Solana is exhibiting early indicators of stabilization after a pointy market crash. Over the previous seven days, SOL is down about 15.5%. The decline intensified throughout the broader market sell-off between January 31 and February 1.

At its lowest level, Solana dropped to $95.87 earlier than discovering help. Since then, the Solana worth has rebounded practically 8% and is now buying and selling round $103.15.

That rebound has erased many of the current day by day losses. Extra importantly, it has been supported by enhancing capital flows and regular long-term holder habits. These alerts counsel that robust consumers are stepping in. However dangers stay. Whether or not this restoration turns right into a sustained rally now will depend on one key stage: $120.

Sponsored

Sponsored

Breakdown Goal Hit as Large Cash Steps In Close to Help

Solana’s current decline adopted a transparent technical sample. On the day by day chart, the SOL worth accomplished a head-and-shoulders breakdown in late January. The draw back goal from this construction pointed towards the $95–$96 zone.

That concentrate on was reached nearly completely at $95.87.

After hitting this stage, promoting stress slowed, and consumers started stepping in. This shift is seen within the Chaikin Cash Move (CMF). CMF measures whether or not capital is flowing into or out of an asset utilizing worth and quantity. When CMF rises, it suggests that enormous buyers are accumulating.

Between January 27 and February 3, SOL’s worth trended decrease, however CMF moved increased. This is named a bullish divergence. It implies that at the same time as the value weakened, cash continued getting into the market.

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto Publication right here.

This habits is unusual throughout sharp corrections. Usually, CMF falls alongside worth. On this case, rising CMF means that whales or probably establishments considered the $95-$96 zone as engaging.

CMF is now transferring again towards the zero line. If it crosses above zero, it will verify that purchasing stress is outweighing promoting. That might strengthen the rebound case. To this point, this knowledge exhibits that Solana’s help close to $96 was not unintentional. It was defended by massive capital.

Sponsored

Sponsored

Lengthy-Time period Holders Keep Affected person, however Quick-Time period Threat Is Rising

