- XRP rebounded from the $1.50 space, however the bounce is being pushed primarily by short-term merchants moderately than long-term holders.

- Falling change outflows and weak participation from broader patrons recommend restricted demand beneath the present worth.

- With key resistance close to $1.69 and fragile help under $1.47, XRP stays weak to a different draw back transfer if conviction fails to return.

XRP is trying to regular itself after a pointy, market-wide sell-off rattled costs on the finish of January. The token briefly dipped close to $1.50 earlier than bouncing again towards the $1.61 space, following the broader breakdown between January 31 and February 1. At first look, the transfer appears like a clear technical rebound, perhaps even the early levels of one thing bigger.

Dig somewhat deeper, although, and the image turns into much less convincing. On-chain and move information recommend this restoration is fragile. The patrons propping up XRP proper now are principally short-term merchants, whereas broader demand stays muted. Three key indicators assist clarify why this bounce may nonetheless battle to carry.

Brief-Time period Merchants Are Driving the Bounce

XRP continues to be buying and selling inside a long-term descending channel that’s been in place since early July. The current rebound occurred proper close to the decrease boundary of that channel, round $1.50, the place patrons predictably stepped in. That half isn’t uncommon. Who these patrons are, nevertheless, issues way more than the place worth bounced.

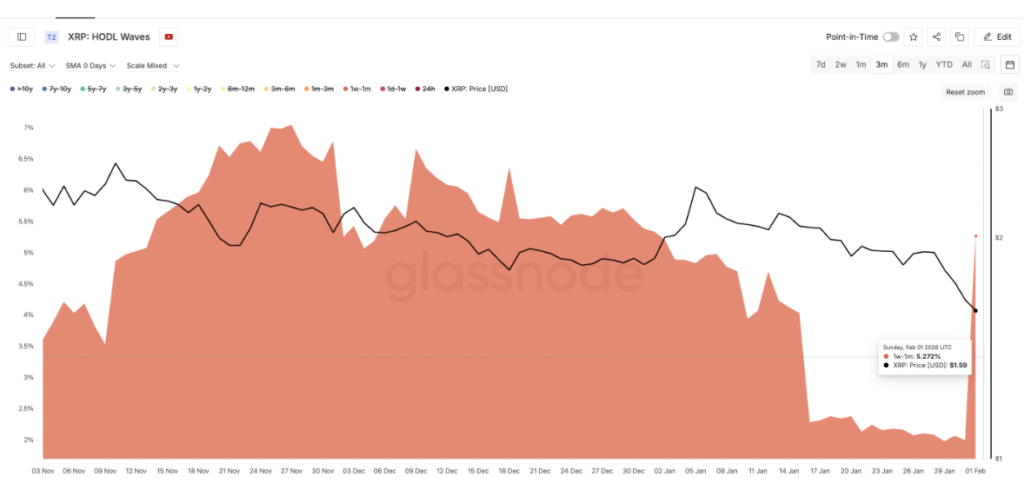

HODL Waves provide a transparent take a look at this. These metrics monitor how lengthy traders have held their cash, breaking provide down by holding interval. Latest information exhibits that the 1-week to 1-month cohort, primarily short-term merchants, accounted for many of the shopping for throughout the bounce.

Between January 31 and February 1, this group’s share of XRP provide jumped from roughly 1.99% to five.27%. That’s a pointy improve in simply two days, and it alerts a surge in speculative positioning moderately than long-term accumulation.

Historical past explains why that’s dangerous. When XRP topped close to $2.35 on January 5, this identical group held round 4.83% of the provision. As worth stalled, they rapidly diminished publicity to about 2.15%, serving to push XRP down towards $1.65 within the weeks that adopted.

In easy phrases, these merchants purchase dips and promote early. They don’t sit by way of uncertainty. With short-term holders as soon as once more main the rebound, present help is constructed on fast-moving capital, not conviction. If worth runs into resistance and hesitates, this group may exit simply as rapidly, triggering contemporary draw back.

