The Bitcoin worth noticed a short-term rebound after slipping to current lows, gaining almost 5% from its late-January backside to check the $76,980 zone. This BTC worth transfer adopted a bullish momentum setup on the 4-hour chart, the place promoting strain appeared to weaken.

At first look, the BTC rebound seemed technically justified. A well-known short-term sample had performed out earlier than. However a more in-depth have a look at on-chain and market construction information exhibits that three main metrics are actually questioning whether or not this bounce can develop right into a sustained restoration.

Chart Setup That Pointed to a 5% Bounce

On the 4-hour timeframe, Bitcoin shaped a bullish divergence between January 31 and February 3.

Throughout this era, the worth of BTC made a decrease low, whereas the Relative Power Index (RSI), a momentum indicator, shaped a better low. This sample typically seems when promoting strain begins fading and short-term rebounds, albeit on a shorter timeframe, turn into probably.

Sponsored

Sponsored

An analogous divergence appeared earlier between January 20 and January 30. That setup led to a rally towards $84,640 earlier than sellers took management once more.

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto Publication right here.

This time, the sample produced a rebound of almost 5%, lifting Bitcoin towards $76,980. The transfer adopted the identical technical script as earlier than, reinforcing the concept the bounce was structurally legitimate.

The BTC worth bounce additionally had macro backing, as talked about by Martin Gaspar, Senior Crypto Market Strategist at FalconX. He attributed the transfer to a rotation from valuable metals, proper earlier than the divergence flashed:

“Given Friday’s blow-off high in metals, merchants could also be anticipating a rotation again to crypto. Whereas BTC had beforehand been seen as a beneficiary of power in gold, capital that will have flowed to crypto off such strikes as an alternative funneled to silver in current months. This might revert as silver cools off,” he stated.

However technical setups solely work when patrons proceed supporting them. And that is the place the primary main problem seems.