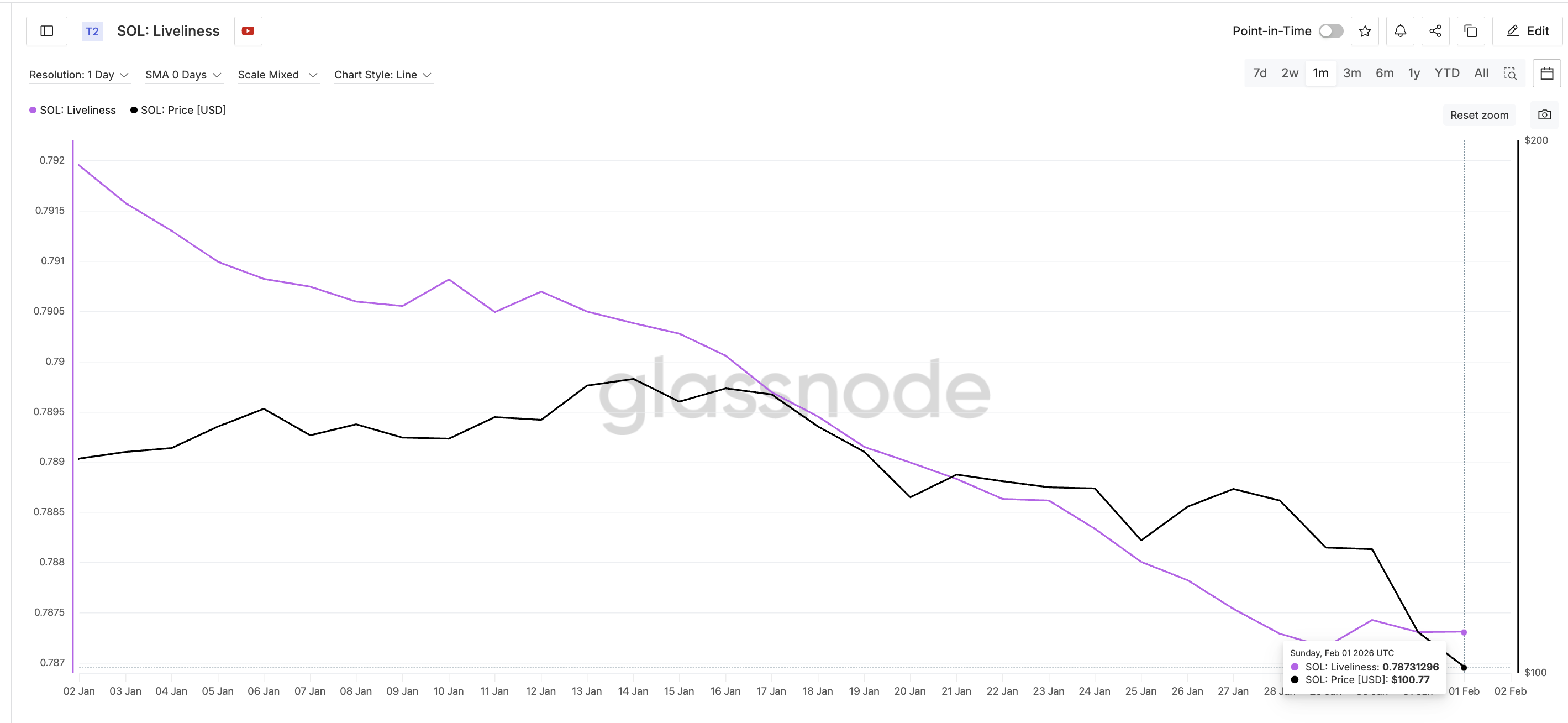

Robust rebounds normally require help from long-term buyers. In Solana’s case, that help is seen in liveliness knowledge.

Liveliness measures how typically long-held cash are being spent. When liveliness rises, long-term holders are promoting. When it falls, they’re holding.

Over the previous month, Solana’s liveliness has been trending decrease.

Even throughout the sharp drop from $127 to beneath $100, liveliness didn’t spike meaningfully. Other than a quick rise round January 29–30, it continued falling. This implies that long-term holders didn’t panic promote. As a substitute, they stayed affected person.

This habits helps the concept the current decline is seen as non permanent somewhat than structural. Nevertheless, not all holder teams are aligned.

