- Solana has rebounded from its $95.87 low, with capital circulation information hinting at accumulation

- Lengthy-term holders stay affected person, whereas short-term merchants are rising exercise

- The $120 stage stays the important thing take a look at that may resolve whether or not this restoration can prolong

Solana has began to regular itself after a brutal market-wide crash that worn out a big chunk of current features. Over the previous seven days, SOL continues to be down roughly 15.5%, with most of that injury concentrated through the aggressive sell-off between January 31 and February 1. On the worst level of the transfer, worth slipped to $95.87 earlier than lastly discovering consumers prepared to step in.

Since that low, Solana has rebounded shut to eight% and is now hovering across the $103 space. That bounce has already erased a lot of the every day losses from the drop, which is notable given how briskly sentiment shifted simply days in the past. Extra importantly, the rebound hasn’t seemed utterly hole, as capital circulation information and long-term holder habits are beginning to lean extra constructive, although dangers haven’t disappeared but.

Breakdown goal hit as consumers quietly step in

Technically, Solana’s decline adopted a reasonably clear sample. On the every day chart, SOL accomplished a head-and-shoulders breakdown in late January, with the projected draw back goal sitting proper across the $95 to $96 zone. That focus on was tagged nearly completely when worth hit $95.87, which frequently marks an space the place promoting stress begins to chill.

After reaching that stage, the tempo of promoting slowed, and consumers started to indicate themselves. This shift is seen within the Chaikin Cash Circulation, which tracks whether or not capital is getting into or leaving an asset primarily based on worth and quantity. Whereas SOL continued to development decrease between January 27 and February 3, CMF truly moved increased, making a bullish divergence that hinted at accumulation beneath the floor.

This type of habits is unusual throughout sharp corrections. Usually, CMF collapses alongside worth, however on this case, rising CMF urged that bigger gamers considered the $95–$96 space as engaging. CMF is now drifting again towards the zero line, and a transfer above it will affirm that purchasing stress is beginning to outweigh promoting, strengthening the rebound narrative.

Lengthy-term holders keep calm as short-term merchants enhance exercise

Robust recoveries often want help from long-term holders, and Solana seems to have that, at the very least for now. Liveliness information, which tracks how typically long-held cash are being spent, has been trending decrease over the previous month. Even through the sharp slide from $127 to beneath $100, liveliness didn’t spike in any significant method.

Apart from a quick uptick round January 29 and 30, long-term holders largely stayed put, suggesting they considered the transfer as a brief shakeout moderately than a deeper structural problem. That endurance helps stabilize worth throughout unstable durations, but it surely doesn’t inform the total story.

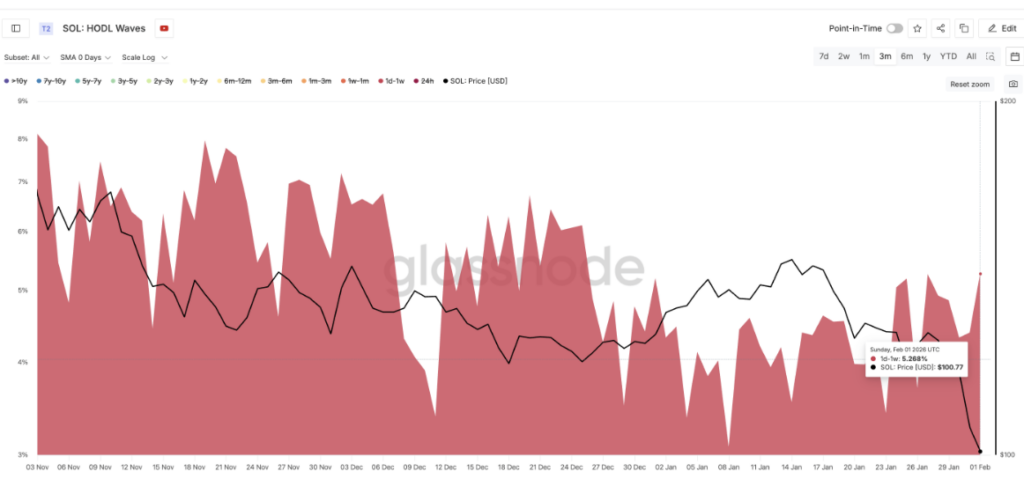

HODL Waves information exhibits that the 1-day to 1-week cohort has been rising, rising from roughly 4.38% to five.26% between late December and early February. This group represents short-term merchants who have a tendency to purchase dips and promote shortly into rebounds. Their elevated presence provides volatility and raises the chance that rallies fade quicker than anticipated if stronger demand doesn’t step in.

Key Solana worth ranges and why $120 nonetheless issues most

With momentum enhancing however uncertainty nonetheless hanging over the market, worth ranges matter greater than indicators proper now. The $95.87 to $96.88 zone stays an important help to look at. So long as SOL holds above this space, the rebound construction stays legitimate, however a clear break beneath it will reopen draw back danger towards the $77 area.

On the upside, Solana is presently testing resistance close to $103.60. A sustained every day shut above this stage would sign short-term power, but it surely isn’t the true take a look at. That stage sits increased, close to $120.88, and it carries heavy technical weight.

This zone marks a serious breakdown level from January 29, strains up intently with the 20-day EMA, and beforehand acted as a launchpad for a 17% rally earlier in January. A every day shut again above $120.88 would recommend that momentum is shifting decisively again to consumers and that the correction part could also be ending. Above it, resistance close to $128 and doubtlessly $148 might come into play, although that upside relies upon closely on continued capital inflows moderately than short-term buying and selling noise.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.