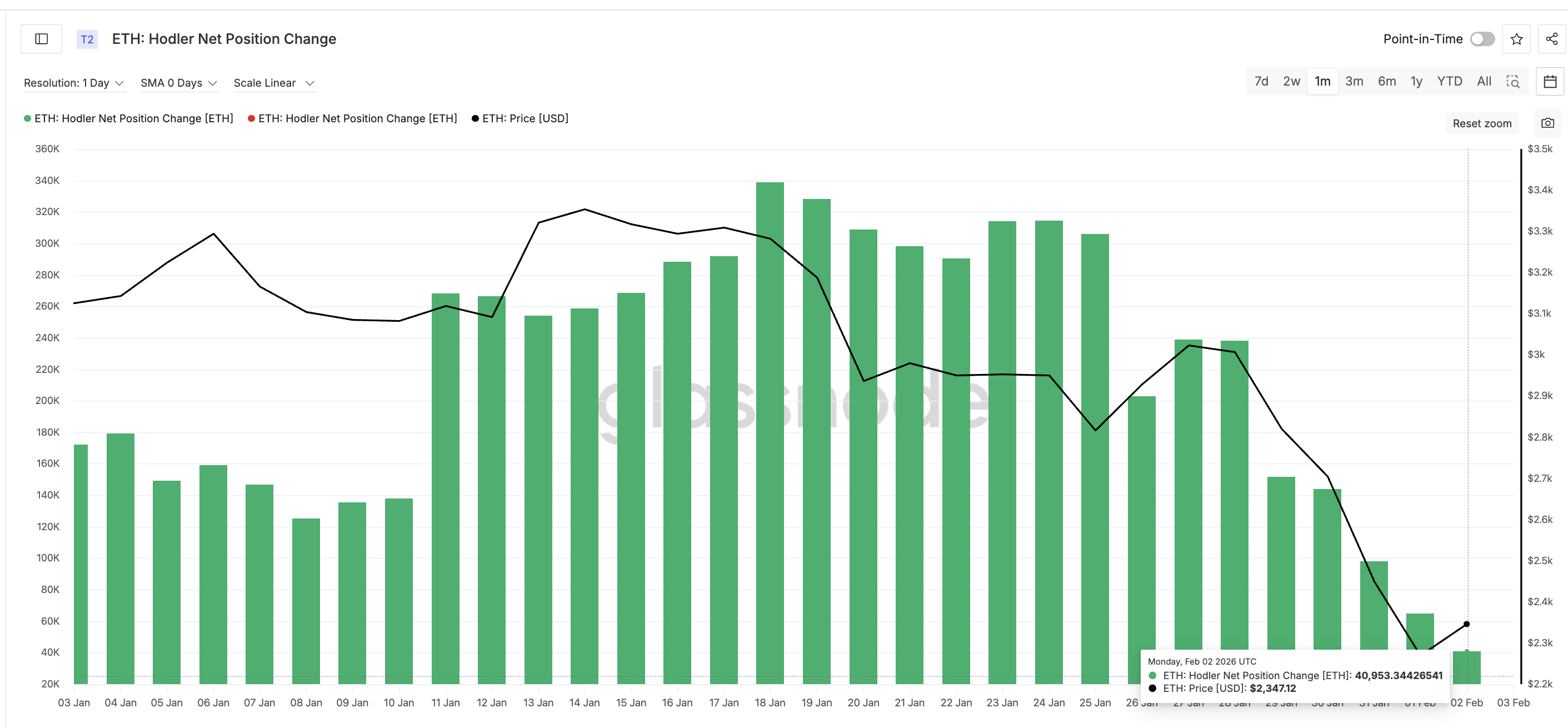

Hodler Internet Place Change tracks whether or not long-term buyers are accumulating or promoting. On January 18, the 30-day internet place change peaked close to +338,708 ETH. This confirmed sturdy accumulation.

By February 2, that determine had collapsed to round +40,953 ETH. That could be a drop of practically 90%.

This implies long-term holders have sharply diminished shopping for in the course of the correction. When conviction holders don’t accumulate into weak point, it normally alerts that the market has not reached a real backside. Sturdy bottoms type when long-term holders hold accumulating at the same time as costs fall. That’s not taking place now.

Sponsored

Sponsored

Paper Earnings And Trade Transfers Present Rallies Are Being Bought

The second warning comes from Ethereum’s Internet Unrealized Revenue/Loss (NUPL) and alternate switch knowledge.

NUPL measures how a lot revenue or loss holders have on paper. It compares present costs with the typical buy worth. When NUPL is excessive, most buyers are in revenue. When it turns unfavorable, many are at a loss.

In late January, Ethereum’s NUPL dropped from round 0.25 to close 0.007 by February 1. This reveals that income have virtually vanished, however not fully.

Nevertheless, on a one-year view, NUPL remains to be removed from true capitulation.

In April 2025, NUPL fell to −0.22. That marked deep worry and capitulation. After that, ETH rallied from about $1,472 to $4,829, a surge of roughly 228%. Right this moment, NUPL is nowhere close to these ranges.

Sponsored

Sponsored

This implies that large-scale capitulation has not occurred but. There should be room for additional draw back earlier than a sturdy backside types.

