- Jupiter plans to carry Polymarket to Solana, positioning prediction markets as a core product

- The change disclosed a $35 million JUP-denominated funding from ParaFi Capital with restricted element

- Key questions round rollout, settlement, and compliance stay unresolved

Jupiter introduced it plans to carry Polymarket to Solana for the primary time, marking a notable growth of its on-chain product lineup. The Solana-based decentralized change shared the replace on X, framing prediction markets as a core vertical quite than a aspect experiment. The timing stood out, particularly as prediction markets have been quietly regaining consideration throughout crypto buying and selling platforms.

This Solana information landed alongside a separate funding disclosure from Jupiter, which the change positioned as a part of a broader on-chain growth push. Taken collectively, the updates counsel Jupiter is making an attempt to widen its footprint past swaps, leaning into extra expressive monetary merchandise. Nonetheless, most of the particulars stay, for now, loosely outlined.

Jupiter outlines prediction markets as a core product

In accordance with Jupiter, customers will be capable to commerce prediction markets instantly on a single on-chain platform. In its publish, the change stated that for the primary time, Polymarket can be accessible on Solana via Jupiter itself. The messaging was clear in intent, even when execution particulars weren’t.

Jupiter described Polymarket as the most important prediction market in crypto and stated the combination would help its objective of constructing a extra full predictions hub. Nevertheless, the announcement stopped in need of explaining how markets can be listed, priced, or finally settled. There was additionally no readability round custody, entry mechanics, or how compliance issues can be dealt with.

Neither Jupiter nor Polymarket shared a rollout timeline or launch sequence. These omissions left open questions, particularly as prediction markets more and more intersect with elections, macro occasions, and main information cycles. Regulatory scrutiny has adopted that development, and this announcement did little to handle these issues instantly.

ParaFi Capital backs Jupiter with a JUP-denominated funding

Alongside the combination information, Jupiter disclosed a $35 million strategic funding from ParaFi Capital. The change stated the funding was totally denominated in JUP, its native token, and settled solely in JupUSD, its dollar-pegged asset. Whereas the deal reportedly closed at spot value, Jupiter didn’t share the reference fee or how pricing was decided.

Jupiter additionally stated ParaFi agreed to an prolonged token lockup, however particulars have been scarce. The change didn’t disclose lock period, vesting schedules, or whether or not governance rights have been concerned. That lack of transparency leaves some room for hypothesis round affect and long-term alignment.

Jupiter co-founder Meow famous that prediction markets can be a significant focus over the approaching yr. He pointed to deliberate work on prediction market APIs and discovery instruments, suggesting an effort to make these markets simpler to seek out and commerce, not simply simpler to launch.

Jupiter’s current scale raises expectations

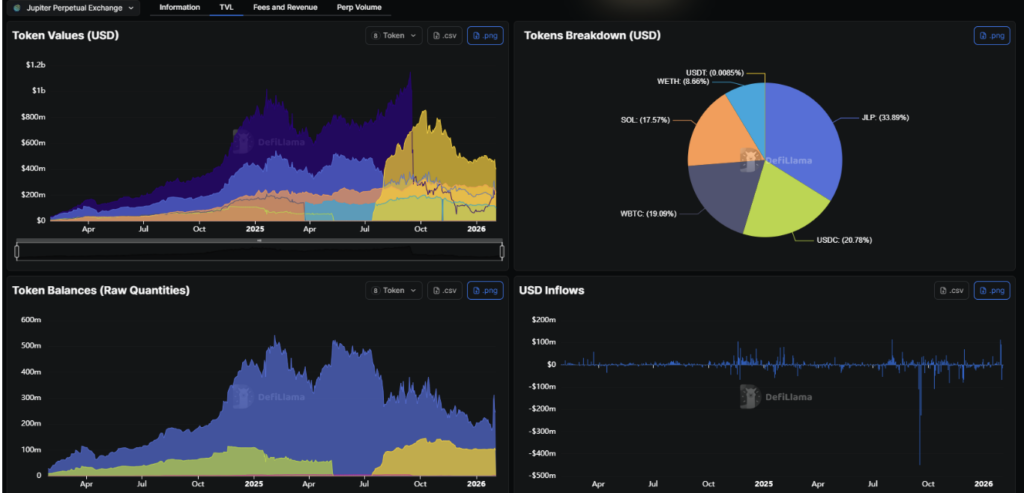

Jupiter already operates at important scale on Solana, in response to DefiLlama information. Complete worth locked sits close to $2.35 billion, with annualized charges approaching $650 million and protocol income estimated round $150 million. These numbers place Jupiter among the many most energetic decentralized venues within the Solana ecosystem.

With that scale comes greater expectations, particularly round execution high quality and danger administration. Prediction markets rely closely on dependable settlement and oracle infrastructure, but Jupiter has not specified which oracle mannequin it plans to make use of. That element will matter as soon as actual capital begins flowing into these markets.

The Solana information additionally highlights unresolved compliance questions. Regulators proceed to scrutinize prediction markets in a number of jurisdictions, and Jupiter has not addressed geographic availability or entry restrictions. For now, these questions stay unanswered.

What this implies within the close to time period

The speedy impression of this growth relies upon virtually solely on implementation and timing. Jupiter has not introduced a launch date, phased rollout, or liquidity plan, leaving merchants with out readability on when markets would possibly really go dwell. The change has positioned prediction markets alongside swaps as a pillar of its development technique, however execution remains to be forward.

Jupiter additionally has not shared quantity targets, price buildings, or incentive packages tied to prediction markets. That implies extra disclosures are possible earlier than any significant exercise begins. For now, the market is left ready for particulars that flip technique into dwell, usable buying and selling performance.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.