Metric One — URPD Exhibits Robust Promote Partitions at Key BTC Ranges

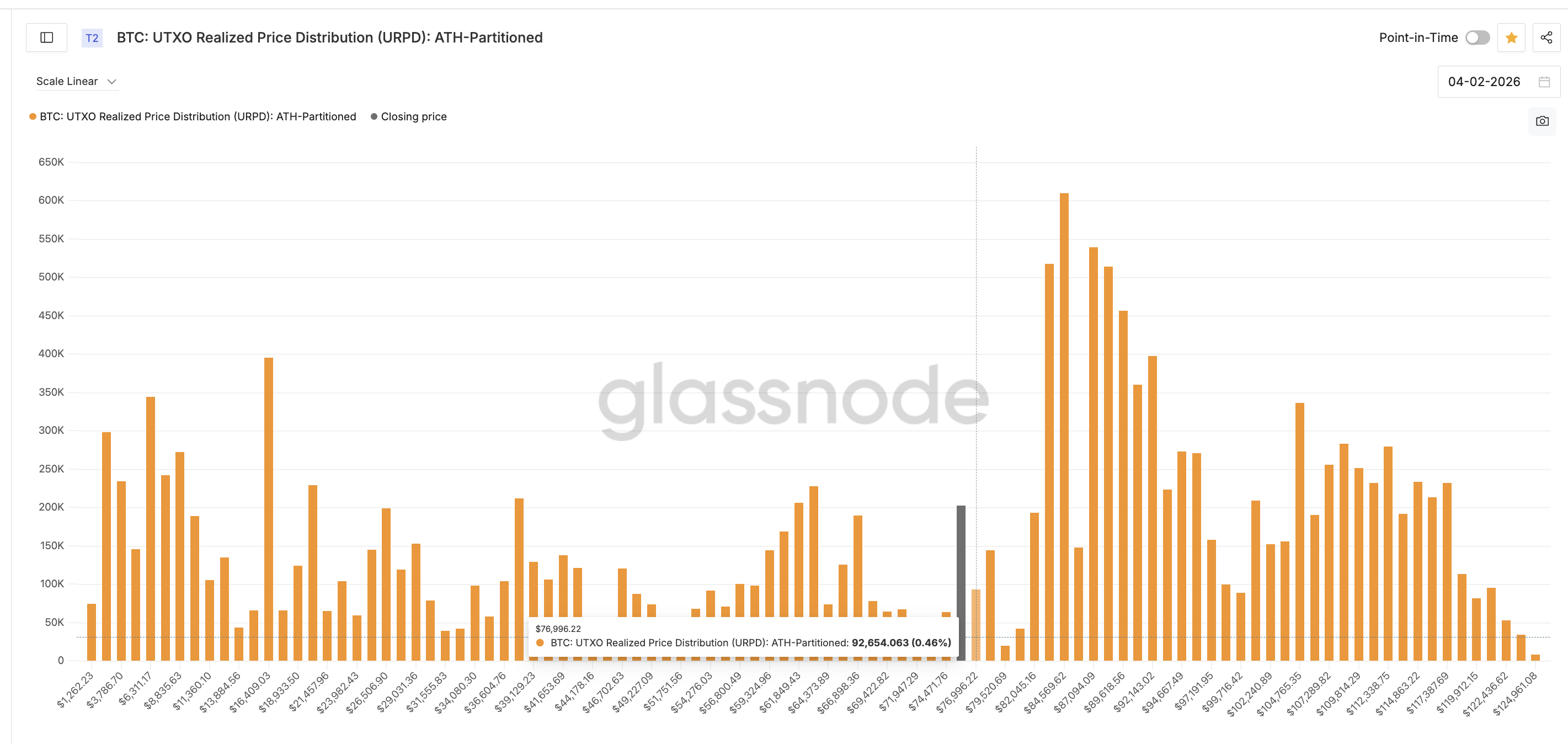

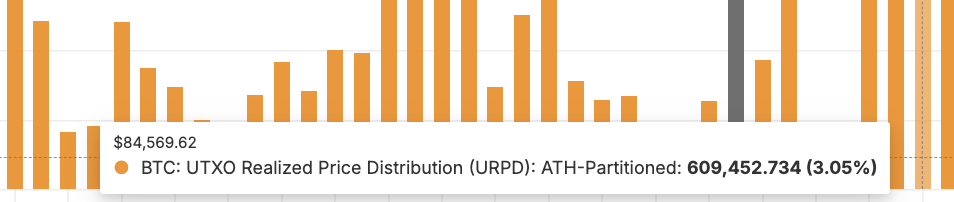

The primary metric questioning the rebound is the UTXO Realized Worth Distribution (URPD), which maps the place massive parts of Bitcoin’s provide final moved.

URPD information exhibits that the world close to $76,990 comprises round 0.46% of the entire provide. This makes it a notable provide cluster, the place many holders are sitting close to their break-even ranges. That explains why the current 5% bounce stalled at $76,980.

Sponsored

Sponsored

When worth approaches these zones, promoting strain typically will increase as buyers look to exit with out losses.

This sample has already appeared as soon as earlier than.

The sooner BTC rebound in late January (talked about earlier) stalled close to $84,640, near the URPD zone, exhibiting an enormous 3.05% provide cluster. That wall proved too robust to interrupt.

Now, the most recent rebound has as soon as once more stopped close to one other supply-heavy zone. This implies that rebounds are being capped by holders, probably promoting into resistance relatively than constructing new positions. With out sufficient recent demand, these promote partitions stay tough to clear.

Rising Trade Reserves and Weak SOPR Present Low Conviction

The second and third metrics come from alternate flows and revenue habits, and collectively they paint a regarding image.

Bitcoin alternate reserves hit a current low of two.718 million BTC on January 19. Since then, reserves have climbed to about 2.752 million BTC.

Sponsored

Sponsored

That is a rise of roughly 34,000 BTC, or round 1.2% in lower than three weeks.

As an alternative of cash leaving exchanges for long-term holding, extra Bitcoin is now being moved again onto buying and selling platforms. This normally displays rising readiness to promote relatively than accumulate.

