- Binance added roughly $100 million value of BTC to its SAFU reserve

- The change is shifting its complete $1B SAFU fund from stablecoins to Bitcoin

- The transfer reinforces Bitcoin’s function as a long-term crypto reserve asset

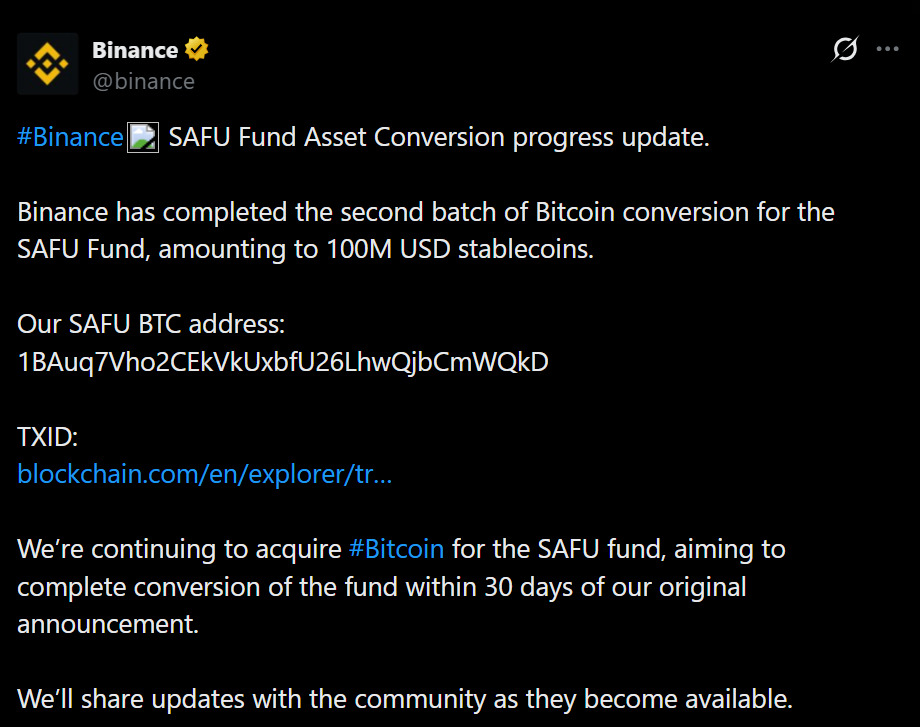

Binance has accomplished the second section of its Bitcoin conversion for the Safe Asset Fund for Customers, including one other $100 million value of BTC to the reserve. The change confirmed the transaction publicly by way of its official X account, sharing each the pockets handle and transaction ID to permit on-chain verification. That transparency indicators this isn’t a symbolic transfer, it’s an operational one.

This newest conversion follows Binance’s announcement in late January 2026 that it could transition the total $1 billion SAFU fund from stablecoins into Bitcoin inside a 30-day window. The plan marked a notable shift in how main crypto platforms take into consideration reserve belongings throughout unstable market circumstances.

The First Batch Set the Tone

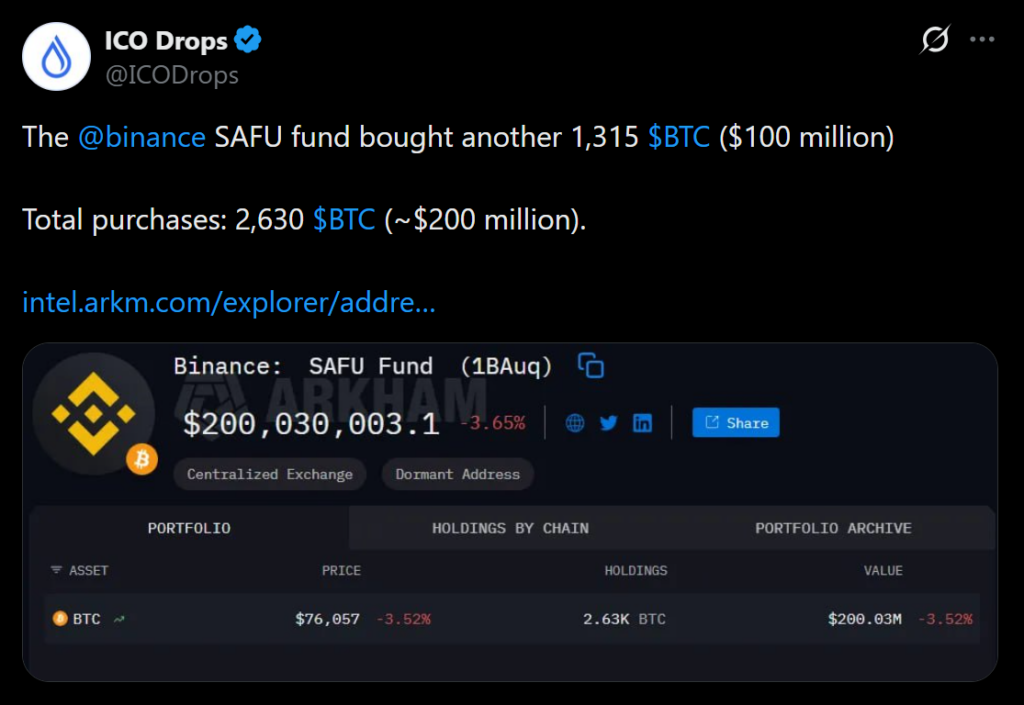

The preliminary conversion befell on February 2, when Binance transferred roughly 1,315 BTC, valued at round $100 million on the time. That first batch made it clear the change was severe about executing the technique shortly reasonably than spacing it out indefinitely. The second tranche now reinforces that dedication.

By breaking the conversion into batches, Binance reduces execution threat whereas nonetheless signaling urgency. It additionally permits the market to look at how a large-scale reserve shift into Bitcoin unfolds in actual time, with out sudden shocks.

SAFU’s Function Goes Past Headlines

SAFU was created in 2018 as an emergency insurance coverage fund, financed by a portion of Binance’s buying and selling charges. Its function has at all times been easy: shield customers in excessive situations. Over time, the fund has advanced into a visual pillar of Binance’s threat administration framework.

Importantly, SAFU features a rebalancing mechanism designed to take care of a minimal worth of $800 million, at the same time as Bitcoin costs fluctuate. That construction provides a layer of stability, guaranteeing the fund stays practical reasonably than purely directional.

A Broader Sign for Crypto Reserves

Transferring SAFU into Bitcoin isn’t nearly asset choice, it’s an announcement about confidence. Binance is successfully selecting BTC volatility over stablecoin publicity, betting that long-term shortage and liquidity outweigh short-term worth swings. That’s a notable stance for one of many largest gamers in crypto.

As extra establishments rethink reserve methods, strikes like this will form how Bitcoin is considered, not simply as a speculative asset, however as balance-sheet infrastructure. Whether or not others comply with stays to be seen, however the sign is already loud.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.