Sponsored

Sponsored

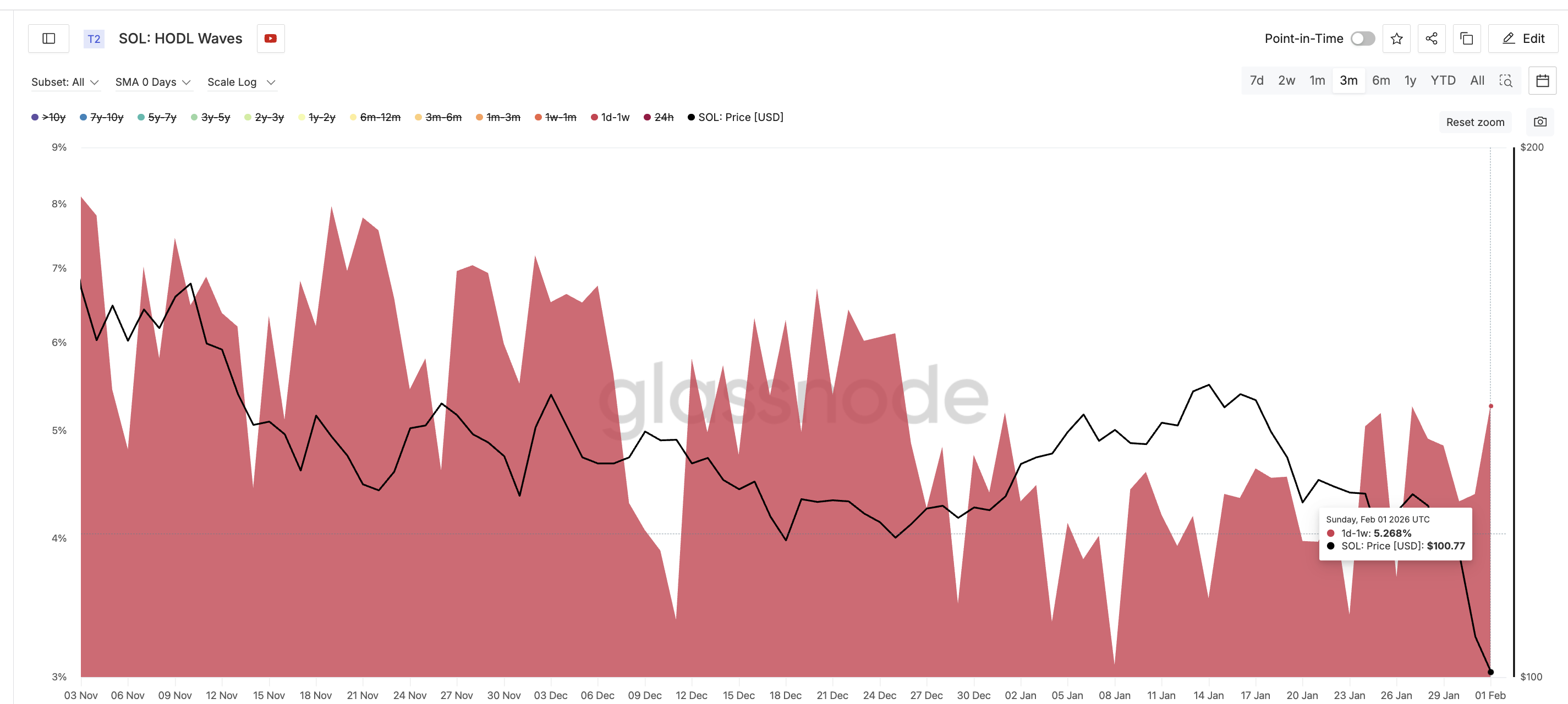

HODL Waves present how lengthy completely different buyers have held their cash. They assist establish which teams are shopping for or promoting. Current knowledge exhibits that the 1-day to 1-week cohort elevated holdings from about 4.38% to five.26% between December 31 and February 1.

This group represents short-term, speculative merchants.

They have a tendency to purchase dips and promote shortly into rebounds. Their rising presence will increase volatility. It additionally raises the chance that rallies might fade as quickly as costs transfer increased.

So whereas long-term holders are exhibiting conviction, short-term merchants have gotten extra lively. This creates a combined construction. It helps short-term rebounds, however limits how far they’ll run except CMF, or somewhat institutional demand, surges or strikes above the zero line.

Key Solana Value Ranges and Why $120 Is the Actual Take a look at

With momentum enhancing however dangers nonetheless current, the Solana worth ranges now matter greater than indicators.

Sponsored

Sponsored

The primary crucial help stays the $95.87–$96.88 zone. This space marks the finished breakdown goal. So long as SOL holds above it, the rebound construction stays intact. If this zone fails, draw back danger opens towards $77. That might invalidate most bullish setups.

On the upside, the primary near-term hurdle sits round $103.60. Solana is at the moment testing this space. A sustained day by day shut above it will sign short-term power.

However crucial stage is $120.88. This stage is important for 3 causes.

First, it marks a serious breakdown level from January 29. Second, it aligns intently with the 20-day exponential transferring common (EMA). The EMA tracks current worth developments and acts as dynamic resistance in downtrends.

Third, Solana’s final profitable reclaim of this zone in early January led to a 17% rally. Reclaiming $120.88 on a day by day shut would sign that momentum is shifting again to consumers. It could additionally point out that the correction part is ending.

Above $120.88, the subsequent Solana worth resistance lies close to $128.29. A break there may open the door towards $148.63 as a part of a reduction rally.

Nevertheless, this upside situation will depend on continued capital inflows and secure long-term holding habits. If short-term merchants dominate quantity, rallies might stall earlier than reaching these targets.