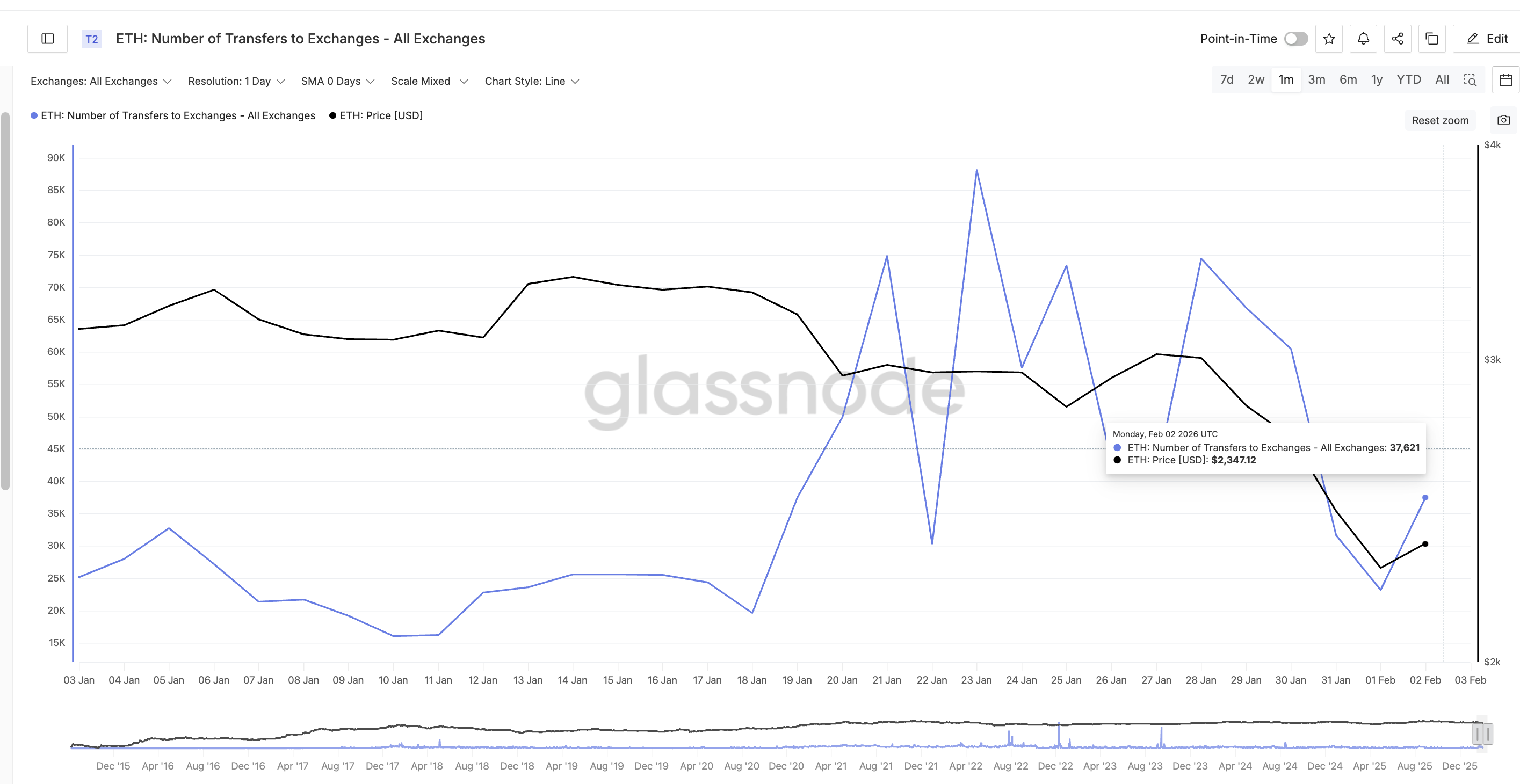

Trade switch knowledge provides to this threat. In the course of the late-January drop, numbers of transfers (not cash) fell to round 23,000–24,000 per day. This confirmed diminished promoting stress close to the lows. However in the course of the rebound between February 1 and February 2, transfers jumped to above 37,000.

That could be a rise of greater than 50% in at some point. This implies many holders (presumably the speculative ones) used the bounce to maneuver ETH to exchanges and sure promote. When each rebound triggers a spike in transfers, it alerts that rallies are being distributed, not amassed.

This sample highlights a rising divide between speculative merchants and longer-term capital.

Gil Rosen, Co-Founding father of the Blockchain Builders Fund, described this break up in an unique quote to BeInCrypto:

“There are two separate capital flows. There may be institutional capital that was starting to closely put money into crypto throughout all asset courses, after which there are retail flows. Institutional capital is at all times macro first, and when markets shift, crypto remains to be seen as a threat asset. In the meantime, short-term speculative capital surged in This autumn,” he highlighted

Sponsored

Sponsored

This habits retains upward strikes weak.

Ethereum Worth Ranges Present Why $1,500 Is Again in Play

With construction holding however conviction weakening, the Ethereum worth ranges now matter greater than indicators. The primary key help sits close to $2,250. This stage has acted as a short-term base after the rebound.

Beneath that, $2,160 stays vital. This marks the latest low and is nearer to the decrease boundary of the falling wedge. A confirmed break beneath this zone would weaken the bullish Ethereum worth construction.

If $2,160 fails and in addition the decrease wedge trendline , threat opens towards the $1,540 area, a key Fib extension stage to the draw back. This type of dip would additionally convey NUPL nearer to historic capitulation ranges and the worth close to the April 2025 zone.

That’s the place a deeper reset might happen. On the upside, Ethereum should reclaim $2,690 to vary the narrative. This stage marks a significant Fibonacci resistance and a previous breakdown zone.

Solely a sustained transfer above $2,690 would sign that patrons are regaining management. Till then, rallies between $2,250 and $2,690 are prone to face heavy promoting stress. So long as ETH stays trapped on this vary, each bounce dangers turning into one other exit alternative.