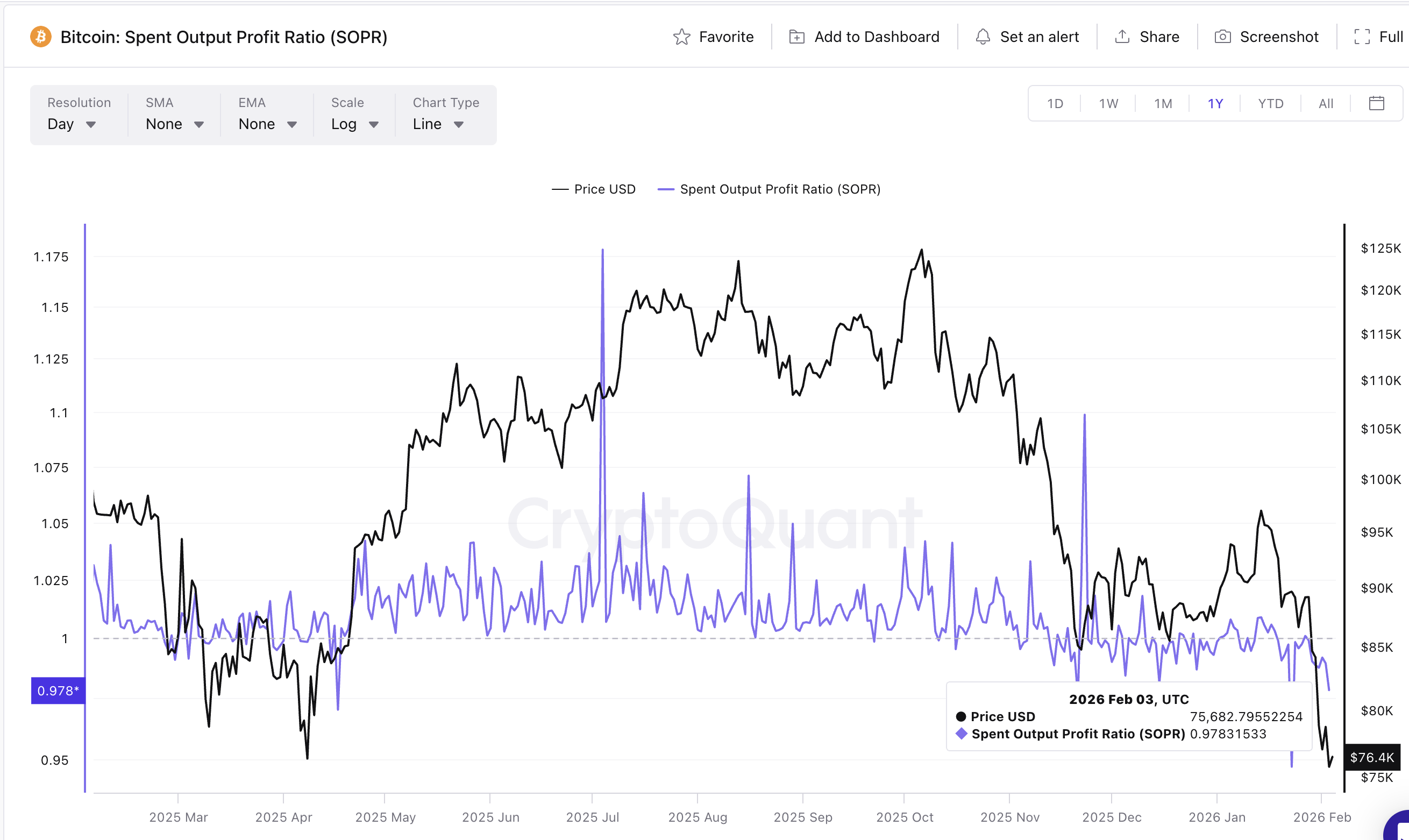

On the identical time, the Spent Output Revenue Ratio (SOPR) is hovering close to yearly lows. SOPR measures whether or not cash are being bought at a revenue or a loss. A price beneath 1 means buyers are realizing losses.

In late January, SOPR dropped near 0.94. It at present sits close to 0.97, nonetheless beneath the impartial degree. This implies many holders are promoting even when they’re underwater.

When rising alternate reserves mix with low SOPR, it alerts defensive habits. Traders are utilizing rebounds to exit positions as an alternative of constructing long-term publicity.

This weakens the muse of any restoration until a significant catalyst seems. Martin Gaspar from FalconX, nonetheless, hints at one sentiment-driven catalyst tied to regulatory readability which may attempt to change the BTC worth outlook:

Sponsored

Sponsored

“Within the weeks ahead, main catalysts will embrace any developments on the crypto market construction invoice, with key teams set to fulfill on the White Home this week to debate the invoice,” he highlighted.

However the worth ranges nonetheless maintain the important thing!

Bitcoin Worth Ranges and Sensible Cash Present the Rebound Is Dropping Help

The Bitcoin worth motion confirms what the three metrics are suggesting. For Bitcoin to regain momentum, a number of ranges should be cleared:

- $76,980: Rapid resistance from the present provide cluster

- $79,360: Subsequent short-term barrier

- $84,640: Main long-term resistance tied to the biggest BTC URPD zone

A sustained restoration requires clear 4-hour closes above these ranges, particularly above $84,640. Up to now, the BTC worth has failed to determine power above the primary barrier.

The Sensible Cash Index provides one other layer of warning. This indicator tracks institutional-style positioning. On the 4-hour chart, it has been trending beneath its sign line since late January. This exhibits that bigger gamers will not be rising publicity alongside the rebound.

The final time the index briefly crossed above its sign line in late January, Bitcoin rallied about 5%. That affirmation is at present lacking. With out renewed sensible cash participation, each short-term BTC rebound may fade.

Additionally, if the elevated panic-driven promoting, as highlighted by a falling SOPR, pushes the BTC worth down, $72,920 turns into a key zone. New draw back targets can come into play if a 4-hour candle closes beneath it.