Change Outflows Are Drying Up

The second warning signal comes from change move information. Change outflows monitor what number of cash are being moved off buying and selling platforms. Rising outflows often recommend accumulation or longer-term holding, whereas falling outflows level to weaker shopping for curiosity.

Robust recoveries are usually supported by growing outflows throughout dips, displaying that new demand is stepping in. XRP is displaying the alternative habits.

On January 31, change outflows have been round 31.38 million XRP. By early February, that quantity had fallen to roughly 9.81 million, a drop of practically 70%. This occurred whereas XRP declined about 14% from its late-January highs.

As a substitute of accelerating as worth fell, shopping for stress truly weakened. That tells us one thing essential. Solely a slender group of merchants is supporting the worth proper now, primarily the short-term cohort already highlighted. Broader market individuals should not growing publicity.

This creates a skinny construction. Value might maintain briefly, however there’s restricted depth beneath it. If short-term holders determine to promote once more, there isn’t a lot contemporary demand ready to soak up that offer.

Conviction Patrons Are Nonetheless Lacking

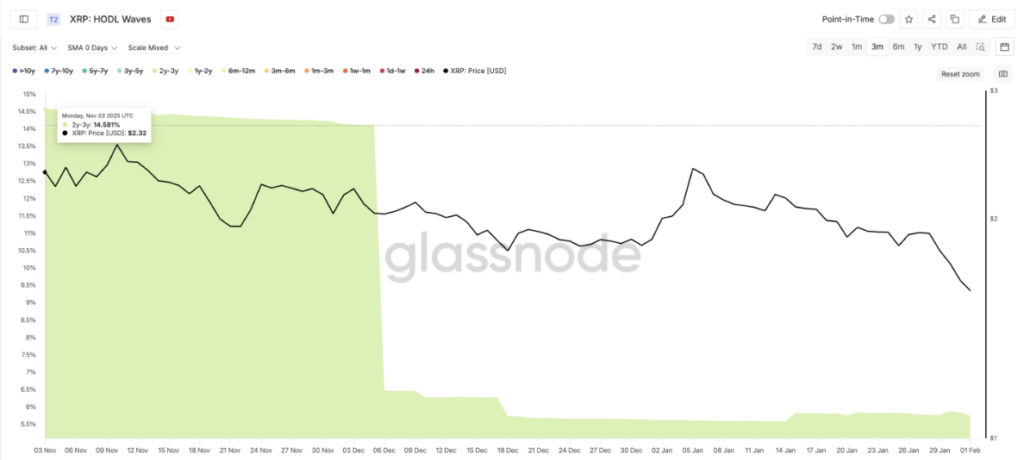

The ultimate danger comes from the absence of long-term, high-conviction traders. HODL Waves present that longer-duration holders, notably the 2-year to 3-year cohort, haven’t returned.

This group as soon as managed greater than 14% of XRP’s provide in late 2025. That determine has since dropped to round 5.7% and stays flat. Even throughout the current dip, there’s been no significant accumulation from this cohort.

These traders usually step in throughout main bottoms. Their continued absence suggests the market doesn’t but view present ranges as engaging for long-term entry. That lack of conviction strains up carefully with the worth construction itself.

A number of ranges now outline XRP’s near-term outlook. On the upside, $1.69 is the primary key barrier. A transfer above it could trace at enhancing confidence. Past that, $1.96 turns into essential. Holding above this stage would problem the falling channel and will shift the development towards impartial.

On the draw back, the $1.47 to $1.50 zone stays very important help. A failure there opens the door towards $1.25. That may affirm a breakdown of the channel and suggest a deeper transfer, probably as a lot as 27% decrease, with $0.93 coming into view.

For now, XRP is caught between $1.47 and $1.69, and uncertainty dominates. The current bounce exhibits that promoting stress has slowed, however weak change flows, fragmented holder habits, and lacking conviction patrons restrict upside potential.

Proper now, the identical merchants holding XRP up are those who offered early final time. Until broader demand and long-term participation return, this fragile help may find yourself being the set off for the subsequent sell-off, moderately than the inspiration for a restoration.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.